.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

By The NewsDay

Feb. 28, 2024

By The NewsDay

Dec. 5, 2023

Old Mutual launches funeral services in Masvingo

Sponsored Content

Vintage travel and tours reveals its successes

Sponsored Content

EcoCash extends payroll services to security companies

Sponsored Content

Winter wheat farmers assured of uninterrupted power supply

Ama is mandated with the overall regulation of production, processing and marketing of agricultural products in Zimbabwe.

By Sharon Sibindi

18h ago

Feature: Market boost for Buhera horticultural farmers

By Staff Reporter

Apr. 29, 2024

Stanbic Bank opens more branches for tobacco players

By Agriculture Reporter

Apr. 25, 2024

Study rules out human factor in southern Africa drought

By Nhau Mangirazi

Apr. 20, 2024

El Niño to trigger drought insurance payouts in Zimbabwe

By Bloomberg News

Apr. 19, 2024

Govt sets target for winter wheat production

By Priviledge Gumbodete

Apr. 17, 2024

El Niño drives Zimbabwean millers to seek Brazilian corn

By Bloomberg News

Apr. 16, 2024

Govt to clamp down on cotton side marketers

By Blessed Ndlovu

Apr. 11, 2024

ZITF is more than an exhibition

By Newsday

Apr. 29, 2024

Call for tougher penalties in football

By Newsday

Apr. 27, 2024

Charity begins at home.

By Newsday

Apr. 26, 2024

Heritage-based Curriculum doomed to fail

By Newsday

Apr. 25, 2024

Pussyfooting around over ZiG deadly

By Newsday

Apr. 24, 2024

Zimplow completes Barzem acquisition

By Melody Chikono

Apr. 30, 2024

Caledonia revenue to grow by 17% in FY24

By Mthandazo Nyoni

Apr. 30, 2024

Food prices rise as inflation swells

By TAFADZWA MHLANGA

Apr. 30, 2024

Botswana eyes investment opportunities in Zim

By Mpumelelo Moyo and Patricia Sibanda

Apr. 30, 2024

BNC appoints Masvipe as acting FD

By BELINDA CHIROODZA

Apr. 29, 2024

.

Sport

.

Opinion

NewsDay cartoon 28 November, 2023 edition

NewsDay cartoon 28 November, 2023 edition

By The Watcher

Nov. 28, 2023

Govt urges unity among lithium miners

Currently there are around eight different lithium exploration and mining projects at different development stages.

By Mthandazo Nyoni

Jun. 1, 2023

Over 130 civilians killed by DR Congo rebels - UN

By BBC News

Dec. 8, 2022

Opaque Chinese deals: Mthuli taken to task

By admin

Aug. 29, 2022

Power outages, raw material shortages hit ART operations

By The NewsDay

Aug. 17, 2022

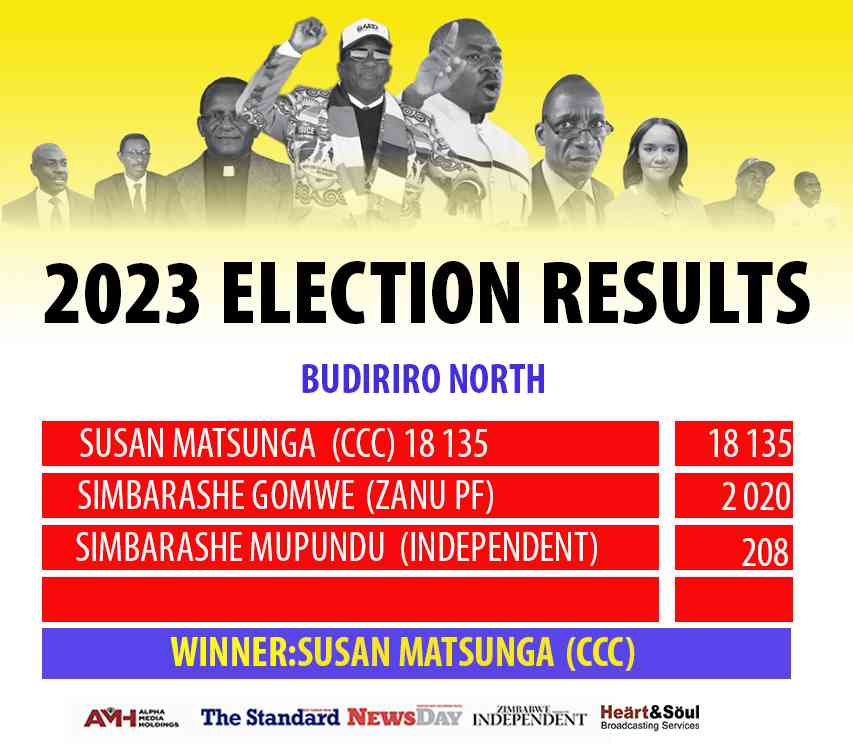

We’re unstoppable: CCC

By The NewsDay

Aug. 16, 2022

Umzingwane, Matobo main road ‘forgotten’

Matobo ward 15 councillor Dickson Moyo said the Old Gwanda road, which is major road passing through Umzingane and Matobo, had been neglected for more than five years.

