An External and Domestic Debt Management Committee (EDDC) will be established to make recommendations to the Ministry of Finance on all external borrowings, domestic debt issuances and guarantees as government moves to contain loan contractions, according to a Bill gazetted on Friday. BY OUR STAFF REPORTER

The committee will also make recommendations to the minister on public debt management policy and strategy, the Public Debt Management Bill says.

EDDC would be made up of the secretary of Finance as the chairperson. It would be composed of the governor of the Reserve Bank of Zimbabwe and the Attorney-General.

The EDDC “shall for each financial year set forth the recommended maximum amount of new government borrowing and government guarantees which may be undertaken throughout the year”. The Finance minister shall be compelled to take into account the committee’s recommendations when exercising authority on contracting new loans.

The far-reaching reforms are meant to curb the recurrence of borrowings not meant for key projects.

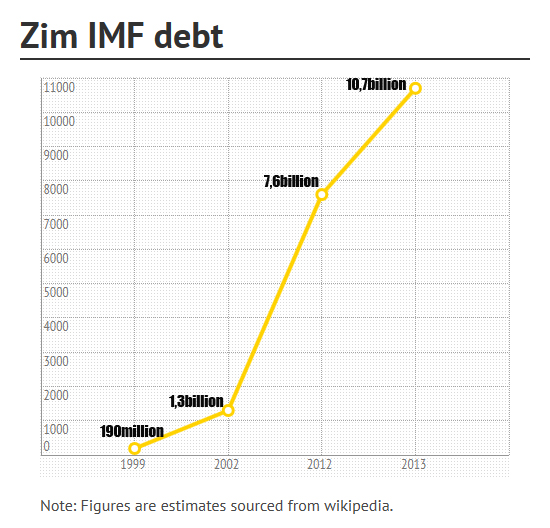

Zimbabwe is reeling from a total domestic and external debt of $9,9 billion which it is failing to service, thus militating against efforts to get fresh lines of credit needed to reboot the economy.

Of the total debt, $6,9 billion is public and publicly guaranteed, meaning that it had been secured with government guarantees.

The Public Debt Management Office will act as the secretariat. According to the Bill, a medium term debt strategy would be crafted to look into the existing public debt portfolio especially (but not exclusively) the government component of the public debt.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The Public Debt Management Office will advise the minister on all government borrowings and “participate in all negotiations with creditors on government borrowings and guaranteed loans”. It will also assess the risks in issuing any guarantees, including assessing the capacity of the beneficiary of a guarantee to repay the loan, and to prepare reports on the method used for each assessment and the results for approval by the minister.

The Public Debt Management Bill seeks to provide for the raising, administration and repayment of loans by the State and for giving of guarantees in respect of certain loans. It also seeks to amend the Public Finance Management Act.

The objectives of public debt management are “to ensure that government’s financing needs and its payment obligations are met at the lowest possible cost over the medium to long term, with a prudent level of risk, and to promote development of the domestic debt market”.

The Finance minister, after consultation with the Ministry of Local Government, shall prescribe an annual borrowing limit for local authorities, the Bill says.

All external borrowings of a public enterprise shall be subject to the prior approval of the relevant minister and the Minister of Finance and Economic Development.

According to the Bill, the Finance minister shall furnish Parliament with a report on government debt management activities, guarantees and lending.

The report shall include “information on how debt management strategy has been implemented over the course of the financial year”. It shall also compose of a list of guarantees issued by government including a classification of guarantees according to their probability of being called in.

The report to Parliament would also include “a list of outstanding borrowings and related debt service projections including classification of the loans by government, public entities and local authorities”.