Officials from the European Investment Bank (EIB) and the International Monetary Fund were recently in the country to assess the re-engagement process, NewsDay has established.

BY VICTORIA MTOMBA

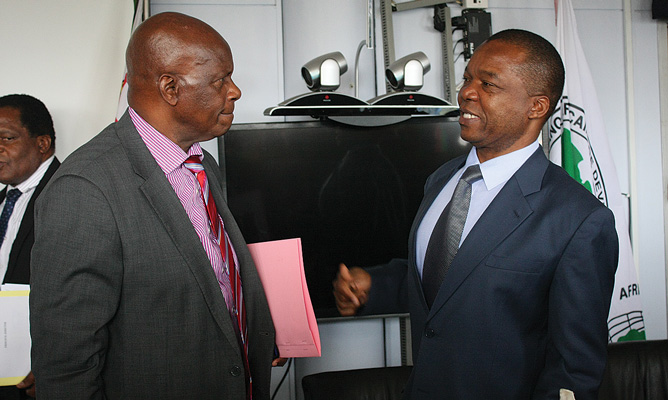

Reserve Bank of Zimbabwe governor John Mangudya said: “It was a dipstick analysis and also to see if the country is on target with the arrears clearance plans. On the repayment of arrears we need to pay the three International Financial Institutions at the same time, that is the African Development Bank, World Bank and the International Monetary Fund. Our target for the payment of the $110 million which is part of the $1,8 billion arrears is September.”

Mangudya said the re-engagement process was going well and he will be travelling to UK this week on an arrears clearance mission.

He said the EIB was also on a fact finding mission to assess and review direct lending to the private sector.

EU ambassador to Zimbabwe Phillipe Van Damme, said the management committee of the EIB adopted a negotiation mandate for the clearance of Zimbabwe’s arrears with EIB.

“The EIB met with Minister of Finance Patrick Chinamasa and governor of the Reserve Bank John Mangudya to discuss the debt arrear clearance plans and to take stock on the present economic and financial situation. The EIB also met with the other multilateral financial institutions, with the Afreximbank and with a number of private sector enterprises and banks,” Van Damme.

Zimbabwe has a debt of $10 billion and the country begun engaging the creditors last October to clear $1,8 billion in arrears.