If you’re exploring easy-to-use BYDFi exchange tools for real-world spending, the new BYDFi Card is quickly becoming one of the most practical options for turning digital assets into everyday payments. It does all this without the endless friction that usually comes with crypto cards. You don’t need to be a power user to make it work, and you definitely don’t need to go through layers of KYC hoops just to tap, swipe, or pay online.

With crypto payments gaining momentum worldwide — and BYDFi stepping into the spotlight as the Official Crypto Exchange Partner of Newcastle United — the timing for a borderless, globally functional card couldn’t be better. Traders want speed. Consumers want usability. And the industry wants something that actually works across countries without black-hole fees.

The BYDFi Card aims to hit that sweet spot.

Why the BYDFi Card Matters Right Now

Most crypto cards promise convenience but deliver complications. Either you’re locked into one region, forced to pre-convert assets manually, or hit with surprise FX fees. The result? A card that feels more like a restricted coupon than a real Visa alternative.

BYDFi’s approach is different. Instead of creating a walled garden, they’ve built the card to function like a bridge — from your spot wallet to the real world, without borders or extra steps. And because BYDFi is known in the community as a simplified, low-latency exchange for global users, the card fits neatly into their “crypto for everyone” philosophy.

They’re not trying to reinvent finance. They’re trying to make it less painful.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Ndiraya concerned as goals dry up

- DeMbare’s double boost

- ‘Zifa suspension won’t affect player transfers’

Keep Reading

You load crypto → BYDFi auto-converts when you pay → the merchant receives fiat. That’s the entire flow.

No switching wallets. No manual conversions. No digging through settings to choose which cryptocurrency to draw from.

The card is designed to keep things frictionless because the average person is not going to apply for a crypto card if they need a tutorial and a spreadsheet to track fees.

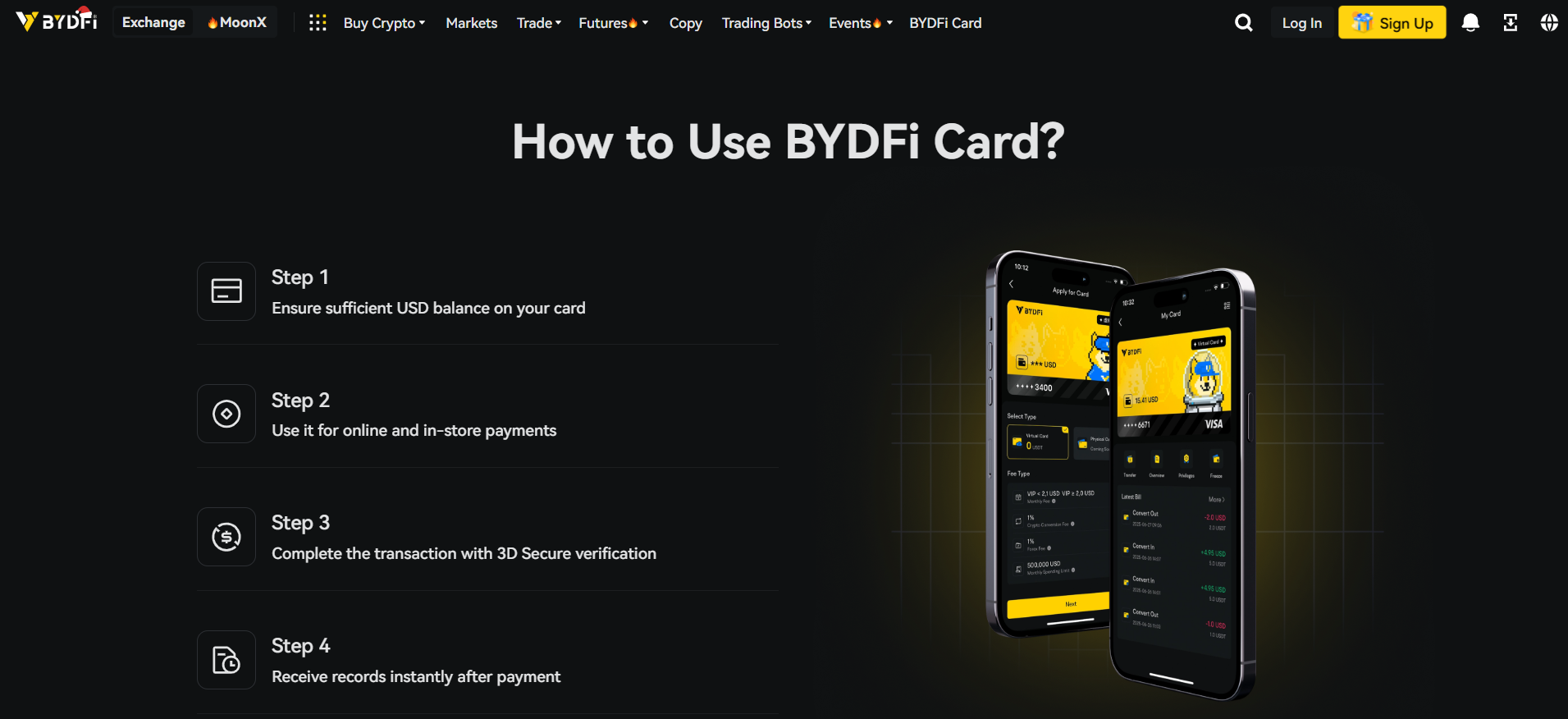

A quick breakdown of the user flow:

