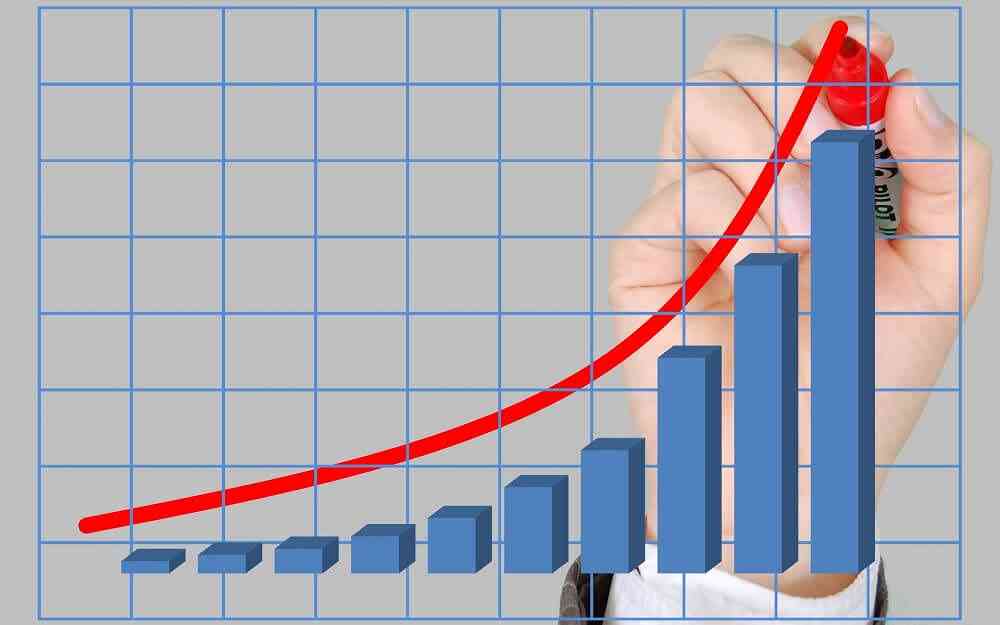

RESEARCHERS at Inter Horizon Securities have projected that revenue at the Victoria Falls Stock Exchange-listed crocodile breeder Padenga Holdings Limited (Padenga) will increase by 30,4% to US$166,81 million during the financial year 2023.

In the prior period, revenue stood at US$127,9 million, an increase of 68% from the previous year.

“We project revenue for FY23 (financial year 2023) to amount to US$166,81 million. EBITDA (earnings before interest, taxes, depreciation and amortisation) is anticipated to come in at US$59,62 million, while the EBITDA margin is expected to strengthen to 35,7%,” Inter Horizon Securities said.

In their analysis of Padenga’s financial results for the year ended December 31, 2022, they projected the group’s revenue to increase by 30% driven by extension of the gold mining operations, high gold prices and an uptick in skin sales.

Padenga expects to complete phase one underground mine at Pickstone Peerless Mine refurbishment in Chegutu in August 2023.

“While no underground mining has started yet at Eureka, this is likely to be developed in the future considering the resources available at the mine. We believe these developments should lead to an uptick in gold output for the group,” they said.

“We forecast mining operations to produce circa 2 291kg (73 670oz) of gold for FY23. Of concern is the high all-in-sustaining-cost which puts pressure on profitability. However, management expects this cost line to average down as production at Pickstone picks up and a higher grade of gold is produced.”

At the crocodile ranching division, the group is currently rehabilitating crocodile pens which is central to the skin quality improvement initiatives.

- Experts downbeat as Ncube cuts GDP forecasts

- Experts downbeat as Ncube cuts GDP forecasts

- Mnangagwa edict ‘will cripple ZSE’

- Tourism industry sees long road to recovery

Keep Reading

Following the shift in consumer taste from big handbags to small handbags, and the upgrade in skin ratings by off-takers, the operations of the business have adjusted to the production of the smaller skin sizes and volumes sold should begin to normalise.

Padenga has also been investing in research and development to improve skin quality.

“Hence, we forecast an uptick in skin sales in the current financial year compared to the previous year. Installation of the phase three solar array to bring the solar plant operating capacity to a total of 1,2 megawatts began during the last quarter of the financial year and will be completed during the first half of 2023,” the researchers said.

“This is expected to alleviate energy costs. We expect the top line to slightly decrease and normalise in FY24 in line with gold price movements.”

Dallaglio posted a strong performance, recording a profit before tax of US$12,9 million in the period under review, compared to a loss of US$4,3 million in the prior comparable period.

Volumes achieved of 1 961 kilogrammes were 10% higher than volumes for the full year in 2021.

This was attributable to the increased contribution from Eureka Mine, which had not yet been fully operational during the same period last year coupled with improved gold prices, according to Padenga.

Revenue for the Zimbabwean crocodile business reduced by 7% in comparison to prior year, as a result of the 17% decrease in the skin volumes partially offset by an improvement in the average realisation per skin.

The group is on a drive to further reduce borrowings and the associated interest charges to sustainable levels. An area of key focus is operationalising Pickstone Peerless underground mining, where development works are at an advanced stage.

The company said Eureka mine continued to contribute significantly to volume growth and profitability. The crocodile farming division has undergone numerous challenges mainly relating to changing customer requirements as well as adverse market conditions.