A MODEST recovery in growth is underway in sub-Saharan Africa, but activity is expected to remain below the dynamic levels of recent years.

By ABEBE AEMRO SELASSIE

Growth this year is expected to reach 2,6%, up slightly from last year’s 1,4%. The upturn is largely attributed to the end of recessions in the region’s two largest economies, Nigeria and South Africa. But while a third of sub-Saharan countries continue to grow at 5% or faster, income per capita will barely increase for the region. In fact, in 12 of the 45 countries, home to over 400 million people, per-capita income is likely to decline. Beyond 2017, growth is expected at about 3½%, below the 5% mark achieved in the first half of the decade.

This recent uptick in growth reflects a combination of some policy adjustments and a more supportive global environment. However, the underlying situation in the region remains difficult as vulnerabilities have increased.

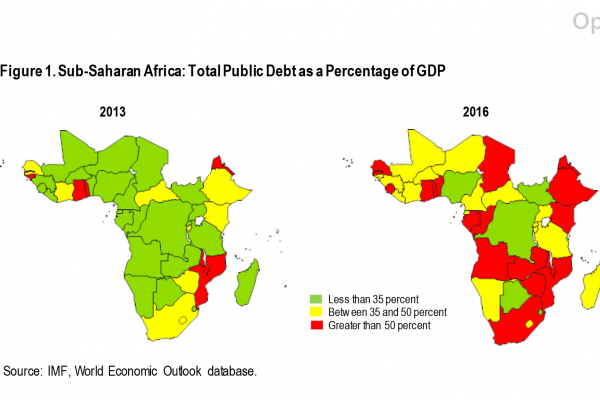

In particular, public debt has risen steadily since 2013, and by the end of 2016, debt exceeded 50% of gross domestic product (GDP) in nearly half of the region’s economies (See Figure 1).

Also, international reserves dropped below desirable levels in many countries and the financial sector has experienced intensified pressures, including from the increasing number of non-performing loans. Meanwhile, private sector credit growth slowed in many sub-Saharan African economies, often due to the crowding out effects of government borrowing.

These vulnerabilities are being compounded by political uncertainty in some the region’s largest economies. No doubt this is weighing on consumer and investor confidence.

In this context, economic recovery in sub-Saharan Africa will require addressing fiscal vulnerabilities and unlocking constraints to growth:

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Curbing debt, no time to waste

Most sub-Saharan African countries already envisage fiscal consolidation over the medium-term to preserve debt sustainability. Experience shows, however, that planned fiscal adjustments tend to be postponed — yet at this juncture there is little scope for further postponement, as continued debt accumulation at the pace seen in recent years would push public debt above sustainable levels.

However, with growth momentum already weak, fiscal adjustment should be undertaken in a way that minimises negative impacts on growth.

Experiences of past fiscal consolidations in sub-Saharan Africa shows that revenue-based adjustments have the smallest negative impact on growth. The largest growth impacts arise from cuts in public investment.

As raising revenues takes time, this reinforces the need to start consolidations soon. Fiscal consolidation should also focus on the composition and efficiency of spending, for example, by making room for outlays on health and education, which have positive social impact and long-term growth effects, and for critically important investment in public infrastructure.

Boosting growth and diversification

Actions to sustainably boost growth and create jobs are urgently needed. For many countries, economic diversification has played a key role in accelerating growth. Experience in sub-Saharan Africa — from countries such as Botswana and Uganda—shows that successful policies in this area should build on a country’s existing strengths and work best if they are tailored to tackle country-specific challenges.

While there is no single path, successful diversification will likely also require enhancing macroeconomic and political stability, improving education outcomes, bolstering governance and transparency in regulation, and deepening financial markets.

While it’s been challenging times for sub-Saharan Africa in recent years, our latest outlook suggests the broad-based slowdown is finally easing.

Policy-makers should use this opportunity to address the issues that are constraining the region’s economic potential and work toward keeping sub-Saharan Africa on the path to recovery.

lAbebe Aemro Selassie is IMF African department director