IN an economy that is deteriorating faster than it can recuperate, economic “bubbles” are bound to be created, with the latest one being the recent bull run on the Zimbabwe Stock Exchange (ZSE). By TATIRA ZWINOIRA

Recently, Bankers’ Association of Zimbabwe advocacy and marketing executive Clive Mphambela said the bull run on the local bourse was one example of a bubble creeping into the economy.

“Hyperinflation risk, my personal view is that it is very real and it is with us, we can only ignore it at our own peril; the signs are there for all of us to see. We can see the bubble creeping into the economy, particularly on the stock market, where as recently as April the ZSE market cap was about $5,6 billion,” he said.

“The question I ask our colleagues in the accounting profession is: are these United States dollars because if they are, we are an extremely rich nation, is it not? The stock market has gone up some 400% to 500% in a few months and the question we should all ask ourselves is what is driving that growth? Is it people having greater expectation of economic growth or is it people taking flight to run away from the possibility of taking money out?”

According to Investopedia, a website on different financial terminologies, a bubble is “an economic cycle characterised by rapid escalation of asset prices followed by a contraction”.

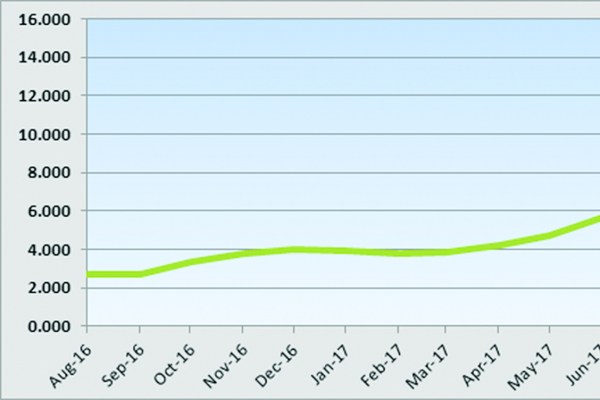

ZSE’s market cap rose by 152,3% in slightly over three months starting in July to $15,13 billion as of Monday, according to data from the bourse.

ZSE acting chief executive officer Martin Matanda said he was aware of discussions of the bull run being a bubble, with some pointing to the underlying reasons that the ZSE started rising in September.

“Some of the reasons advanced are the increase in money supply due to maturing Treasury Bills as well as real time gross settlement (RTGS) bank balances. In short, investors appear to favour real assets and consequently, bids significantly outweigh offers, hence the rising trends being witnessed,” he said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“ZSE ensures that it is safe for investors to invest in listed products by ensuring that issuers adhere to their continuing obligations such as publication of financial results and disclosure of material events through Press announcements. This is being done and we believe that investors are making decisions to trade on the ZSE from an informed point of view.”

He said it was important to note that market capitalisation was not the only valuation, it was also a perception of what the market is worth.

“The key question maybe is why has that valuation risen to $15 billion in a very short period of time. It is also important to note that it is not unusual for a country’s stock market capitalisation to be 100% or more of the GDP. JSE’s [Johannesburg Stock Exchange] market cap for example is about 280% of South Africa’s GDP [gross domestic product]. Worldwide the average market cap to GDP is 99,23% as of December 2016,” Matanda said.

However, the difference between JSE and ZSE is that the former has risen over a space of 130 years since its creation in 1887, with companies growing over the years, as the economy grew compared to the over three months of the latter.

The fear of a bubble stems from the fact that the market cap is now ahead of the GDP by 8,13% and that most of the investment on the ZSE comes from the use of RTGS balances.

ZSE market cap has outpaced GDP due to the shrinking economy on the back of rising inflation, high parallel market premium rates, paltry job creation, company closures and declining levels of cash. To that effect, the economy cannot back the bull run of ZSE.

RTGS balances are far more than cash in the coffers and far less than the required 40% or 50% cash to back. This has created a bubble.

Last month, Reserve Bank of Zimbabwe governor John Mangudya seemingly confirmed RTGS balances are a bubble when he said “as long as the cash in circulation was about 40% or 50% of the RTGS balances, the bubble could be controlled”.

The cash in circulation is 12,31% which includes nostro, bond notes and foreign currency.

RBZ deputy director for international banking and portfolio management, Ernest Matiza, also recently described the stock exchange as a bubble.

“If you look at it (ZSE), that does not have any real value, as it is not chasing production. It takes one night for that bubble to burst and everyone goes home nursing their wounds otherwise that is a bubble,” he said, adding that there was no economic activity happening on the ZSE.

However, Securities Commission of Zimbabwe chief executive officer Tafadzwa Chinamo said the bull run on the ZSE was not a bubble.

“I look at such things from a technical point of view. When you say $15 billion are you talking United States dollars? What is the prefix there? If you put your money in Econet shares, for example, and sell them will you get United States dollars?” he said.

“The stock exchange is a mere reflection of what is happening on the ground. Until we figure out what the $15 billion is, then you cannot talk of a bubble. If it was dollars, then you could say wow because every foreign would have sold and gone, but they are not doing that because they cannot get that United States dollar.”

He said the bull run could not be called a bubble since investors were using the money in the RTGS balances.

Stockbrokers who spoke to NewsDay agreed with Chinamo’s sentiments that as long as RTGS balances were being used to invest, the bull run could not be called a bubble.

But, with a GDP that cannot support the gains on the ZSE or RTGS balances being used by investors not being adequately backed, investors may need to reconsider leaving their investments on the ZSE.