Moovah, Zimbabwe’s leading short-term insurance firm, has taken customer convenience to a new level by offering to deliver motor vehicle insurance discs to customers’ doorsteps.

The move comes at a time when motorists wait in long queues at various institutions across the country when renewing their vehicle licences at the end of every quarter.

However, this is set to end with Moovah’s innovative move, along with its platforms and insurance products, which give motorists time to focus on other productive matters.

“Register your car anytime, anywhere from the comfort of your home or office and we will deliver the insurance discs where you are,” Moovah said.

When customers buy motor insurance, Zimbabwe National Road Administration (Zinara) and radio licenses on Moovah, they will enjoy the option of having discs delivered to their doorsteps.

“After buying your insurance and you want the discs delivered to your premises, simply email the registration number and Zinara receipt number to [email protected],” said Moovah.

“To renew your vehicle insurance, Zinara and ZBC licence discs on Moovah, simply dial *901# on any Econet registered number, select Vehicle Registration, select Add Vehicle and input Vehicle Registration Details,” Moovah added.

In Zimbabwe, it is illegal to drive a vehicle without insurance. The minimum requirement is third party insurance which allows third parties an avenue to claim compensation for any damage to property, physical harm as well as death caused by the insured vehicle.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

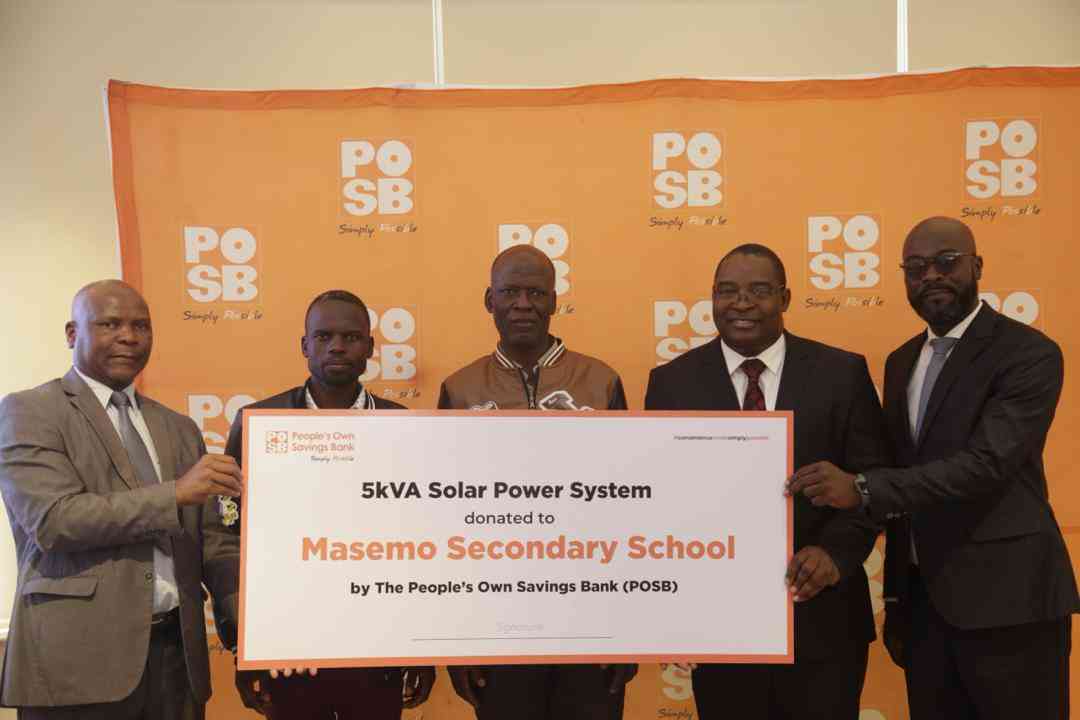

- Letters: How solar power is transforming African farms

Keep Reading

In order to get a vehicle licence from Zinara, a vehicle owner needs to ensure the vehicle has a minimum of third-party insurance. This statute is listed under [Chapter 18:11 of the Road Safety Act.

Moovah’s third-party insurance covers liability for death or bodily injury to third party vehicles or third-party property. Third-party bodily injury and death is covered up to US$2 000 and third-party property damage up to US$2 000.

In addition, the company’s full third-party, fire and theft insurance covers damage or loss caused by fire or theft or attempted theft to the insured vehicle or its accessories. This insurance product covers up to US$10 000 for bodily injury and death while third-party property damage up to US$10 000.

“Our comprehensive motor vehicle insurance provides for accidental damage to the insured vehicle, third-party property and bodily injury up to US$20 000. The insured vehicle is covered up to the insured value or market value,” said Moovah.

“This package also covers your car if it is damaged by hail storms, falling trees or other acts of nature or through an accident.

“We provide 24 hours roadside assistance countrywide from AAZ, all year round in the event of an accident. AAZ is available on +263 782 783 691, +263 712 406 033 and +263 242 932089.”