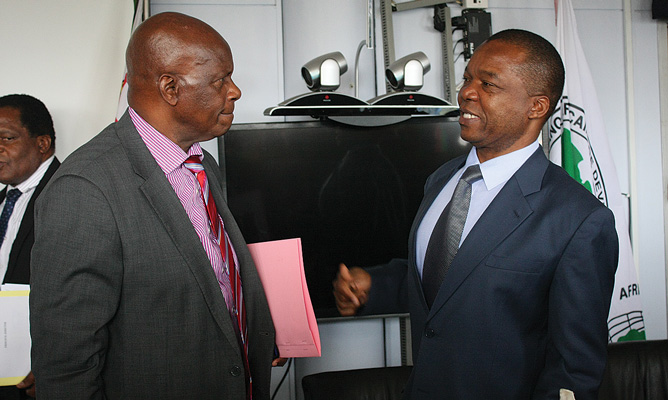

FORMER Finance minister Tendai Biti has accused his successor, Patrick Chinamasa and Reserve Bank of Zimbabwe (RBZ) governor, John Mangudya of lying that the bond notes were meant to address the cash crunch, yet it was a clandestine way to replace the $1,8 billion illegally withdrawn from the central bank’s Real Time Gross Settlement (RTGS) balances to monetise government expenditure.

BY BLESSED MHLANGA

Biti, leader of the opposition People’s Democratic Party, told delegates at a Crisis in Zimbabwe Coalition public meeting in Harare last week that the proposed $200 million bond notes were being introduced to cover the shortfall caused by the illegal transaction.

“So what has happened is that given the shrinking revenue and the increasing appetite of expenditure, the government has had to look somewhere to finance its recurrent expenditure,” he said.

“The government has gone and raided the RTGs balances at the central bank, so when you want your money, the bank then orders that money from the RBZ, and when that happens the, central bank can’t give the bank your money because it’s physically not there, because someone has raided that money to finance recurrent expenditure. The government has raided banks for the $1,8 billion. This is why something that is dramatic must happen, which is to bring back the Zimdollar.

“Mid-term last year, Chinamasa revised the budget from $4,1 billion dollars to a budget of $3,5 billion. When he revised the revenue figures downwards, he did not also revise the expenditure figures downwards. Expenditure has actually increased in an expenditure budget to $5 billion.”

Biti said employment costs were now at 91% of total expenditure and President Robert Mugabe’s appetite to travel has put a strain on government recurrent expenditure and, therefore, forcing the liquidity crunch.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

However, Mangudya yesterday dismissed Biti’s claims, saying the RTGS system was intact and no money was raided by government.

“There are no challenges with the movement of RTGS transactions in Zimbabwe. We actually encourage the banking public and businesses to make their payments using RTGS and plastic money and only use cash as an exception,” he said.

“I think the former Minister of Finance was misquoted on the RTGS figure of US$1,8 billion since there is no relationship between the cash shortages at some banks with RTGS balances of the banking sector, which stand at around US$750 million. Cash used in Zimbabwe is withdrawn from nostro accounts and not RTGS.”

Mangudya said due to the continuous withdrawal from the nostro accounts to meet high import and cash demands, it was essential that the country is transformed by encouraging more exports to replenish their nostro accounts.

“The statement attributed to the former minister seems to be a denial of the fact that the major reason for the cash shortage in the country is due to the haemorrhaging effect of hoarding and exernalisation of cash,” he said.

“What this means is that once cash is withdrawn by banks from their nostro accounts and imported into the country, that cash is not efficiently circulating within the national economy. It’s being drained from the economy by those hoarding or externalising it.”