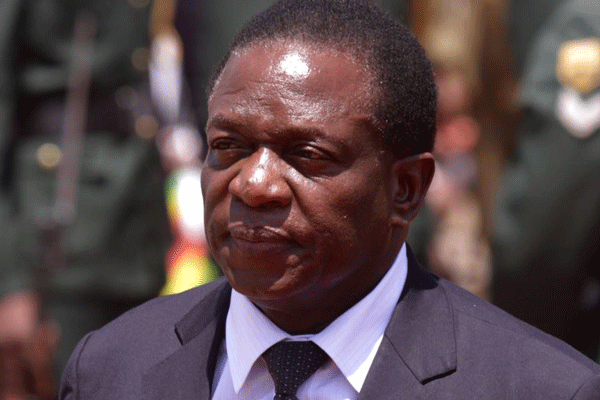

Vice-President Emmerson Mnangagwa has again called on the financial sector to reduce charges on the use of debit and credit cards to ease the cost of transacting in the country, in view of the current cash shortages.

BY TARISAI MANDIZHA

Speaking at the just-ended Buy Zimbabwe 7th Buy Local Summit and Investment Forum in Victoria Falls, Mnangagwa said for the country to successfully industrialise and promote the purchase of local products, it required symbiotic efforts from the financial sector, retailers, wholesalers and suppliers, among others, to ease the cost of transacting.

“I want to recognise some of the players in the financial sector who heeded my recent call to reduce charges on the use of debit and credit cards. It is my hope that those who have not reviewed the charges will follow suit,” Mnangagwa said.

“Allow me to reiterate, once again, that the reduction of such charges will have a ripple effect on the transactional, precautionary and speculative demand for hard cash. No one will have an incentive to hold or hoard money and eventually the long winding queues at our banking halls are bound to disappear.”

He said in order to fully industrialise and integrate the mainstream economy there is need to ensure that consumers are willing and able to buy products and services for their needs.

“This can be assured by a market where it is cheap and convenient to transact as financial literacy levels are improving the Buy Zimbabwe campaign should be blended with more use of plastic money,” he said.

He said stakeholders are encouraged to remain engaged under the Buy Zimbabwe initiative, in the quest to develop a local content policy as this will be a key step in shaping procurement and industrial policy of the country.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Mnangagwa said the industrial sector is the major driving force in turning around the fortunes of the economy not only from a productivity point of view, but also for its potential to enhance the country’s export earnings.

“Local production and value chains as well as forward and backward linkages need to be successful with the long-term objective of penetrating the global market.

“To enhance industrialisation, the country must have a fully functional robust and competitive economy which is inclusive of micro, small and medium enterprises. To this end, Buy Zimbabwe should not in any way be an opportunity to inculcate a monopolistic behaviour, but companies must, instead, be cognisant of the regional and international pricing and productivity trends to ensure that our products are globally competitive,” he said.

According to official statistics the country processed point-of-sale (POS) transactions worth $2,9 billion in 2016 with POS volumes increasing by 260% during the same period.

POS transactions are all payments made at swipe machines using plastic money in the form of debit and credit cards.