THE interbank market became operational last Monday after several false starts in a move that would help in the distribution of liquidity.

BY VICTORIA MTOMBA

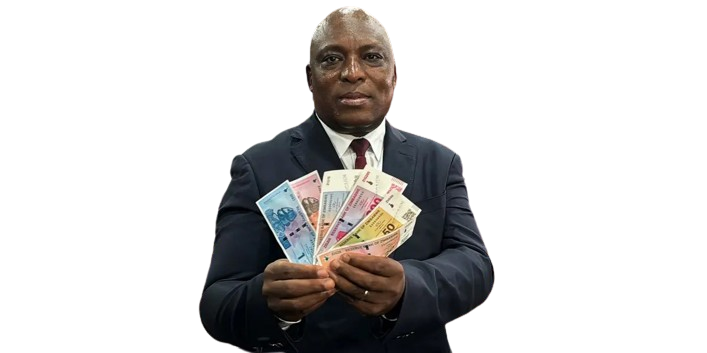

Four banks have so far used the facility, Reserve Bank of Zimbabwe (RBZ) governor John Mangudya told NewsDay last week.

Banks have operated without a market to trade excess liquidity since the country embraced a multi-currency regime in 2009.

“This is an important milestone in Zimbabwe financial sector as the facility would assist in meeting the short-term liquidity gaps of qualifying institutions whilst at the same time establishing a reference rate for pricing of financial products through the discount window,” Mangudya said.

“Four banks used the facility during the first week of its inception. We were finalising the structure for the surplus banks’ comfort to transfer risks under the facility of Afreximbank.”

The facility is guaranteed by the African Export-Import Bank (Afreximbank) under the under the Afreximbank Trade Debt Backed Securities (AFTRADES) up to $100 million.

The facility is managed by RBZ as an agent bank for Afreximbank for the purposes of managing the surplus and deficit participants’ requirements under AFTRADES.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The surplus banks’ risk under AFTRADES would be transferred offshore to Afreximbank.

The interbank market allows banks to extend loans to one another for a specified term. Most interbank loans are for maturities of one week or less; the majority being overnight.

Banks borrow and lend in the interbank market in order to manage liquidity and satisfy regulations such as reserve requirements.

The interest rate charged depends on the availability of money in the market. The absence of an interbank market had resulted in the market being segmented with some banks having huge surpluses while others have experienced liquidity challenges.

Under normal circumstances, liquidity would have moved from the surplus institutions to those experiencing shortages through the interbank market.

Banks with excess liquidity were averse to lending to those experiencing shortages due to credit risk issues associated with those institutions.

The facility will be used as a precursor programme for the lender of last resort function by the central bank. The interbank market has not been operational since the country adopted the multi-currency system in 2009.