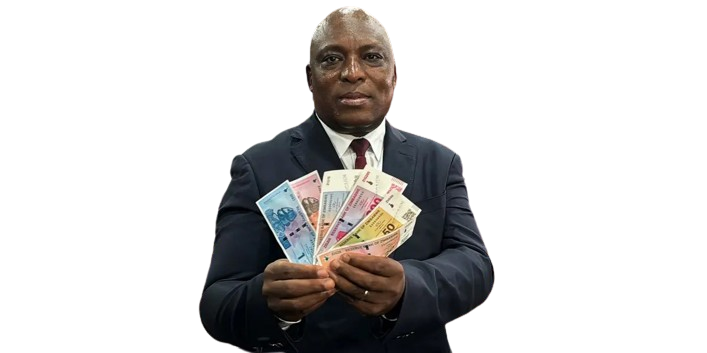

Reserve Bank of Zimbabwe (RBZ) governor John Mangudya yesterday vowed to forge ahead with plans to introduce bond notes in October despite widespread resentment by citizens and opposition political parties.

BY MTHANDAZO NYONI

In May, Mangudya said bond notes would be introduced as part of measures to stem the prevailing cash shortages under a $200 million facility guaranteed by the African Export-Import Bank. Under the facility, qualifying exporters would get an additional 5% export incentive in bond notes, which will be at par with the United States dollar.

In an interview with NewsDay yesterday, Mangudya said he would not buckle to populist sentiments as the move was in the best interest of the economy.

“We are doing policies that are good for the country whether they are popular or not. Populist policies never work. We are in an economy that needs hard decisions,” he said.

“We need production so that we can export and maintain the multi-currency system. We are aware of the challenges people went through in 2008, but we need to have bold measures. We don’t take decisions on face value. We take decisions that are necessary for this country.”

Mangudya said bond notes would help companies export thereby improving production.

He said any exporter, who has made an export transaction, would receive a 5% incentive based on export receipts, which will be debited to their account, meant to hold export proceeds in a bank. When a depositor makes a withdrawal, the bank would issue to the client the bond notes that it has in its coffers alongside the dollar, he said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Thousands of people have taken to the streets demonstrating against government’s plans to introduce bond notes, with critics equating the move to the reintroduction of the banished local currency. The local currency was dumped in 2008 and gave way to a multi-currency regime in 2009. It was decommissioned last year.

Despite assurances by Mangudya that RBZ would not go above the $200 million ceiling, calls to halt the introduction of the bond notes were growing louder by the day signalling waning confidence in monetary authorities.