Although the financial crisis in Zimbabwe is being blamed on lack of investment and exports, there is more that can be done to make sure that the problem is not as bad as it is now.

By Harris Madhuku,Our Reader

The definition of money is not all about notes and coins, as the majority of bankers and Zimbabweans are adamantly insisting. It’s an ancient definition and approach to believe that all transactions to be done have to be hard cash.

It is not a secret if we say that the shortage of money in circulation is mainly because more money is going outside the country than what is coming in.

There are a wide range of reasons that are to blame for the dryness of the money supply system in the country. The most immediate thing is that Zimbabwe is expensive compared to its trading partners, so Zimbabweans opt to go to other countries to buy little things such as clothes and even tissue.

Secondly, consumer confidence in the country is at its lowest levels and people no longer trust that you can buy a high-quality item in the Zimbabwean market; in the case that you get it, it will be expensive and it’s better if you go outside the country and buy it for yourself.

We have noticed that people are buying blankets, beds and all kinds of furniture from South Africa, Zambia, Botswana and other countries.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

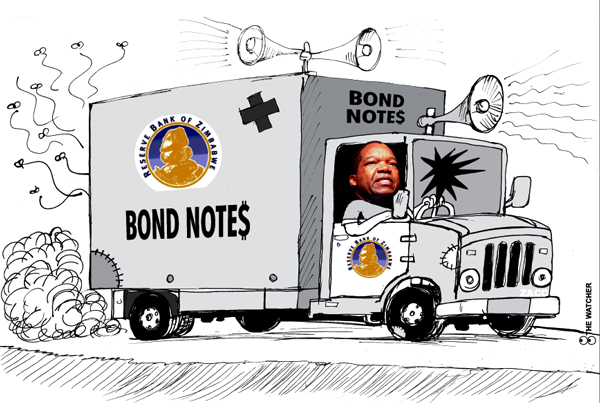

From a banking point of view, it is acknowledgeable that the Reserve Bank no longer has the power to print money in the event that there is reason to do so because its monetary policy role is limited in the multi-currency system.

However, it is the responsibility of the central bank to make sure that every person in the country is banked. It does not need anybody to be employed in order to be banked.

Now the question is: How is that supposed to happen? The central bank must make sure that there are laws that make every bank in Zimbabwe scratch or reduce to very insignificant levels the charges for unemployed or student account holders.

At the same time, it must be made a law for commercial banks to offer a debit, MasterCard or VISA card to each and every account holder free of charge.

Currently, customers have to apply for a bank card and that long process discourages people from having bank cards. What happens when people do not have bank cards? They will demand hard cash from banks for every transaction in their lives.

What happens to the banks when every customer is demanding his/her money? They will run out of cash because the money is going into the informal sector that is not banked as well.

We cannot say there is no money in the economy at the moment, but the fact is that the money is not banked. In this case, everyone needs a better solution that is convenient because they have been spending days in order to withdraw their money, so

anything that can help depositors to do their transactions will be welcomed.