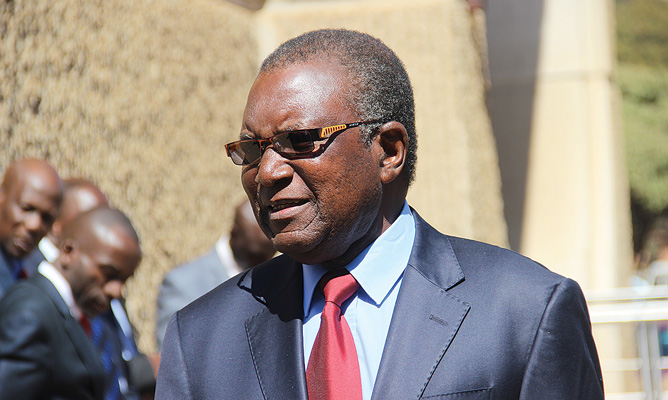

Fake motor vehicle insurance policies have flooded the country with millions of dollars being lost to fraudsters, Transport minister Joram Gumbo has said.

by VENERANDA LANGA

Gumbo, in a ministerial statement to the National Assembly on Thursday, said there was a lot of corruption in vehicle insurance to the extent that the Traffic Safety Council of Zimbabwe (TSCZ) had experienced problems in collecting levies from third party insurance firms.

“Of late, the Traffic Safety Council of Zimbabwe has had problems in collecting the 12% levy from insurance companies, mainly because the industry has been plagued by fake insurance policies, while some insurance companies are not complying with the requirements to remit the money,” he said.

“Regrettably, the TSCZ has no garnishee powers to get the money from the bank accounts of defaulting insurance companies.”

The levy TSCZ gets from insurance companies is for road safety communication.

Gumbo said to ensure compliance, his ministry had consulted the Insurance Council of Zimbabwe (ICZ) to introduce electronic insurance cover notes.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The project will see insurance companies being linked to databases of Zimbabwe National Road Agency (Zinara) and Central Vehicle Registry (CVR) to ensure no vehicle was licensed without a valid insurance policy.

“The system has already been designed and is expected to be operational in the next three months,” he said.

Gumbo said people injured in vehicles bearing fake third party insurance policies and vehicle number plates were not entitled to compensation.

“In other countries, third party insurance is administered by government, but in our case, we have been relying on insurance companies as agents since the colonial era,” he said.

He said Statutory Instrument 124/2009 stipulates every injured person gets $1 000 government compensation, while insurance companies pay $2 000.

If persons were injured in a small vehicle, he said $5 000 was paid by government and shared by all the injured, while insurance companies pay $10 000, and if it was a bus accident, government pays $10 000, while insurance companies pay $20 000.

According to the chairperson of the Transport and Infrastructure Development Parliamentary Portfolio Committee Dextor Nduna, TSCZ could have received up to $8,5 million per annum given the high traffic volumes in the country.

“In 2015 about 571 000 vehicles were insured and what was supposed to accumulate to the TSCZ is $8,5 million. Since dollarisation in 2009, about $59 million could have been lost due to non-remittance of the levies to TSCZ. We have never gone below 400 000 vehicles,” Nduna said.