THE Deposit Protection Corporation (DPC) has confirmed the cancellation of operating licences for ZB Building Society (ZBBS) and FBC Building Society (FBCBS) following approved mergers that integrated both institutions into their parent banks.

In December 2025, FBC Holdings Limited (FBCH) secured regulatory approval to merge FBC Bank Limited and FBC Building Society, with the consolidation taking effect at the end of the month. The move is aimed at streamlining operations and strengthening the group’s financial services platform.

Earlier, ZB Financial Holdings (ZBFH), the holding company for ZBBS, revealed plans to consolidate its banking operations under a single banking licence.

According to DPC, FBCBS ceased to be a member of the Deposit Protection Scheme following the cancellation of its operating licence on December 30, 2025.

All deposit liabilities and related banking assets were transferred to FBC Bank Limited, a registered member of the Deposit Protection Scheme.

“Deposits previously held with FBC Building Society continue to be protected under the Deposit Protection Corporation Act [Chapter 24:29] through FBC Bank Limited; and no compensation is payable under the DPC Act, as FBC Building Society did not become insolvent,” DPC said.

On ZB Building Society, DPC said the cancellation of its licence was part of an approved restructuring and not due to insolvency.

It said the building society had sufficient assets to meet depositor obligations, which were transferred to ZB Bank, a registered banking institution and member of the Deposit Protection Scheme.

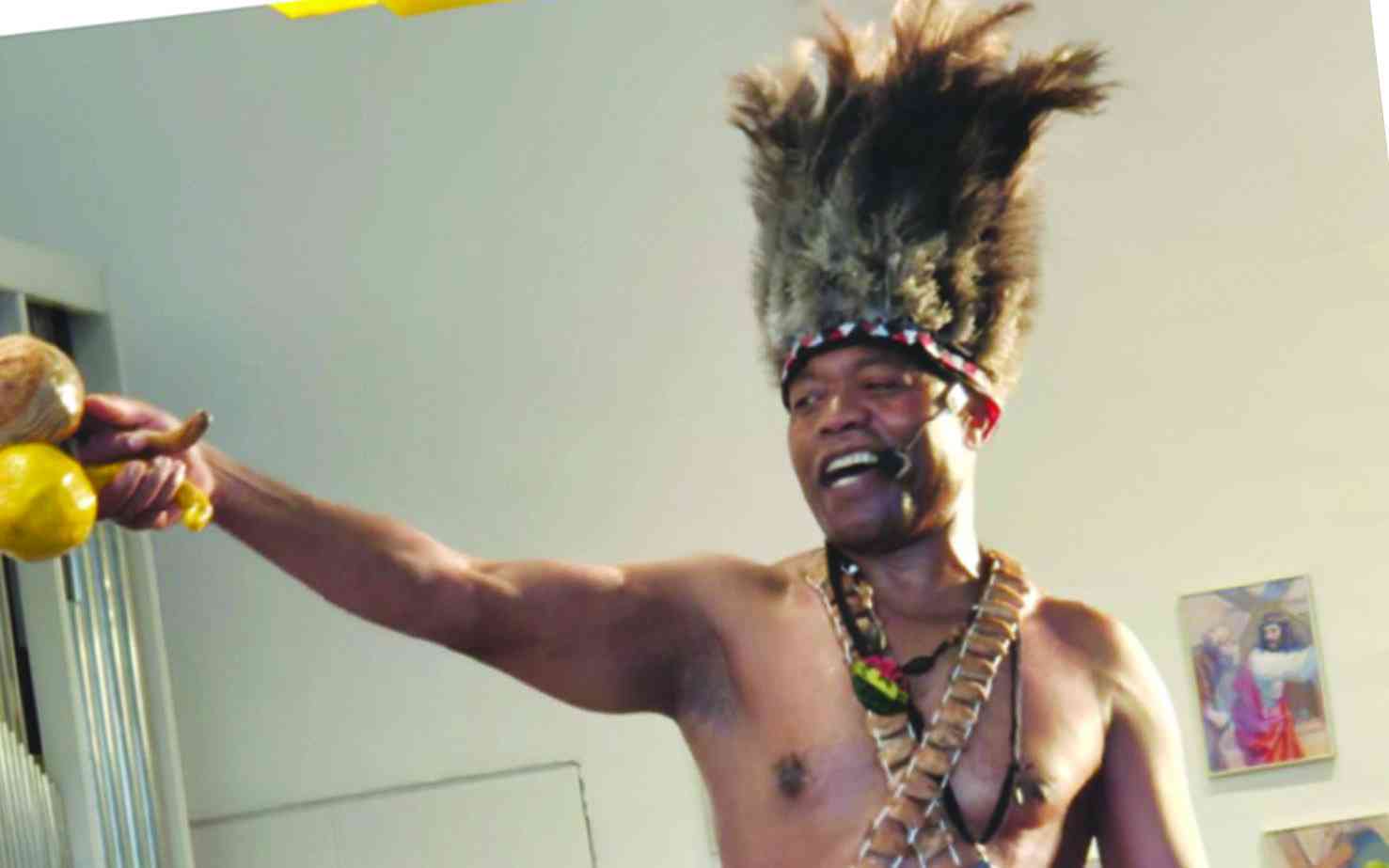

- Dembo’s music lives on

- Ex-DPC boss charged for ‘looting’ spree

- Ex-DPC boss charged for ‘looting’ spree

- DPC pays out $139 million

Keep Reading

“Depositors are advised that eligible deposits previously held with ZB Building Society continue to be protected under the Deposit Protection Corporation Act [Chapter 24:29] through ZB Bank and that no compensation is payable under the Deposit Protection Act, as the institution did not become insolvent,” DPC said.

“The DPC will assume a monitoring role, where applicable, to ensure that the rights and interests of depositors are safeguarded during the transition and any related processes. The DPC remains committed to protecting depositors, promoting confidence in the financial system, and supporting orderly and transparent resolution processes within the financial

sector.”

Both FBCH and ZBFH said the consolidations are part of efforts to strengthen their balance sheets.