Matiza estate up in flames... as business partner refuses with US$2m

Local News

By Rejoice Phiri

| 16h ago

Matiza, who held several ministerial posts, died on January 22, 2021 at St Annes Hospital in Harare after battling COVID-19.

Uphold media freedom, govt urged

By Sharon Buwerimwe

16h ago

.

Videos

Tapera Chikandiwa, Founder Of High Achievers Coach Education Centre In Conversation With Trevor

By The NewsDay

May. 3, 2024

By The NewsDay

May. 3, 2024

By The NewsDay

May. 3, 2024

By The NewsDay

Feb. 28, 2024

Old Mutual launches funeral services in Masvingo

Sponsored Content

Vintage travel and tours reveals its successes

Sponsored Content

EcoCash extends payroll services to security companies

Sponsored Content

Only 2% of Zim women own agricultural land: World Bank

The WB said fewer women earned their livelihoods in the agriculture sector, 66% compared to 57%, with their productivity lower.

By BELINDA CHIROODZA

May. 2, 2024

Feature: Market boost for Buhera horticultural farmers

By Staff Reporter

Apr. 29, 2024

Stanbic Bank opens more branches for tobacco players

By Agriculture Reporter

Apr. 25, 2024

Study rules out human factor in southern Africa drought

By Nhau Mangirazi

Apr. 20, 2024

Demand for milk seen softening

By Mthandazo Nyoni

Apr. 18, 2024

Govt sets target for winter wheat production

By Priviledge Gumbodete

Apr. 17, 2024

El Niño drives Zimbabwean millers to seek Brazilian corn

By Bloomberg News

Apr. 16, 2024

RBZ must stay the course

By Newsday

May. 2, 2024

Workers’ Day has lost its lustre

By Newsday

May. 1, 2024

Mushayavanhu’s last chance saloon

By Newsday

Apr. 30, 2024

ZITF is more than an exhibition

By Newsday

Apr. 29, 2024

Call for tougher penalties in football

By Newsday

Apr. 27, 2024

African Sun flush with cash for capital investments

The commitment comes after the firm increased its capital commitments last year to US$11,01 million, up 20,22% on the 2022 figures.

By Tatira Zwinoira

May. 3, 2024

Watch ZiG closely: Fews Net

By BELINDA CHIROODZA

May. 3, 2024

Zimplats spends US$789 million on projects

By Mthandazo Nyoni

May. 2, 2024

Zim to achieve zero tariffs by 2035

By TAFADZWA MHLANGA

May. 2, 2024

Econet in a remittance first for Zimbabwe

By Donald Nyandoro

May. 1, 2024

Risk management and insurance club launched at GZU

By Melody Chikono

May. 1, 2024

Kuvimba CEO steps down

By Business Reporter

May. 1, 2024

A third of Zim’s industry ready for AfCFTA: CZI

By TAFADZWA MHLANGA

May. 1, 2024

.

Sport

.

Opinion

NewsDay cartoon 28 November, 2023 edition

NewsDay cartoon 28 November, 2023 edition

By The Watcher

Nov. 28, 2023

Govt urges unity among lithium miners

Currently there are around eight different lithium exploration and mining projects at different development stages.

By Mthandazo Nyoni

Jun. 1, 2023

Over 130 civilians killed by DR Congo rebels - UN

By BBC News

Dec. 8, 2022

Opaque Chinese deals: Mthuli taken to task

By admin

Aug. 29, 2022

Power outages, raw material shortages hit ART operations

By The NewsDay

Aug. 17, 2022

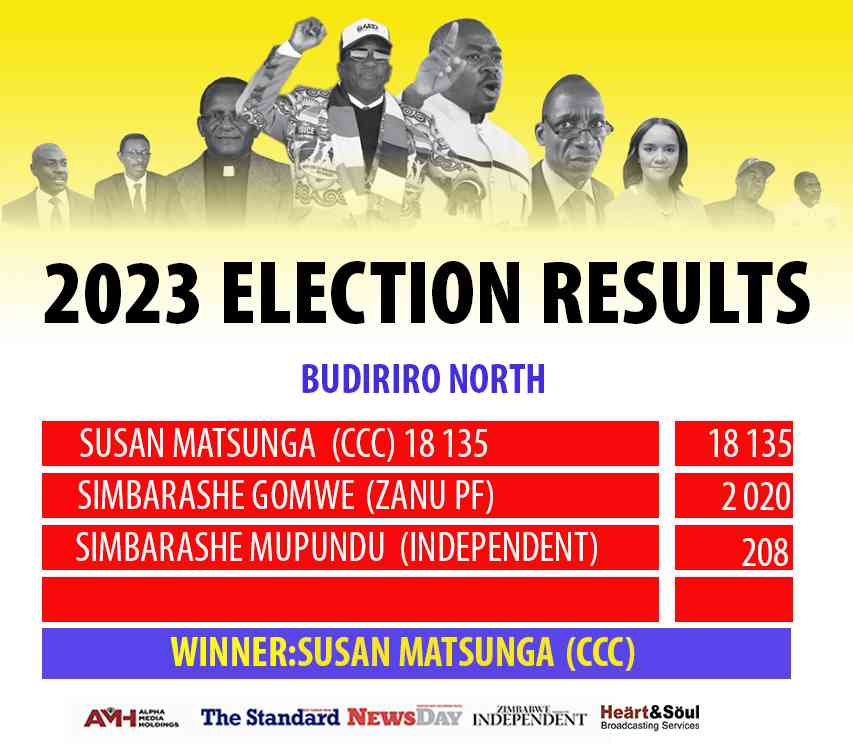

We’re unstoppable: CCC

By The NewsDay

Aug. 16, 2022

Umzingwane, Matobo main road ‘forgotten’

Matobo ward 15 councillor Dickson Moyo said the Old Gwanda road, which is major road passing through Umzingane and Matobo, had been neglected for more than five years.

By The NewsDay

Jul. 29, 2022

Press Freedom and climate journalism: United in crisis

Some journalists understandably believe they are targeted by Israeli forces.

By AMH Voices

16h ago

Manzungu elected into Comesa board

Manzungu said on April 30, the CBC held its annual general meeting where new executive positions were announced.

By Style Reporter

May. 3, 2024

Police investigate Uebert Angel alleged murder plot

By Mirriam Mangwaya

May. 2, 2024

Izodzo Choral Group drops fourth album

By Style Reporter

May. 2, 2024

Church challenged to join in drug abuse fight

By Style Reporter

Apr. 29, 2024

Grace tidings: Beware of your thoughts

By Doug Mamvura

Apr. 28, 2024

No joy for Bulawayo forex dealers

The suspects appeared separately before Bulawayo magistrate Sherpard Mjanja on Thursday before they were remanded to different dates as they were charged separately.

By JERSSIE MPOFU

16h ago

Fatima hostel almost complete

By MARGARET LUBINDA

May. 3, 2024

Cllrs plead for security at Nyamandlovu aquifer

By JERSSIE MPOFU

May. 3, 2024

MRP raids apostolic sects

By Silas Nkala

May. 3, 2024

Asthma needs to be well controlled to stay healthy

A quick relief inhaler contains a fast-acting medication to open your airways and help you breathe more easily when you are having an asthma attack.

By Cimas

May. 3, 2024