By The NewsDay

Jul. 29, 2022

Background checks important when recruiting

Safeguard’s Investigations Division conducts background checks on behalf of employers. It also offers truth verification tests using a voice stress analysis (VSA) test.

By AMH Voices

Apr. 27, 2024

Church challenged to join in drug abuse fight

By Style Reporter

Apr. 29, 2024

Grace tidings: Beware of your thoughts

Legally, God has already done everything He needs to do to provide our redemption.

By Doug Mamvura

Apr. 28, 2024

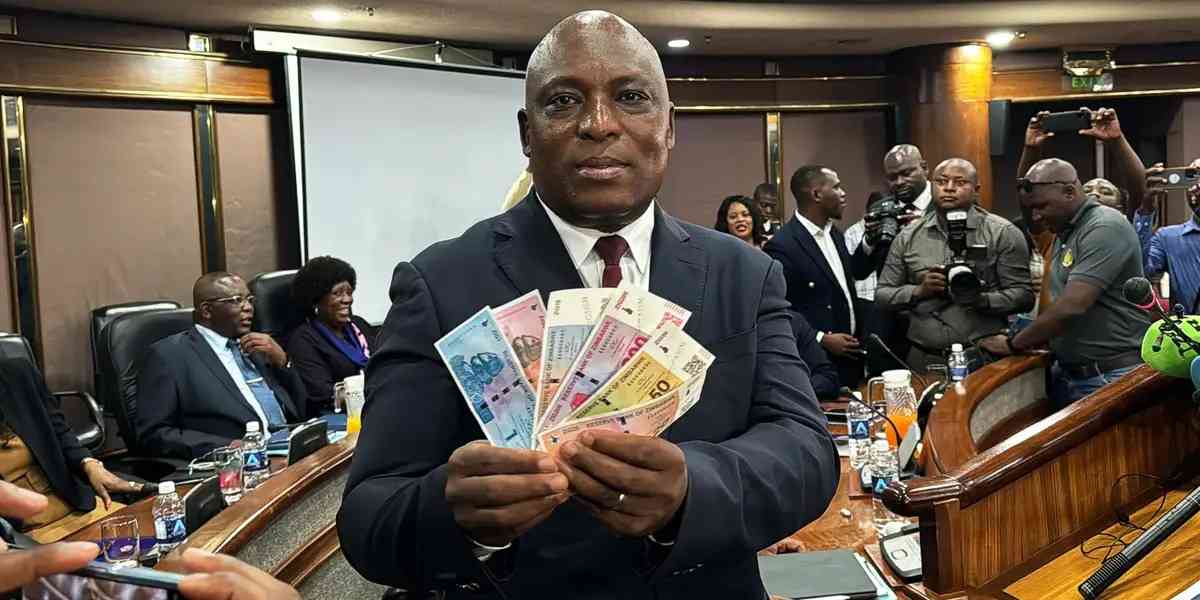

Letter to my people: Generari’s currency horror show

By Doctor Stop It

Apr. 28, 2024

Village Rhapsody: The impact of climate change on Zimbabwe’s water resources

By GARY GERALD MTOMBENI

Apr. 28, 2024

Let them know!

By Tim Middleton

Apr. 28, 2024

Zim men steal solar equipment in Botswana

Christopher Ncube appeared before Plumtree magistrate Joshua Nembaware who remanded him in custody to tomorrow for trial.

By Silas Nkala

18h ago

Chinese miner appeases Pumula residents

By Innocent Magondo

Apr. 30, 2024

Former ZNA captain relieves Gukurahundi atrocities

By Silas Nkala

Apr. 30, 2024

‘Land occupiers fuel human-wildlife conflict’

By Silas Nkala

Apr. 30, 2024

Premium

Zim secures multi-million dollar jet deal

Mushshak is an Urdu (official Pakistan national language) word which translates to proficient.

By Tinashe Kairiza

Apr. 26, 2024