BY TATIRA ZWINOIRA

AGAINST the backdrop of worsening economic conditions in Zimbabwe, pensioners are increasingly paying a huge price as evidenced by the goings-on at one of the country’s oldest retirement homes, BS Leon, which has been operational since 1952.

BS Leon is located in the low-density suburb of Monavale, Harare. Almost as if cut off from the rest of the capital, the retirement home is a cluster of well-designed one to two-bedroom housing units.

The small homes are neatly stacked together on both sides of the long driveway from the gate, rising towards the top of the hill where the infirmary and reception are located.

During a recent visit at the home, NewsDay crew found several elderly people seated outside the infirmary almost like they were around a campfire recounting stories of old.

Some were rich in years, whilst others were barely talking, let alone aware of their surroundings due to advanced age.

“We are being affected by the cost of food; feeding 100 people three times a day and lack of electricity… We need money to run our generators so that our vulnerable can have hot water for bath and hot meals. We have a staff of approximately 80 people and we need to pay them every month. Just the cost of everything has more than quadrupled for us, so we are appealing so that we can get help,” BS Leon’s chairwoman, Martine Pelham Fox, said.

“Families are coming to support their relatives but a lot of them find it increasingly difficult to meet our subscriptions, so they come here and ask us to give a lesser subscription every month so we discount a lot so that we can keep their family member here. We have been subsidizing many people and it is becoming increasingly difficult for us to do it.”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Fox said that the age range of the residents at BS Leon was between 60 and 80.

The plight of BS Leon is just one out of many as pensioners and the elderly are getting no joy and as such are now becoming one of the most vulnerable groups in Zimbabwe.

At a gathering in March, attempting to explain Zimbabwe’s declining economy, economist John Robertson made the point that at his “great age” he was still working because his pension fund was eroded during the 2007/08 hyperinflation period.

“Our savings evaporated completely with the hyperinflation in Zimbabwe. Some people have been building up some savings since…my pension fund evaporated along with the hyperinflation that is why I am still working at my great age,” he said.

The 2007/08 hyperinflation era is still deeply etched in the minds of many who witnessed their earnings vanish after inflation skyrocketed to 79,6 billion percent for the month-on-month rate and 8,7 sextillion percent for year-on-year.

As such, pensioners witnessed savings being eroded in a space of two years. This was made worse when Zimbabwe dollarised in early 2009 and abandoned the local currency, which effectively wiped out pensions.

Despite this history, pensioners are once more in the same position where pensions are being wiped out by inflation after government’s decision to scrap off the multi-currency regime.

This is expected to affect 6% of Zimbabwe’s nearly 14 million population aged 65 years and over, according to Zimbabwe’s National Statistics agency Inter- Censal Demographic Survey 2017.

In Sadc, the average monthly pension payouts range between US$30 and US$150 as some governments offer more support besides monetary.

In Zimbabwe, pensioners mostly receive pension payouts of ZW$ 80 (US$7,61) against a monthly cost of living ranging between US$150 and US$200.

To qualify for pension in Zimbabwe, a worker must have reached 60 years with at least 120 months of contributions. However, many usually retire at 65.

The cost of living, according to the Consumer Council of Zimbabwe, is being driven by an increase in the prices of basic goods and services causing the annual inflation rate to reach nearly 176% as at the end of June.

The re-introduction of a local currency caused businesses to raise prices of services and goods to a level where there would be value preservation. As such, pension payouts are being eroded by these price increases.

“As you are aware a new phase of erosion of insurance and pension values has emerged… As in the past, loss of value is associated with three factors: macro- economic, more so or regulatory and institution-specific. Again, in the absence of indexation, inflation is eroding the value of fixed premiums and pension contributions. The existence of a three-tier pricing structure further complicates the situation,” a recent Zimbabwe Congress of Trade Unions report read. This is happening despite pensioners from dollarisation till the adoption of the RTGS dollar having contributed towards their pension fund in US dollar value terms.

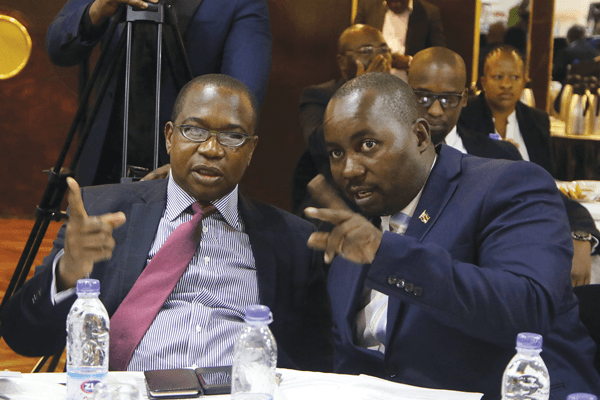

“The prevailing inflationary environment is also imposing great hardships on vulnerable pensioners. Therefore, proposed adjustments in compensation of employees will also be cascaded to pensioners,” said Finance minister Mthuli Ncube (pictured), in his recent Mid-Term 2019 Budget Review Statement.

In a recent senate assembly meeting to discuss pensioners, Senator Siphiwe Ncube said these groups had better remunerations during the Rhodesian era.

The challenges being faced by pensioners today are despite government establishing a commission of inquiry (COI) in September 2015, tasked with examining the loss of value of pensions and insurance holders after the 2007/08 hyperinflationary period and later dollarisation.

The inquiry covered a 20-year period from 1996 to 2015 covering the regulatory, financial and governance of 11 life insurance companies, nine funeral insurers, four independent pension administrators, 15 stand-alone pension funds, the National Social Security Authority, the Government Pension Agency, and the Insurance and Pensions Commission (IPEC).

Upon completion of the COI, many recommendations were made. The major one was that compensation to prejudiced insurance policyholders and pensioners be based on assets that survived hyperinflation, with no compensation for loss arising from hyperinflation or geopolitical factors.

Till this day, none of the recommendations have been adhered to.

Until IPEC implements these measures, the reality is pensioners will continue to suffer.