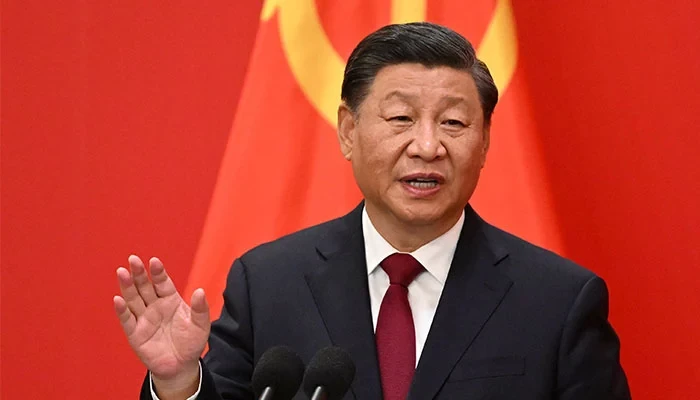

After the Communist Party Congress concluded, Chinese tech companies listed in Hong Kong and New York suffered from heavy selling on the first trading day due to a slump in stocks revealing fear of investors over President Xi Jinping securing his third term in power, media reports said.

It must be noted that Chinese equities usually perform well after the conclusion of party congresses, but not so much this time. One of the key reasons for this is that the 20th Party Congress saw the ascent of leaders to the country's highest decision-making body, the Politburo Standing Committee, who lack reform-mindedness, reported Nikkei Asia.

These leaders chosen by Xi Jinping himself are keen on ideology and politics. It is in sheer contrast to the retiring policymakers who were more economy and market-minded.

There was a ray of hope in China's tech sector as the borders were opening. A boost in the economy was also predicted however the appointments done in politburo were not supportive of these aspirations.

Xi Jinping's appointments in the highest decision-making body were aimed towards tightening his grip over the body rather than a decision based on the larger good of the country's economy.

An index which tracks major Chinese companies traded on US exchanges namely the Nasdaq Golden Dragon China Index plummeted by 20 per cent on the concluding day of the Communist Party Congress, reported Nikkei Asia.

In Hong Kong, the Hang Seng Tech Index sank over 9.6 per cent. Overall, the indexes have dropped more than 45 per cent and 47 per cent this year. Shares in Alibaba Group Holding, China's best-known tech company, fell below the USD 68 price of its IPO in 2014.

Apparently what happens is that once the leadership transitions take place the market predicts growth. As per Goldman Sachs, an American multinational investment bank and financial services company, the growth is anticipated because the market expects that the incoming leaders would prioritize economic growth.

- Putin exacerbates Africa’s food crisis

- Internet gags costing Africa US$2bn in revenue

- Society must change its negative perception on disability

- Chinese threats on The Standard condemned

Keep Reading

However, Xi's favourites held the posts in the politburo and were too focused on ideology and politics. Lorraine Tan, Morningstar's director of equity research in Asia, said the sell-off reflected disappointment in the new makeup of the standing committee.

She noted that the standing committee continued a cautious approach to dealing with COVID, which has been looked upon by big Chinese companies as a demotivating factor as it causes huge unpredictability in the businesses.

"This points to greater risk for slower economic growth, with consumer spending to remain soft," she said. "As such, earnings estimates are likely to be notched lower for 2023."

Brian Tycangco, an analyst of Asian stock markets at US investment research company Stansberry Research highlighted that the policies for tech companies and the economy in Xi's speech concerned investors.

There are other key factors in play as well. One of them is the escalating tensions between US and China. There is a war for superiority between the US and China over the semiconductor sector. Both want to surpass the other. Another is the auditing of US-listed Chinese companies, he said.

"The degree and intensity of the sell-off [on Oct. 24] would appear to indicate a deterioration of confidence among international investors when it comes to China equities," Tycangco said.

COVID pandemic restrictions has given a blow to China's tech stocks. It all started when regulators began to apply more scrutiny and derailed plans for a mega IPO by Ant Group, Alibaba's fintech affiliate.

Some 50 popular US-listed Chinese stocks including Alibaba, Pinduoduo and JD.com have lost a combined USD 1.4 trillion in market capitalization since their peaks in February 2021, reported the media portal.