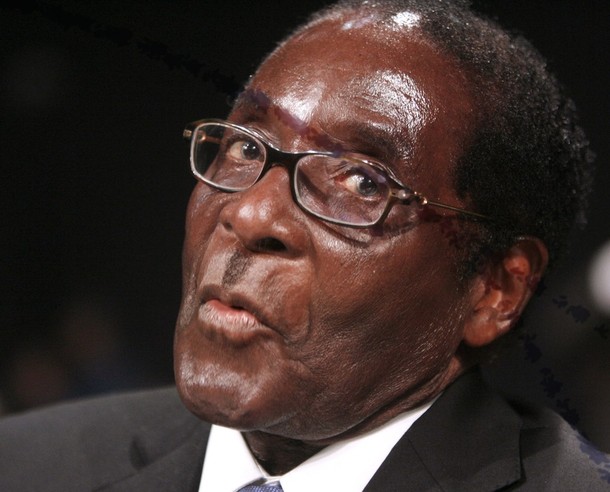

President Robert Mugabe has signed into law the Reserve Bank of Zimbabwe (RBZ) Debt Assumption Bill which attracted heated debate in the National Assembly recently when opposition MPs demanded publication of the central bank’s debtors.

by VENERANDA LANGA

The Act, signed into law on July 27, will pave the way for the government to take liability of an estimated $1,35 billion debts incurred by the RBZ before December 31 2008.

During debate on the Bill in the National Assembly, MPs argued it was unfair for Zimbabweans to take over such a huge debt without knowing how it was incurred, and without making known the beneficiaries of the RBZ farm mechanisation scheme.

However, Finance minister Patrick Chinamasa argued that the law would provide a clean balance sheet for the RBZ and enable it to attract international funding, as well as focus on its core business of being lender of last resort to banks.

Meanwhile, the Public Debt Management Bill is now before Senate scrutiny after it was passed by the National Assembly a fortnight ago.

The preamble of the Bill as presented by Chinamasa reads: “The Bill seeks to provide for the management of public debt in Zimbabwe. It also seeks to provide for the functions and administration of the Public Debt Management Office which is a department that currently exists within the Ministry of Finance and Economic Development.”

Some of the functions of the Public Debt Management Office will include preparing and publishing annual borrowing plans which include a borrowing limit, advising the minister on government borrowings and guarantee loans, doing debt sustainability analysis, monitoring and evaluating projects funded, among other duties.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

If passed, the law will ensure government’s financing needs and payment obligations are met at the lowest possible cost over the medium to long term, with a prudent level of risk, and to promote development of the domestic debt market.

The Parliamentary Portfolio Committee on Budget and Finance chaired by David Chapfika suggested that all loans and borrowings by government should first be scrutinised by Parliament before approval.