Zanu PF deploys FAZ for by-elections

Local News

By Problem Masau

| 21h ago

Our roads a nightmare: Mohadi

By Mthandazo Nyoni

21h ago

.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

By The NewsDay

Feb. 28, 2024

By The NewsDay

Dec. 5, 2023

Old Mutual launches funeral services in Masvingo

Sponsored Content

Vintage travel and tours reveals its successes

Sponsored Content

EcoCash extends payroll services to security companies

Sponsored Content

Stanbic Bank opens more branches for tobacco players

Muhau said the setting up of three more implants was one way of living up to that commitment as it brings banking facilities closer to the regions of production.

By Agriculture Reporter

Apr. 25, 2024

Study rules out human factor in southern Africa drought

By Nhau Mangirazi

Apr. 20, 2024

El Niño to trigger drought insurance payouts in Zimbabwe

By Bloomberg News

Apr. 19, 2024

Demand for milk seen softening

By Mthandazo Nyoni

Apr. 18, 2024

Govt sets target for winter wheat production

By Priviledge Gumbodete

Apr. 17, 2024

Govt to clamp down on cotton side marketers

By Blessed Ndlovu

Apr. 11, 2024

High rabbit pellets prices choke Zimbabwe farmers

By Mthandazo Nyoni

Apr. 5, 2024

Tobacco firm BAT hires new MD

By Blessed Ndlovu

Apr. 4, 2024

Pussyfooting around over ZiG deadly

By Newsday

Apr. 24, 2024

Let’s walk the talk on grain reserves

By Newsday

Apr. 23, 2024

Confidence is earned, indeed!

By Newsday

Apr. 22, 2024

Professionalism key in luring sponsors

By admin

Apr. 20, 2024

Economy, drought cast pall on Uhuru celebrations

By Newsday

Apr. 19, 2024

Interest rates seen tumbling below 20%

By Mthandazo Nyoni

Apr. 25, 2024

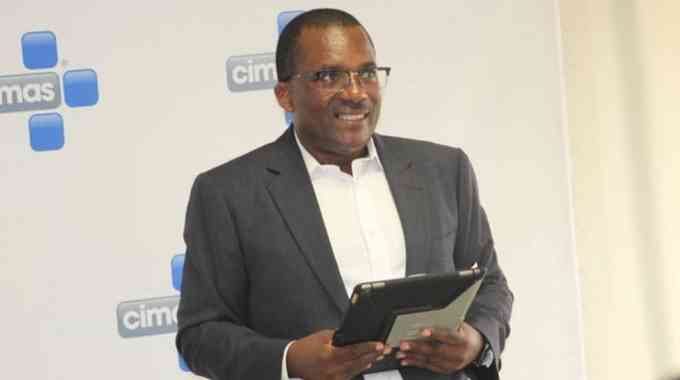

Nyazema lands CBZ CEO post

By Blessed Ndlovu

Apr. 25, 2024

Invictus inks gas to power deal

By TAFADZWA MHLANGA

Apr. 24, 2024

CBZ appoints Zembe chairperson

By Blessed Ndlovu

Apr. 24, 2024

Zimplow CEO resigns

By Business Reporter

Apr. 24, 2024

Zim exports uncompetitive: ZimTrade

By Melody Chikono

Apr. 24, 2024

.

Sport

.

Opinion

NewsDay cartoon 28 November, 2023 edition

NewsDay cartoon 28 November, 2023 edition

By The Watcher

Nov. 28, 2023

Govt urges unity among lithium miners

Currently there are around eight different lithium exploration and mining projects at different development stages.

By Mthandazo Nyoni

Jun. 1, 2023

Over 130 civilians killed by DR Congo rebels - UN

By BBC News

Dec. 8, 2022

Opaque Chinese deals: Mthuli taken to task

By admin

Aug. 29, 2022

Power outages, raw material shortages hit ART operations

By The NewsDay

Aug. 17, 2022

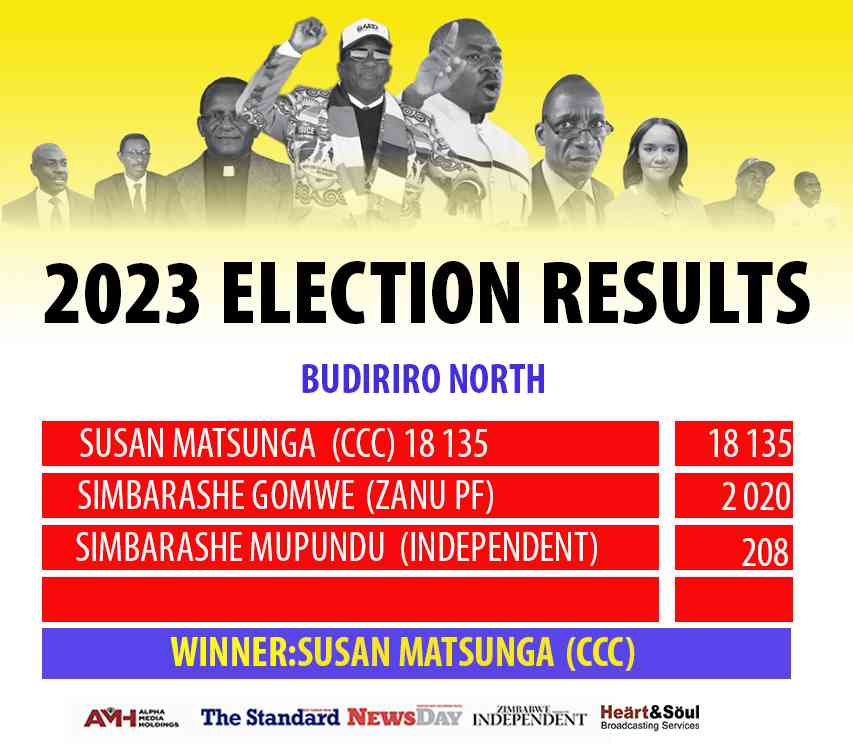

We’re unstoppable: CCC

By The NewsDay

Aug. 16, 2022

Umzingwane, Matobo main road ‘forgotten’

Matobo ward 15 councillor Dickson Moyo said the Old Gwanda road, which is major road passing through Umzingane and Matobo, had been neglected for more than five years.

By The NewsDay

Jul. 29, 2022

The existential crisis of Zim’s national identity

Throughout our rich history, we have fought against colonialism, struggled for independence, and yearned for a future defined by justice and equality.

By AMH Voices

Apr. 25, 2024

Prophet lauds Tanzania, Zimbabwe relationship

Madzibaba Jonah usually goes around the continent and Asian countries where he joins other apostolic members in prayer.

By Style Reporter

Apr. 25, 2024

Wash boost for indigenous churches

By Style Reporter

Apr. 24, 2024

Mahachi pays tribute to late SA gospel icon

By Style Reporter

Apr. 23, 2024

Richest Forex Traders in Tanzania

By The Standard

Apr. 22, 2024

Gwanda water crisis deepens

“Efforts to sink deeper the pipe that draws water are being made, but this is not a final solution, it's just a short term measure as we wait for Zinwa to bring water from Blanket Dam.”

By Silas Nkala

21h ago

We’ll be Zim’s industrial hub again: Coltart

By Silas Nkala

Apr. 25, 2024

Binga South MP, minister clash over boreholes

By Patricia Sibanda

Apr. 25, 2024

Premium

Zim secures multi-million dollar jet deal

Mushshak is an Urdu (official Pakistan national language) word which translates to proficient.

By Tinashe Kairiza

14h ago