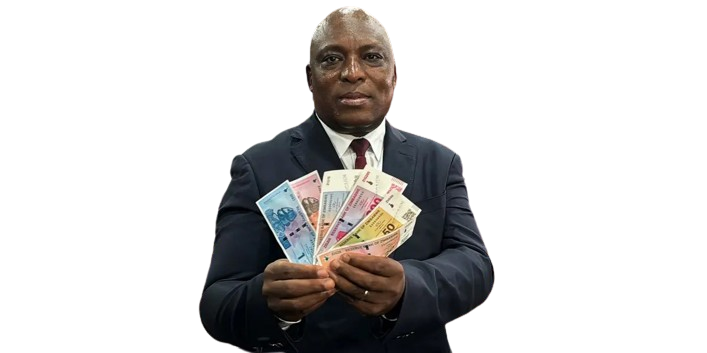

CBZ Holdings (CBZ) says their banking division has enough cash resources to satisfy their 367 000 active bank accounts, while the market faces a decline in United States dollars.

BY TATIRA ZWINOIRA

The group chief executive officer, Never Nyemudzo told NewsDay on the sidelines of their analyst briefing for the year ended December 31, 2016 last Thursday that they have been resourcing their automated teller machines (ATMs) on a daily basis to ensure there was cash.

“What I can safely tell you is that the bank has enough cash resources and every day we have been able to pay our clients when they come through. The bank has also been resourcing their ATMs 24/7, so that all our clients at their convenience can always reach out and have cash. We have also made sure that all other alternative platforms, where our clients wish to do e-banking, are kept up-to-date and fast, so that our clients can enjoy convenience and speed when they transact,” he said.

The cash demand in the country still remains relatively high, with bond notes dominating transactions due to the United States dollar shortages.

CBZ banking division, in its end-of-year results for the period ended December 31, 2016, recorded an increase in deposits of 5% to $1,73 billion from $1,65 billion in the previous year. This showed a rise in cash demand, as the group’s demand deposits rose 7% points during the period.

Demand deposits are deposits of money that can be withdrawn without prior notice, which analysts say indicate depositors wanting to have ready access to their cash. Deposits for the group, as at December 31, 2016, was $1,77 billion, which was an improvement from the previous year’s $1,68 billion.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

CBZ had a capital cover by 6,1 times, while the previous year had a 5,3 times capital cover.

In terms of making cash available for foreign payments, Nyemudzo said the group followed the central bank’s priority list of foreign exchange usage.

“As a group and bank, we have always adhered by that priority list in terms of providing foreign currency so we are quite happy with the turnaround that we have been able to achieve for our customers,” he said.

The group saw its 2016 profit after tax dropping by 32,5% to $28,3 million from the previous year on the back of a decline in net interest income. Interest income is the main avenue banks make their money, apart from fees and commissions and trading revenue.