MARKET forces have caused havoc on the Zimbabwe dollar on the parallel market, with the exchange rate shooting to US$1:$70.

BY TATIRA ZWINOIRA

Last week, from Monday to Saturday, the US$:Zimdollar rate plunged nearly 23%, with tobacco farmers reportedly calling on government to urgently address the currency instability.

The rapid deterioration has dramatically exposed the futility of government’s decision to reintroduce the local unit as the sole legal tender in June last year as all efforts to curb the rising exchange rate have fallen flat.

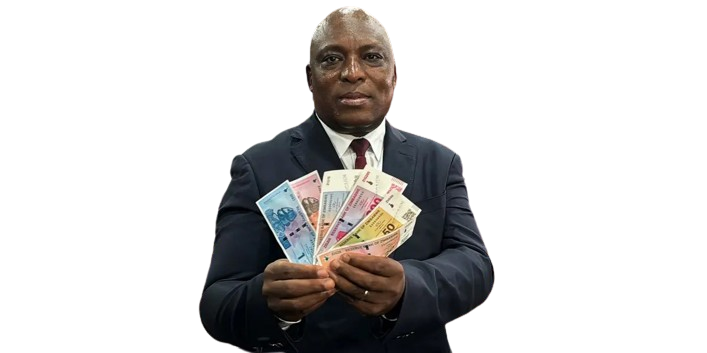

Reserve Bank of Zimbabwe governor John Mangudya last week told Parliament that parallel market dealers were like coronavirus.

“The Zimdollar experiment and ‘policy missteps’ were never going to succeed because the right institutions, i.e a strong and independent central bank; high productivity and production; trust and confidence among others were and are not yet in place. Economies are not commanded into prosperity,” economist Prosper Chitambara tweeted over the weekend.

To mitigate against the growing monetary challenges, the central bank since 2015 has turned to quantitative easing through the issuance of Treasury Bills to increase money supply and encourage lending and investment.

However, Chitambara said this had not worked due to lack of conditions suitable for it. “It’s very easy to run a nominal budget surplus through quantitative easing. The only problem with quantitative easing when you are a highly consumption-oriented economy in an environment of low productivity is that sooner or later, you will end up in a situation where ‘too much money is chasing too few goods’,” he said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The Zimbabwe dollar continues to fall in value due to the currency lacking foreign currency, commodity or market confidence backing.

And with the global coronavirus pandemic, two of Zimbabwe’s sources of foreign currency earners — exports and foreign remittances — are set to be adversely affected, thus weakening the Zimdollar further.

Renowned American economist Steve Hanke rated the Zimdollar as the second junkiest currency in the world.

The main effect of the continued fall of the Zimdollar has been hyperinflation as well as wage and business income erosion that has greatly slowed the economy resulting in an expected double-digit contraction for 2020.

Former Finance minister Tendai Biti reiterated his call for the adoption of the South African rand to stabilise the economy.

“In July 2010 after a meeting in Boksburg, Johannesburg, with Pravin Gordhan (former South African Finance minister), I briefed my principals on the need and imperative of joining the Rand Monetary Union and Sacu [Southern African Customs Union]. The idea was ferociously shot down purely on the grounds of nationalism. South Africa was said to be brash and arrogant,” Biti said in a series of tweets last week.

“Be that as it may, adoption of the rand and joining the Rand Monetary Union is the only viable mid-term solution. The US$ is overvalued and has appreciated more than 2% in last two years.

Zimbabwe must devalue to a stable international currency which is the rand.”

As Finance minister, Biti oversaw Zimbabwe’s highest consecutive growth rates between 2009 and 2012 since independence based on statistics of the country’s gross domestic product at the World Bank.

“With the US$ now trading above $65 on the parallel market, it is time the regime accepted the failure beyond any shadow of doubt of its monetary and exchange rate policies. We have constantly argued that you can rig everything else, but not the economy. An urgent reset is required,” he said.