THE Zimbabwe National Road Administration (Zinara) has accredited only 20 insurance firms on its new digital database as part of the computerisation of third party motor insurance, a senior official has said.

BY STAFF REPORTER

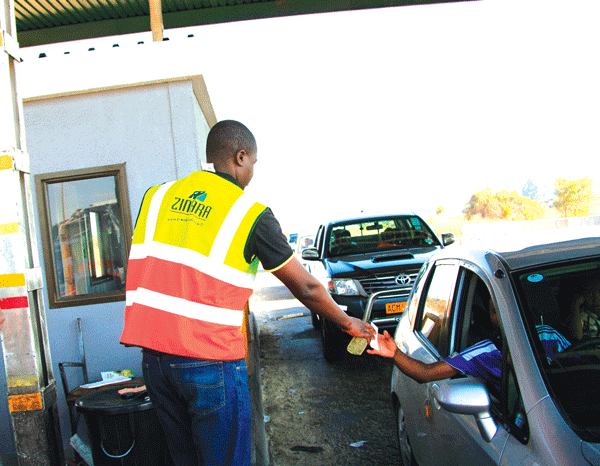

The computerisation exercise of third party motor insurance cover came amid claims fake notes had flooded the market, with the Traffic Safety Council of Zimbabwe (TSCZ) experiencing problems in collecting the 12% levy from third party insurance firms.

The roads administrator’s Precious Murove told NewsDay that Zinara would not be involved directly in the selling of insurance to motorists, but had created a platform for companies to transact.

“A total of 20 out 22 insurance companies have registered for access to the Zinara system. The system records every transaction detail, an automatic online payment and can provide an audit trail for the benefit of all stakeholders that include Traffic Safety Council, Zimra [(Zimbabwe Revenue Authority] stamp duty as well as the insurance companies,” Murove said.

“It is important to highlight that Zinara is not necessarily selling the insurance licence discs, but has provided a platform where insurance companies can transact through the digital computerised system. Motorists will now have assurance that the insurance cover notes are authentic, since they are now computerised, unlike in the previous manual era where there were a lot of fake cover notes”.

Murove said the move to digitally issue motor insurance would benefit government which was struggling with revenue streams, while motorists would now be shielded from fake cover notes.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“Government will realise increased revenue through effective collection of Traffic Safety Council Statutory levy of 12,5% on the third party motor insurance.

“Furthermore, the government can easily verify all the revenue collected through insurance companies. This implementation will bring confidence to the motoring public that in the event of lodging a claim with any of the registered insurance companies, they are guaranteed of compensation,” Murove said.

Amid reports of the proliferation of fake insurance cover notes, Zinara at the end of last month announced the computerisation programme would begin on May 2.

In March, Transport and Infrastructure Development minister Joram Gumbo told the National Assembly that corruption was rife in vehicle insurance to the extent that the TSCZ had experienced problems in collecting the 12% levy from third party insurance firms. He said TSCZ was losing an estimated $5,4 million annually. The levy TSCZ gets from insurance companies was for road safety communication.