By Tatenda Square

ZIMBABWE Stock Exchange-listed wine and spirit maker African Distillers Limited (Afdis) recorded a growth in volumes for the financial year despite the challenging macroeconomic conditions.

The company recorded an increase in volumes by 34% in the comparative nine month period mainly driven by a surge in the consumption of spirits and readyto-drink beverages.

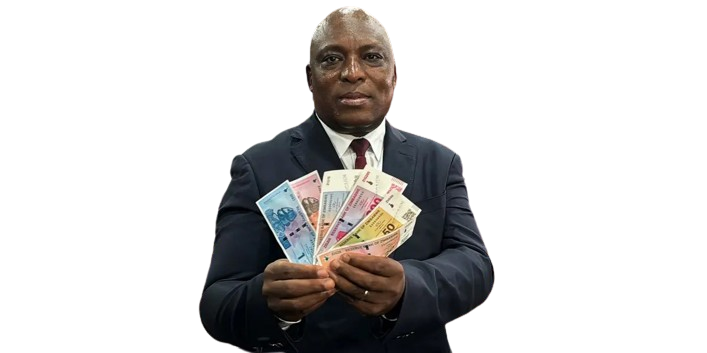

“Volume grew by 34% on the comparative nine month period mainly driven by spirits and ready to drink which grew by 50% and 22% respectively,” Afdis chairperson Pearson Gowero said in the company’s financial statement for the year ended March 31, 2021.

“A new product, Gold Blend Number 9, was launched in the spirit category and was well received by the market, thereby impacting positively on the performance of brown spirits.”

Gowero said wines only grew by 2% as a result of reduced activity in the restaurant and hotel channel due to COVID-19 restrictions.

He revealed that Delta had acquired additional shares during the year, effectively resulting in Afdis being a subsidiary and, therefore, altering the beverage company’s financial reporting period.

“The company has, therefore, changed its financial year from June 30 to March 31, to align with the group. Accordingly, the current financial statements have been prepared for the nine-month period from July 2020 to March 2021 and care should be exercised when making a comparison to the prior 12-month period,” Gowero said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Afdis revenue stood at $2,76 billion while operating income was $393,58 million. In historical cost terms, revenue was $2,408 billion while operating income stood at $662,23 million.

Gowero said the revenue growth was due to firm demand for the company’s products which resulted in high volumes.

The net cash on hand was $75 million and this is largely made up of foreign currency at the banks awaiting remittance to foreign suppliers.

However, the Afdis board has recommended not to declare a final dividend as the company requires funds to undertake capital expansion projects. The total dividend for the nine months still remains at $0,50 per share.

- Follow us on Twitter @NewsDayZimbabwe