THE African Development Bank (AfDB) has given Zimbabwe a US$5,32 million grant to improve the governance and accountability of State-owned entities.

The grant comes under the Institutional Support for State Enterprises Reform (Isser) project whose objective is to strengthen governance and management of public entities thereby reducing fiscal risks and facilitating economic recovery.

The implementation of this project started at the beginning of last month and will end on September 30, 2026.

The grant comes from AfDB’s African Development Fund that contributes to the promotion of economic and social development in 38 least developed African countries. The contribution takes place by providing concessional funding for projects and programmes, as well as technical assistance for studies and capacity-building activities.

“The government of Zimbabwe has received a grant, an amount of UA4 million (US$5,3 million) from the African Development Fund, to finance the Institutional Support for State Enterprise Reform project,” AfDB said, in its procurement notice released last Thursday.

“This project aims to strengthen good governance and enhancing accountability through supporting interventions regarding public administration, improved service delivery and financial management (PFM). The project will enhance Zimbabwe’s capacity to effectively translate into action and implement the existing corporate governance and PFM provisions.”

AfDB said this would include designing electronic systems for reporting and monitoring the Public Entities Corporate Governance Act, the Public Finance Management Act, and the Audit Act.

AfDB uses a unit of account or UA equivalent to the International Monetary Fund’s Special Drawing Rights as its reporting currency.

- New perspectives: Building capacity of agricultural players in Zim

- New perspectives: Building capacity of agricultural players in Zim

- Xenophobic attacks against Zimbabweans barbaric

- AfDB president Adesina coming to Zimbabwe

Keep Reading

In the bank’s Isser appraisal report released last month, UA1 was equivalent to US$1,3307.

Thus, UA4 million converts to US$5,32 million or US$5,33 million using this month’s monthly average that AfDB has used for the currency conversion.

“The project will also support implementation and roll-out of the hybrid ownership model for State enterprises and parastatals,” AfDB said.

The bank said the principal objective of the project was to strengthen governance and management of public entities thereby reducing fiscal risks and facilitating economic recovery.

“The modes of procurement to be used in the project are: Open Competitive Bidding National; Shopping; Quality and Cost Based Selection; Least Cost Selection; and Individual Consultants,” AfDB said.

The need for State enterprises reforms comes as over 100 State-owned entities are now technically insolvent.

At one stage, State enterprises and parastatals contributed about 40% of the gross domestic product. The contribution has since fallen to about 7,5%.

According to Office of the President and Cabinet’s department of Policy Analysis, Co-ordination and Development Planning, US$30 billion is needed to recapitalise State entities.

“Weak corporate governance and financial oversight including corruption, poor financial and operational performance, and ineffective monitoring and evaluation, have limited their (SEPs) potential to deliver services,” read part of last’s month’s Isser appraisal report.

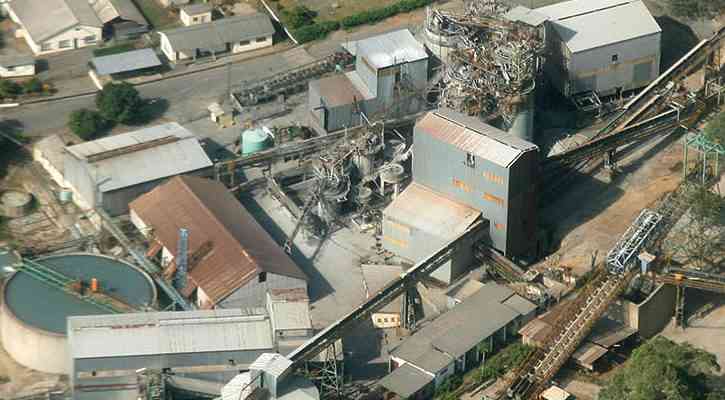

“Other major common challenges facing SEPs include dilapidated plants and equipment, under-capitalisation, outdated technology, inadequate working capital, huge debt overhang, limited access to lines of credit, skills flight, and inter-parastatal debt.”

The bank said the challenges had resulted in most SEPs incurring significant losses, accumulating short-term debt and arrears, resulting in loss of equity.

“Based on the 2022 implementation status report for the SMTRF (Short-to-Medium Term Reform Framework), progress on SEPs (State-owned enterprises and parastatals) reforms has been slow with 27,7%, 44,6% and 27,7% policy decisions completed, still underway and having been revisited, respectively,” AfDB said.

Government is in the process of partially or fully privatising SEPs.