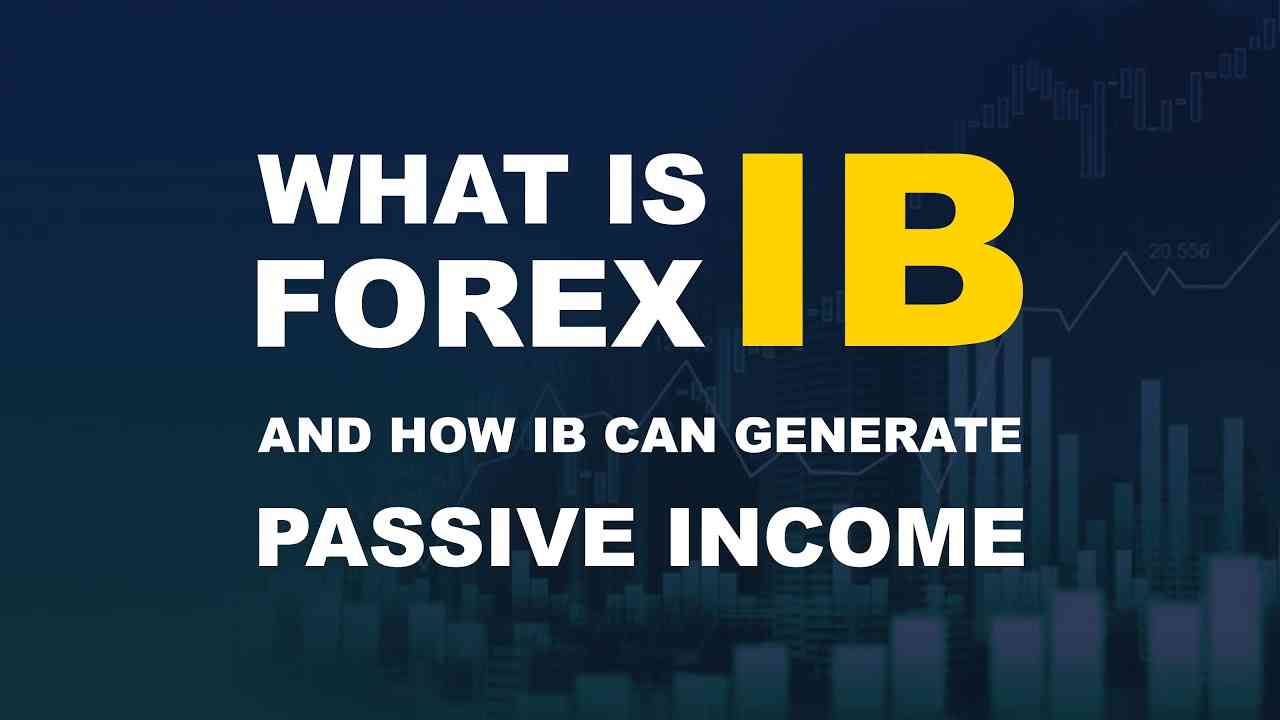

The market where trade takes place is known as "forex," which stands for "foreign exchange." Despite the fact that people are aware of it, the exchange of currencies is necessary in order to engage in international business and trade. This means that currencies are of significance to the vast majority of people throughout the world. The foreign exchange marketplace is the largest and also most liquid marketplace on the planet. Every day, transactions on this market involve a vast number of different parties and involve the exchange of trillions of dollars.

When dealing in foreign exchange, a broker will charge a fee known as Forex IB Commission for each transaction. This fee is often a very tiny fraction of the overall value of the deal, and it can either be a flat rate or a variable percentage of the whole value.CM trading forex program is emerging as leading and competitive though. Since the majority of forex brokers earn their money off of Forex IB Commission, it is essential to have a solid understanding of how CMtrading forex program operates before you begin trading.

2. The party that initiates the trade is responsible for paying the Forex IB Commission, which is typically expressed as a percentage of the overall value of the transaction.The Foreign Exchange, or Forex, market is the place where currencies are exchanged. Forex IB Commission is typically expressed as a portion of the total value of the transaction, and it is the party who starts the trade that is responsible for paying the fee. Every single day, trillions of dollars are traded on the foreign exchange market, which makes it the biggest and most dynamic market in the whole world.

3. In certain circumstances, one or both of the participants to a trade may be required to pay a Forex IB Commission.Forex, or the Foreign Exchange Market, is a market where all currencies are traded. With an estimated daily volume of transactions that is greater than $5 trillion, the foreign exchange market is the largest and most dynamic market in the entire world. This is not even remotely comparable to the total value of all the stock markets in the world combined. But in your opinion, what does that mean? If you look more closely at foreign exchange (FX), you might discover some intriguing trading chances that aren't available with other types of investments.

Both parties to a deal could be required to pay a Forex IB Commission in certain circumstances.

4. Because a trader's profitability might be affected by Forex IB Commission, it is essential to take this factor into consideration when selecting a broker.

The foreign exchange market, also known simply as Forex, is a decentralised worldwide market where trading takes place in all of the world's currencies. The foreign exchange market has an average daily transaction volume that is greater than $5 trillion, making it the largest and most dynamic market in the whole world. This is not even remotely comparable to the total value of all the stock markets in the world combined.

Is $100 sufficient for forex exchange?Yes, a deposit of $100 is often sufficient to begin trading forex and testing a trading technique. Because it is not a significant amount of money, the potential risk vs benefit will be restricted. Investing with a little amount of risk assets, on the other hand, gives you the opportunity to test a new investing strategy or gives beginners who are new to forex trading the chance to learn via trial and error.

- Zim tycoons elevate offspring to key roles

- Mujuru, daughter in bitter wrangle

- Zim tycoons elevate offspring to key roles

- 5 best forex trading strategies for Africans

Keep Reading

Trading foreign exchange with such a low quantity of capital will have a significant negative impact on your bottom line, but it can be an essential part of learning with less exposure to financial loss. If you make the smallest trading size for forex, including such units per month of the EUR/USD pair, and indeed the price is 1.1224, your trader may need a 30:1 liquidity needs from you. Another example would be if you open the largest deal size for forex, such as 100,000 units of the GBP/USD pair. That 3.33% of the total amount of the trade, which ended up being $1,122.4, would wind up as $37.41 in security, and it's going to be blocked as soon as the trade was opened. As a result, there would be a total of only $62.41 accessible (and this figure does not even take into account the value of the difference).

Final Thought:After all the discussion above, it is clear that even if the forex market is incredibly competitive, it can also be lucrative and fruitful. However, as per the motive of CMtrading.com, the IB job contributes significantly to their ability to make a profit. As a result, we consider this CMtrading forex program to be very friendly toward IBs.