By Tapiwa Gomo

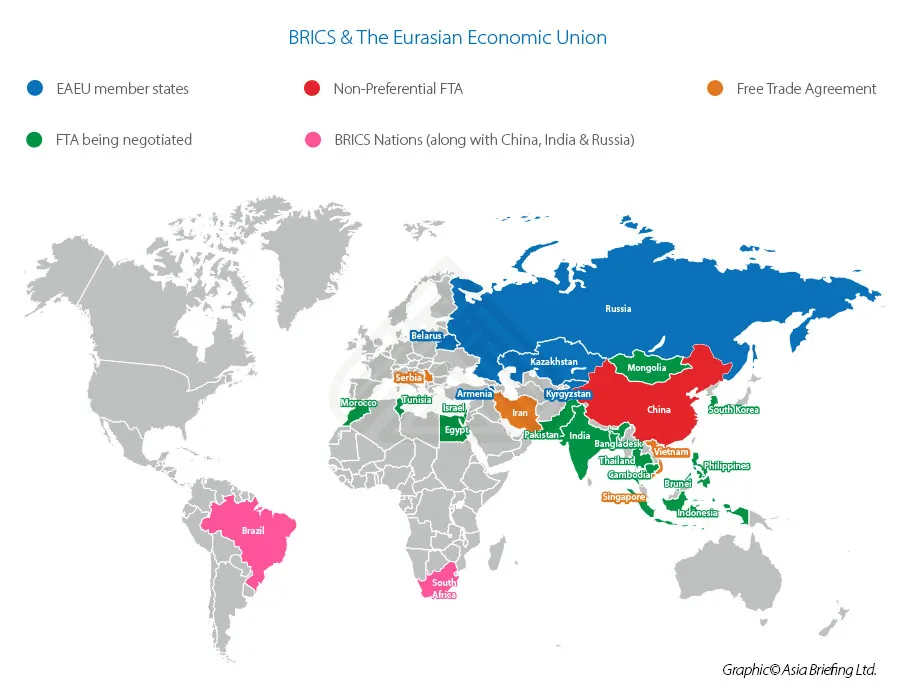

When the Bric group, initially comprising Brazil, Russia, India and China met on June 16, 2009, there was high optimism at the birth of an alternative to Western economic hegemony. The first summit’s focus was on improving the global economic situation and reforming financial institutions. After the summit, there were calls for global financial reforms and a new global reserve currency. In December 2010, South Africa became part of Brics which some argued provided the missing piece of the puzzle.

Since the 2009 Brics summit, that optimism was beginning to wan as Brics struggled to stamp its authority mainly on its initial objectives of providing an alternative to Western levers of economic control such as World Trade Organisation, the World Bank and the International Monetary Fund (IMF). This was not due to lack of trying but largely because the West had a major hold on global political and economic structures and systems and it remained a major arbiter and intermediary in global trade.

The war in Ukraine has exposed the West of its racist exceptionalism and impetuous decision-making by unthoughtfully imposing sanctions on Russia. Before the war Russia was already under Western sanctions and it has always known that the West would impose additional sanctions and worked on insulating its economy by limiting foreign debt, amassed central bank reserves of foreign assets to support the value of its currency and created a domestic payment system in case it faced sanctions that severed its access to foreign bank transfer mechanisms.

Today, Russia can still trade tapping into its Brics membership and friends to keep trade flows mainly energy supplies ongoing, while the West sulks under the guise of sanctions. If it were not for this, the entire world would have been plunged into the massive impact of the war in Ukraine.

Currently Western media is selling the impact of the war in Ukraine and the impact of sanctions on Russia on the global economy as if they are on thing. This is old-fashioned propaganda. There is no denying that the war in Ukraine has implications on the global economy, but it is largely the sanctions imposed by the West on Russia that is impacting the global economy more than the war itself.

This is because of the myopic miscalculation by the West over the impact of their sanctions vis à vis Russia’s relations with other regions. Let’s start by looking at the impact of the sanctions on Russia on the global economy. On March 15, the IMF announced that the war in Ukraine will slow down global economic growth and escalate inflation. It also warned that in addition to causing human suffering, the war will pushing prices of food and energy upwards, thus eroding the value of incomes, while disrupting trade and supply chains. Food insecurity in countries that depended on Russia and Ukraine wheat supplies will deepen. Globally, fuel and food prices are on the rise.

In Western propaganda, the impact of sanctions on Western countries is either concealed or blamed on Russia. Take for example, financial markets in Western economies are also feeling the heat as trillions of dollars in wealth have been erased. Some have cautioned that if the world is no longer able to access Russia’s colossal energy, fertilizer, grain and industrial metal supplies, the impact on the global economy could be worse. Now the only reason this is the case is not the war in Ukraine. There is no war in Russia. There is a war by Russia in Ukraine. Limited access to Russian supplies is only caused by sanctions and not the war in Ukraine.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Why is this the time for Brics to shore up? The IMF in a nuanced caution noted that in the long-term, “the war may fundamentally alter the global economic and geopolitical order should energy trade shift, supply chains reconfigure, payment networks fragment, and countries rethink reserve currency holdings.”

Already, some Brics countries have taken advantage of the West-Russia trade freeze to shore up their economies and to rearrange their trading.

Last week, the State-run Indian Oil Corp. bought three million barrels of crude oil from Russia to secure its energy needs at discounted prices, despite Western pressure to comply with sanctions. This means that, India may be able to cushion its citizens from high fuel prices, while sustaining energy supplies for its industry. India will be looking to buy more from Russia, while the West sulks.

Earlier this month, China expressed interest in buying or increasing its stakes in Russian energy and commodity companies as it seeks to bolster its energy and food security. South Africa has remained politically neutral beyond calling for dialogue to end the war. In 2021, South Africa’s exports to and imports from Russia and friends was worth R15,7 billion, while trade with Western countries was R1,131 trillion. While the trade with the Western bloc is expected to decline due to the ricocheting impact of sanctions, South Africa can still count on Brics members and their friends should the West decide to be hard on it.

While these may appear to be temporary survival measures, one thing is certain that the longer the war in Ukraine lasts, the more likely these will become new but long-term trade relations, thus reconfiguring global trade relations. Again, the IMF has cautioned that if the war continued, in addition to Europe witnessing disruptions in natural gas imports and wider supply-chain disruptions, the emerging trading arrangements that seek to bypass Western sanctions could fundamentally reshape the global economic order in the long-term. Already Russia is counting on some of its Brics partners, while Asian economies will seek to capitalise on discounted oil prices from Russia to boost their economies. As global trading takes a new shape, the West is slowly, but certainly losing its control and intermediary role on global trade.

- Tapiwa Gomo is a development consultant based in Pretoria, South Africa. He writes here in his personal capacity.