- Top up with USDT, USDC, BTC, or ETH

- Spend online, in-store, or globally wherever Visa/Mastercard works

- Auto-conversion executes at the point of transaction

- Transactions settle instantly through your BYDFi wallet

- In-app dashboard tracks spending, limits, and top-ups

If you’ve ever used a neobank card like Revolut or Wise, the experience feels surprisingly similar — but powered by your BYDFi balance instead of a traditional bank account.

Global, Borderless SpendingUnlike some competitors, the BYDFi Card doesn’t lock you into your home country for activation. As long as you’re in an eligible region, you can simply request the card, activate it in the app, and start spending.

This “no borders” design solves one of crypto’s biggest pain points: Your crypto works everywhere, but your crypto card doesn’t.

With BYDFi, your card follows your travel patterns, not your residency status. That alone makes it appealing for:

- Nomads and remote workers

- Frequent travelers

- Users living abroad temporarily

- Traders who want to spend profits instantly

Crypto value is already global — it’s the financial infrastructure around it that’s stuck in 1998. BYDFi’s card is one step toward closing that gap.

A Quick Look: BYDFi Card vs. Traditional Crypto CardsHere’s how the BYDFi Card stacks up compared to some common competitors:

Feature

BYDFi Card

Binance Card

Crypto.com Card

Borderless Usage

✔ Global availability

Limited regions

Limited regions

KYC Requirement

Simplified

Full KYC

Full KYC

Auto-Conversion

✔ Automatic

✔ Automatic

✔ Automatic

App Usability

Very easy

Moderate

More complex

Fees

Low/transparent

Varies by region

Multiple fee layers

Rewards

Ongoing promos tied to campaigns

Cashback tiers

CRO-based tiers

This isn’t a “BYDFi wins everything” situation — each card has strengths. But if you want simplicity, global reach, and no CRO/Binance token staking pressure, the BYDFi Card is objectively more accessible.

Building Trust Through Newcastle UnitedCrypto cards are more than a novelty—they’re a daily financial tool. Users naturally ask: Is this platform stable? Will my funds be secure? Can I rely on this card long-term? BYDFi’s 2025 partnership with Newcastle United addresses these concerns head-on.

By aligning with a globally recognized Premier League club, BYDFi signals financial strength, strategic vision, and mainstream credibility. This partnership isn’t just marketing—it demonstrates that BYDFi is committed to building a lasting presence in the crypto market. For cardholders, it provides reassurance that the BYDFi Card is supported by a credible and stable exchange, designed for everyday use without the fear of sudden discontinuation.

Fees, Limits, and Real-World Usability

Fees can make or break a crypto debit card. BYDFi keeps the structure simple:

What users typically experience:

- Low FX fees

- No hidden markups for conversion

- Minimal top-up fees

- Zero monthly maintenance cost

- Clean withdrawal/spending limits

Instead of adding micro-fees everywhere, BYDFi relies on transparent conversion and low spreads. This is one of the reasons crypto-native users gravitate toward their ecosystem: you know what you’re paying upfront.

Who the BYDFi Card Is Best ForThe card isn’t trying to be everything for everyone. But it’s surprisingly good for several types of users:

- Crypto traders who want instant off-ramping

Spend USDT today, whether the market pumps or dumps tomorrow.

- Frequent travelers

Avoid the “my bank froze my card again” nightmare.

- Users are tired of KYC burnout

The application flow is notably simpler than most competitors.

- Non-technical users

If you can send USDT, you can use this card.

- People who dislike locked staking requirements

Unlike CRO or BNB-dependent cards, no token lock-ins are required.

Why This Card Works — Without Overcomplicating ThingsA lot of crypto products fail because they forget who they’re building for. Not everyone wants a DeFi textbook disguised as a debit card.

The BYDFi Card works because it:

- Removes friction

- Reduces fees

- Keeps everything inside a clean app

- Doesn’t ask users to jump through staking hoops

- Allows crypto to be spent globally, not regionally

It reflects BYDFi’s broader philosophy — the same philosophy behind MoonX, the dual-engine CEX/DEX model, and the exchange’s rising visibility in 2025.

Crypto is supposed to be practical. BYDFi built a card that treats it that way.

Final ThoughtsThe BYDFi Card isn’t trying to overthrow banks or reinvent the Visa network. It simply gives crypto users a smoother, more borderless way to spend what they already hold — and it does so with fewer restrictions than most crypto cards on the market.

If you’re looking for a straightforward, globally functional, no-nonsense option for spending digital assets, the BYDFi Card delivers exactly that.