In the midst of the noise and rumblings around the new structured currency, where there is no shortage of opinion on what should or should have been done, it is very easy to forget about the actual Monetary Policy Statement (MPS).

Perhaps the idea to announce the new currency at the same time as the MPS was a strategic move by the authorities, but if we are not careful we can miss a chance to analyse a very important policy document whilst focusing on the structured currency.

Although the new currency forms part and parcel of the monetary policy, it is also important that there are other aspects of the monetary policy beyond just the currency and this article will dwell on those.

An MPS in simpletons language is a medical report of the state of the financial sector of the economy. It gives an overview of the financial flows in and out of the country over the year and an overview of the status of the banking sector paying attention to certain evaluation metrics. Terms like exchange rate, inflation, balance of payment, broad money supply and statutory reserves amongst others are used very often in the MPS.

The Central Bank usually have a choice to make their monetary policy either restrictive or accommodative. The former is also sometimes called a hawkish policy as it seeks to increase interest rates and statutory reserve requirements to tame inflation in the country.

The latter is often referred to as dovish policy and is the direct opposite of the hawkish policy that the RBZ has been pursuing for some time now.

In this hawkish policy, the policy rate for the greater part of last year was between 130% - 150% per annum for the local currency and this is the minimum rate that banks can lend at.

However, an accommodation facility for the productive sector at 75% per annum was availed. Given the new local currency, the policy rate is now at 20% which is still very restrictive.

- Zimpraise to release album Number 13

- Hyperinflation headache for accountants

- Zimpraise to release album Number 13

- Hyperinflation headache for accountants

Keep Reading

In addition, Open Market Operations, which are activities by the Central Bank to control money supply were applied including instruments like gold coins to tame inflation. Statutory reserves were also reviewed upwards to 15% for demand and call deposits, meaning for every dollar you have in your bank account that you use for everyday transactions, fifteen cents of that can’t be lent out by the banks.

Non-Negotiable Certificate of Deposit (NNCD) were also utilised by the Apex bank to mop up excess liquidity in the market in their attempt to tame inflation.

The foreign currency auction system had become an integral part of the monetary system in Zimbabwe since mid-2020. Essentially over that time US$4 billion was channelled via the auction to importers and was financed by the exporters. This auction had become a bone of contention due to its operationalisation, with other economic agents blaming it for selling cheap foreign currency and it has now reached the end of its life. The auction was closed with a backlog which will be converted into the new currency.

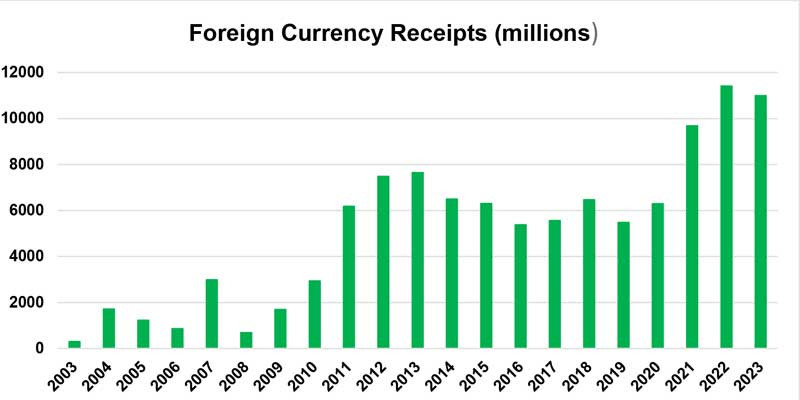

The other important component of the MPS are the foreign currency flows of the country. In this section the Central Bank breaks down all the inflows i.e. exports, international remittances, Foreign Direct Investments, private loans, and income receipts. This will be against the foreign payments that are made by the country mainly via imports.

In 2023 the country faced a four per cent drop in receipts but are still way above the imports and foreign currency earning capacity of many regional peers.

The financial sector has also witnessed a steady increase in the diaspora remittances over the years and has now become a critical component of our foreign currency inflows.

These free funds saw a 17% jump in 2023 and is expected to continue on its streak. Exports took a 17% knock, albeit being the largest contributor to these inflows. The knock in exports were mainly due to the softening of commodity prices, which are the bulk of exports. According to the MPS 2024 started on a good note with first two months exports recording a 23% improvement.

The MPS also looks at the health of the banking sector in the economy. This looks at various metrics to assess the fitness of the sector such as loan to deposit ratios, cost to income ratio etc.

Of interest is the non-performing loans ratio which is beginning to spike given that the majority of loans and advances are in hard currency. However, at the moment they are still below the 5% benchmark.

The asset mix of the banking sector is also worth an analysis with loans and advances contributing just under 30%, a 2-percentage point decline from the 2022 numbers whilst balances with the central bank increased to 15% in line with the statutory reserves.

Securities & Investments together with fixed assets were over a quarter of the assets in both years as some of the banks looked at hardening their balance sheets.

The majority of loans and advances remain toward the productive sector despite a 6 percentage point knock off, whilst the consumptive ones were just up 20%. The allocation of loans to the agriculture sector shrunk from 23% in 2022 to under 15% in 2023 as the El Nino induced drought was anticipated. The mining and manufacturing sectors witnessed a marginal increase in the loans advanced to it by the banks together with the distribution sector.

In terms of the banking sector income mix, fees and commission were 20% of the income mix down from 29% in 2022.

On the other non-interest income, revaluation gains frominvestment properties and foreign currency assets was 48% of total income, a level that was maintained from 2022.

In rounding up it appears that the financial sector has managed to survive despite the monetary challenges from a macroeconomic perspective, and this has been justified by various strategies undertaken such as hardening the balance sheet.

However, there are sectors such as the mortgage sector which need the assistance of the banking sector more than what it is currently doing at the moment and the new currency will be essential in ensuring that this is achieved.

- Hozheri is an investment analyst with an interest in sharing opinions on capital markets performance, the economy and international trade, among other areas. He holds a B. Com in Finance and is progressing well with the CFA programme. — 0784 707 653 and Rufaro Hozheri is his username for all social media platforms.