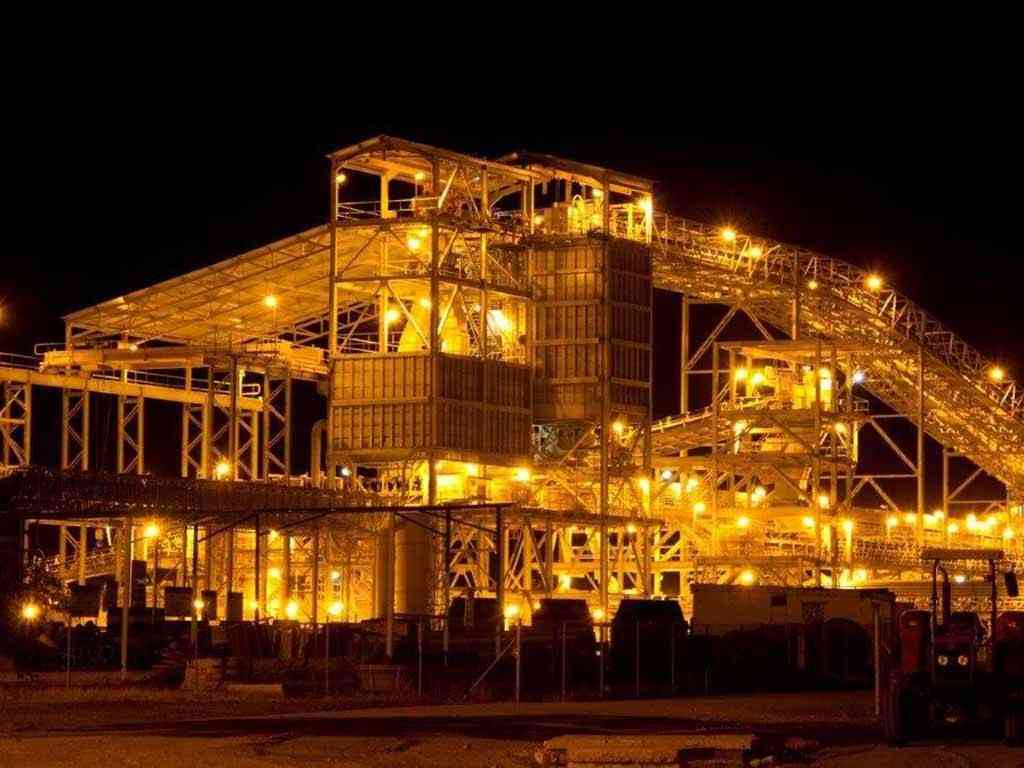

PLATINUM group of metals miner, Zimplats, has committed US$289 million to finish its major projects to scale up production as it moves away from its reliance on certain mines, NewsDay Business has learnt.

In the quarter ended December 31, 2023, Zimplats said all major capital projects under execution at Zimplats progressed according to plan during the period.

“The mine development and upgrade projects (Bimha and Mupani mines) will replace production from Rukodzi Mine, which was depleted in FY2022, and that from Ngwarati and Mupfuti mines, which will be depleted in FY2025 and FY2028, respectively,” Zimplats said.

“Cumulatively, US$368 million has been spent on these projects, with an additional US$51 million committed, against a total project budget of US$468 million. US$220 million has been spent on the smelter expansion and SO2 abatement plant project, with a further US$187 million committed against a total project budget of US$521 million.”

Zimplats said US$1 million was spent on the implementation of the 35 megawatt (MW) solar plant project to date, with US$35 million committed as at December 31, 2023, against a budget of US$37 million.

“This is the first of the project’s four phases, which will be implemented at an estimated total cost of US$201 million to generate 185MW,” Zimplats said.

“US$18 million has been spent on the execution of the Base Metal Refinery refurbishment project to date, with a further US$16 million committed, against a total budget of US$190 million as at 31 December 2023.”

Thus, in total, US$289 million has been committed to finishing these projects.

- FC Platinum reach Chibuku Cup last eight

- Inside sport: The right way to do it

- FC Platinum 8 points clear as Chicken Inn falters again

- FC Platinum move six points clear

Keep Reading

During the 2023 fourth quarter, mining volumes benefited from pillar reclamation operations at Rukodzi Mine and the continued ramp-up in production from Mupani Mine, which is under development.

Resultantly, the ore mined increased by 1% to nearly two million tonnes from the prior quarter and 4% from the 2022 comparative quarter.

Zimplats said increased tonnes from pillar reclamation bolstered 6E (platinum, palladium, rhodium, ruthenium, osmium and gold) head grade, which increased by 1% from the prior quarter and was stable year-on-year.

Meanwhile, ore milled was in line with mined volumes in the period and was stable quarter-on-quarter and year-on-year, with the concentrator plants performing at expected throughput rates.

These mixed results led to PGM 6E ounces seeing a 1% decline in the fourth quarter to 163 307 ounces, from the third quarter, but a 1% improvement from the 2022 comparative.

Zimplats has had to implement cost containment initiatives, in response to softening metal prices which resulted in a 1% retracement in total operating cash costs from the prior quarter, with the year-on-year increase of 3%.

Cash costs of metal produced in the quarter under review was US$134,84 million, 1% and 0,38% down from the previous quarter and the 2022 comparative, respectively.

“Transfers to closing stocks from operating costs amounted to US$0,4 million during the period, in line with inventory movement in the value chain. Cash costs of metal produced declined by 1% from the prior quarter and were stable year-on-year,” Zimplats said.

“Operating cash cost of US$825 per 6E ounce retraced by 1% from the prior quarter and were 2% lower year-on-year, benefiting from higher production volumes, which offset inflationary pressures on utilities.”