Zim loses US$9b to corruption

Local News

By Problem Masau

| 21h ago

.

Videos

Tapera Chikandiwa, Founder Of High Achievers Coach Education Centre In Conversation With Trevor

By The NewsDay

May. 3, 2024

By The NewsDay

May. 3, 2024

By The NewsDay

May. 3, 2024

By The NewsDay

Feb. 28, 2024

Old Mutual launches funeral services in Masvingo

Sponsored Content

Vintage travel and tours reveals its successes

Sponsored Content

EcoCash extends payroll services to security companies

Sponsored Content

Only 2% of Zim women own agricultural land: World Bank

The WB said fewer women earned their livelihoods in the agriculture sector, 66% compared to 57%, with their productivity lower.

By BELINDA CHIROODZA

May. 2, 2024

Feature: Market boost for Buhera horticultural farmers

By Staff Reporter

Apr. 29, 2024

Stanbic Bank opens more branches for tobacco players

By Agriculture Reporter

Apr. 25, 2024

Study rules out human factor in southern Africa drought

By Nhau Mangirazi

Apr. 20, 2024

Demand for milk seen softening

By Mthandazo Nyoni

Apr. 18, 2024

Govt sets target for winter wheat production

By Priviledge Gumbodete

Apr. 17, 2024

El Niño drives Zimbabwean millers to seek Brazilian corn

By Bloomberg News

Apr. 16, 2024

Flip-flopping kills confidence in ZiG

By Newsday

May. 4, 2024

A long way out of the woods for Zim journos

By Newsday

May. 3, 2024

RBZ must stay the course

By Newsday

May. 2, 2024

Workers’ Day has lost its lustre

By Newsday

May. 1, 2024

Mushayavanhu’s last chance saloon

By Newsday

Apr. 30, 2024

‘Entrepreneurs need to enter into alliances’

By TAFADZWA MHLANGA

May. 6, 2024

CBZ to monitor risks to protect 330% profit

By Tatira Zwinoira

May. 6, 2024

ZCTU mourns over low wages

By Blessed Ndlovu

May. 6, 2024

African Sun flush with cash for capital investments

By Tatira Zwinoira

May. 3, 2024

Watch ZiG closely: Fews Net

By BELINDA CHIROODZA

May. 3, 2024

.

Sport

.

Opinion

NewsDay cartoon 28 November, 2023 edition

NewsDay cartoon 28 November, 2023 edition

By The Watcher

Nov. 28, 2023

Govt urges unity among lithium miners

Currently there are around eight different lithium exploration and mining projects at different development stages.

By Mthandazo Nyoni

Jun. 1, 2023

Over 130 civilians killed by DR Congo rebels - UN

By BBC News

Dec. 8, 2022

Opaque Chinese deals: Mthuli taken to task

By admin

Aug. 29, 2022

Power outages, raw material shortages hit ART operations

By The NewsDay

Aug. 17, 2022

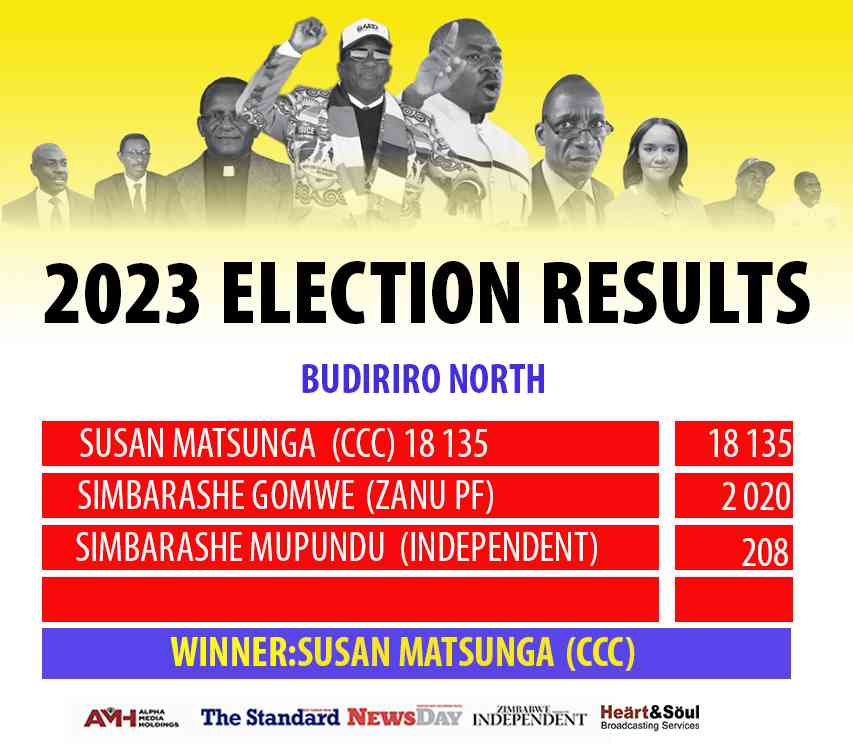

We’re unstoppable: CCC

By The NewsDay

Aug. 16, 2022

Umzingwane, Matobo main road ‘forgotten’

Matobo ward 15 councillor Dickson Moyo said the Old Gwanda road, which is major road passing through Umzingane and Matobo, had been neglected for more than five years.

By The NewsDay

Jul. 29, 2022

Press Freedom and climate journalism: United in crisis

Some journalists understandably believe they are targeted by Israeli forces.

By AMH Voices

May. 4, 2024

Sofar hosts concert at Chapungu Sculpture Park

By Style Reporter

May. 6, 2024

Full house at Mvurwi’s new club official opening

The duo did not disappoint as they gave a scintillating performance in front of the packed Mzansi Lounge.

By Style Reporter

May. 6, 2024

VFEX suspends BNC stocks

By Tatira Zwinoira

May. 5, 2024

Teachers divided over job action.

By Miriam Mangwaya

May. 5, 2024

Bulawayo road rehab chews US$2m

The ERRP focuses on urgent repairs and rehabilitation of roads across the country.

By Innocent Magondo

21h ago

Free cleft lip surgery at Mpilo

By Mpumelelo Moyo and Patricia Sibanda

May. 6, 2024

BCC warns residents, MRP over open air worshippers

By Silas Nkala

May. 6, 2024

Coltart sticks to his guns on arts festival

By Sharon Sibindi

May. 6, 2024

Evolve ICT Summit hailed as a great success

In addition to the insightful sessions, the Evolve ICT Summit provided a platform for tech companies to unveil their latest innovations through product demonstrations and exhibitions.

By Donald Nyandoro

7h ago

By Mike Juru

May. 3, 2024

By Staff Reporter

May. 3, 2024