CEMENT manufacturer, Khayah Cement Limited, had ZWL$0,61 to every dollar of short-term debt as at the end of June 30, 2023, threatening the firm’s ability to generate capex, it has been revealed.

A look at the firm’s financial report for the half year ended June 30, 2023, revealed that the firm had a current ratio of 0,61. This indicated Khayah had low capital to leverage on the country’s growing construction projects heading into the firm’s second half of the financial year.

In the report, the firm’s shrinking liquidity was owing to its trade and other payables, money owed to suppliers for goods or services received on credit, rising 136,3% to ZWL$74,12 billion during the period from the comparative 2022 time-frame.

Further, Khayah saw other amounts owing rising 373,38% to ZWL$42,53 billion in its related party payables during the period compared to the 2022 comparative.

The cement manufacturer’s massive debt was driven by the foreign currency exchange losses seen in last year’s second quarter that caused a revaluation of the foreign currency-denominated long term borrowing.

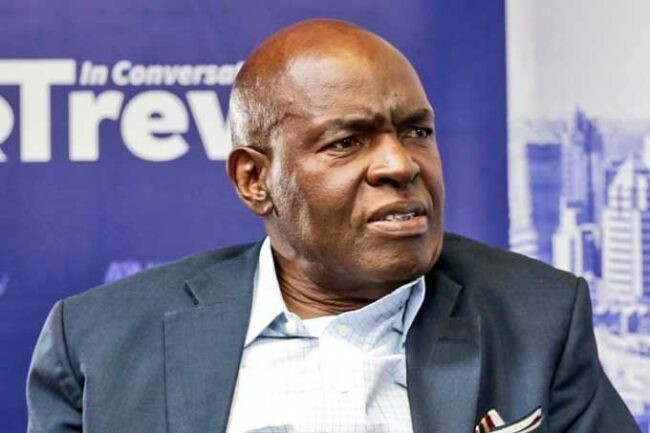

“The company incurred an inflation-adjusted operating loss of ZWL$378,4 billion up from the ZWL$38,7 billion registered in the prior period. The increase in the operating loss position was primarily driven by the foreign currency exchange losses arising from the revaluation of the foreign currency-denominated long-term borrowing,” Khayah’s board chairman Kumbirayi Katsande said, in a statement attached to the results under review.

“This was, in turn, a result of the depreciation of the local currency against the US$ which moved from US$1: 671,45 at the end of December 2022 to US$1: 5,739.80 at the end of June 2023. The company recorded an overall loss position of ZWL$265,2 billion, up from ZWL$48,8 billion recorded in the prior year’s comparative period.”

He said the firm had net long term borrowings of ZWL$268,3 billion as of June 30, 2023, compared to the prior year’s comparative of ZWL$62,6 billion.

- Zimra is now owed over $33 billion as defaults rise

- Fresh warning over gold coins

- DT Bio Mudimba: A sungura perfectionist

- RBZ suspends Access Forex domestic money transfer

Keep Reading

“Inflation-adjusted revenues increased by 210% to close at ZWL$99,8 billion (2022: ZWL32,2 billion) over the comparative period,” Katsande said.

“Cement volumes increased by 117% as production ramped up following the restoration of the collapsed cement mill roof and commissioning of the new vertical cement mill while aggregates and dry motor volumes increased by 213% and 211% respectively versus the same period last year.”

The firm posted an overall loss despite it earning 89% of its revenue in foreign currency during the period under review, an increase of 100% from the 2022 comparative period.

The foreign currency exchange losses last year saw administration and distribution expenses rising by 138,16% during the period to ZWL$41,08 billion from the 2022 comparative timeframe.

“We maintain a positive view of the outlook in the medium to long-term, with sustainable growth expected to be anchored on growth in agriculture, the individual household sector and Government-funded infrastructure projects. The medium to long-term outlook remains positive,” Katsande said.

Khaya’s total assets rose 24,2% to ZWL$236,97 billion during the period from the 2022 comparative, owing to the challenges during the period under review.