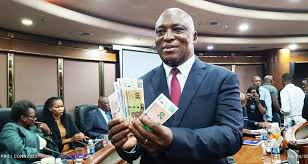

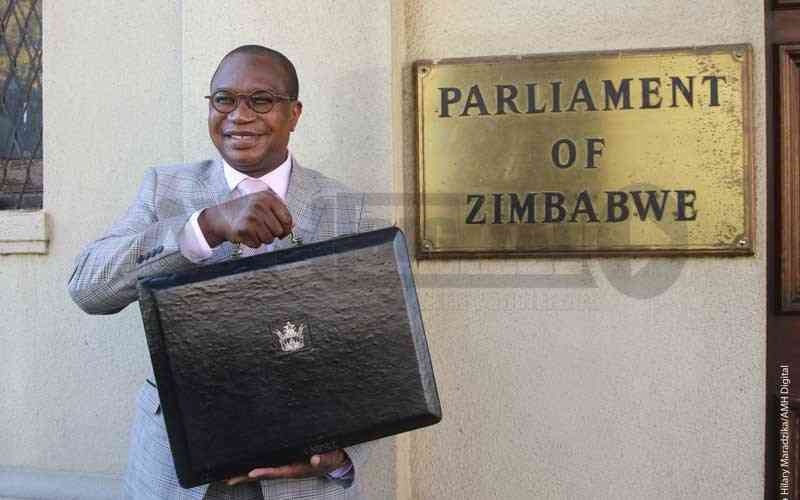

FINANCE, Economic Development and Investment Promotion minister Mthuli Ncube will today present the ZWL$47 trillion 2024 national budget amid a deteriorating economy.

On one hand, Ncube must appease restive constituencies such as the civil servants that have been clamouring for their salaries to be restored to a minimum of US$540 as per pre-October 2018 levels.

Business is clamouring for Ncube to loosen the reins on taxation, with bankers proposing a slash or a removal of the 2% intermediated money transfer tax (IMTT) on cash withdrawals of US$1 000 and above.

They have also proposed that all corporate tax should be payable in local currency to shore up the demand for the Zimdollar which will strengthen the local unit.

This year, Treasury directed that quarterly payments be paid in local currency.

This was credited for stabilising the local unit.

This constituency also wants to settle all its quarterly taxes in local currency.

In June, Treasury directed companies to settle 50% of the foreign currency portion of their corporate tax obligations in local currency.

- The fiddler: A vote of confidence

- Assets requirement headache for insurers

- Letter to my people: There is serious trouble in the cockpit

- Letter to my people: There is serious trouble in the cockpit

Keep Reading

The central bank has recommended that the government considers removing the IMTT on transactions that are intermediated through plastic bank cards and other digital platforms to promote the use of plastic money.

Business has been pushing for the removal of the 2% IMTT on transactions saying it amounted to double taxation. Ncube has remained adamant that the tax head is necessary to finance government’s growing needs.

On the other hand, the Treasury chief needs to contain costs and raise additional revenue to meet the country's growing needs with El-Nino-induced drought looming.

Ncube has acknowledged that the wage bill issue is not cast in stone as it has to take cognisance of wage compression, gaps in service delivery for critical social sectors such as health and education, skills flight, low remuneration levels arising from the loss of value of the local currency and devolved functions of government, among other issues.

Treasury has an extra burden after taking over the central bank’s debt.

There is no doubt that Ncube will raise additional revenue through taxes to fund the budget as Zimbabwe does not get budgetary support or cannot access cheap loans from multilateral financial institutions.

Other than taxes, Treasury can also raise money through borrowing from the domestic market and the central bank.

Government borrowing from the domestic market has been blamed for crowding out the private sector. It is also limiting its borrowing from the central bank.

The 2024 budget comes as government has said the tight fiscal and monetary policy thrust would be intensified as part of measures to stabilise the economy.

There is also a temptation to be Father Christmas and dole out sweeteners.

The tax-free threshold needs another review. In August, Ncube increased the tax-free threshold to ZWL$500 000 from ZWL$91 666 which has been overtaken by rising prices.

The review will boost aggregate demand, leading to more sales.

As Ncube presents the 2024 national budget, the nation hopes the economics professor will discard populism which comes with dire consequences. That the bids by ministries and departments totalled ZWL$110 trillion while Ncube can only offer ZWL$47 trillion signals the problems ahead and calls for meticulous allocation of the scarce resources.

The Treasury chief should cut the coat according to the size of the cloth. Anything to the contrary would be financial suicide.