Brief history of mobile money services

It was 1983 when the Nottingham Building Society (United Kingdom) introduced “Homelink”, an online banking system which involved your television set and a telephone to pay bills and transfer money [it is important to note that the TV set was not as smart as it is in present day].

Nevanji E Madanhire Jr

This was the founding of online banking and mobile money transfer. Several years later in 1997, a development for this system came from the Stanford Credit Union when they introduced the first banking website, allowing their credit union members to transact using the Internet.

Alas, Internet banking was born and adopted by banks worldwide. In Zimbabwe, efforts to adopt an online banking method remained sluggish and the benefits of Internet banking were not embraced as well as they were in other countries.

Maybe it was the technology that people were not receptive to, but I would like to think that it was a result of Zimbabweans losing confidence in the banking system plus not having access to the infrastructure that enabled them to carry out payments online; we did not have broadband Internet back then and having a cellphone was a luxury.

How telecommunication companies helped Zimbabwean masses

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In 2011, when Ecocash was launched, Econet Wireless Zimbabwe had over five million subscribers on their network.

Ecocash was not an Internet banking solution as such, but it was an “online”-based mobile money transfer platform which provided convenience to the masses who took their time to register.

Instead of a father giving the rural-bound bus driver money to take to areas where banks are non-existent, the rustic grandmother received a cellphone which became her wallet, her safe and her means of communication.

Now money could be sent more frequently and it was cheaper since the bus driver was not getting a share for safe-keeping and delivery.

It was not long until people started using Ecocash in their businesses too.

Transactions became instant and there was no need to go to the bank anymore.

Gone were those days when one would stand in a queue for a Real Time Gross Settlement (RTGS) [remember those from 2009?] which would only reflect in the other persons’ account the next morning.

Within 14 months, Ecocash had two million subscribers and a total of $700 million had changed hands. The results were astounding. Every month, transactions amounted to $150 million making Ecocash a success.

Where are we today?

With the Ecocash success story fresh in our heads, everyone is trying to cash in on the potential that exists within mobile money transfer platforms.

Telecel Zimbabwe has since introduced its Telecash and NetOne its OneWallet.

The thing that interests me about the telecommunications industry is that service providers are not merely producing copycat products and services, but they continue to innovate to outperform each other which gives users the best products that their money can buy.

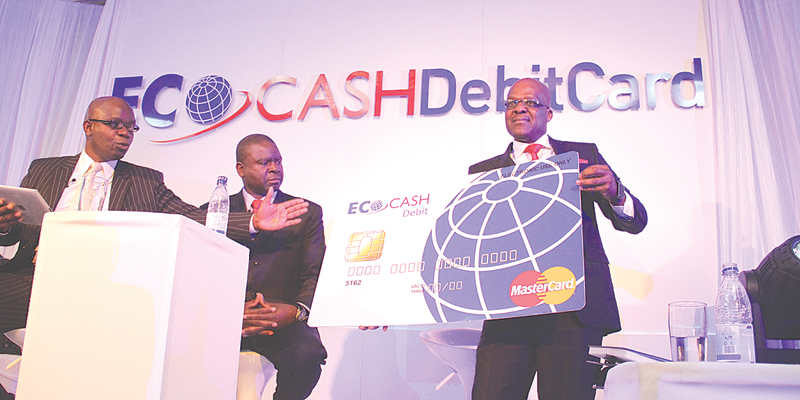

Telecash has gone a step further than its competitors by introducing a debit card that allows you to withdraw money and make payments using ZimSwitch.

Wow! That’s certainly the way to go. Here is a scenario, you are in a grocery shop and the person in front of you is paying using the long codes with multiple asterisks (*) and a hashtags (#) on their cellphone; not forgetting the numbers in between.

Bottom-line is, that will take a while. Now, thanks to Telecel, one can swipe their Telecash gold debit card just like any bank card, making the process less tedious.

You don’t even need a bank account! Your phone is your bank account. This gets me excited and here is why.

Last year, a particular bank approached students at the university presenting the opportunity to open bank accounts [for free since we are students].

The application process was offline and form-based. They provided us with a photographer [free of charge] since we needed passport size photos to be account holders.

I was keen on having a bank account with little bank charges, but all that was ruined for me. My account was confirmed four months later via SMS, I had even forgotten about my application.

If it took them that long to activate my account, how long would it take me to get some cash out?

So I kept my money. And it’s been six months now and they still text me requesting that I change my access codes.

No place for dinosaurs

This is not entirely an article about mobile money platforms as it is about change in our organisations and individual way of thinking.

When the whole world was rushing to automate its processes to cut on costs, Zimbabwean companies lagged behind — keeping a robust structure in our organisations.

Our companies are like dinosaurs, unable to adopt to the ever changing environment.

Executives use high initial costs of technology as an excuse not to implement advanced techniques in production — that is just an excuse covering up the fact that they are afraid of change.

I can tell you right now that there is technology that was invented 10 years ago that can increase efficiency by more than 500%. And I mean it, 500%.

That is a very convincing figure that ensures a high rate of return on investment and shareholder satisfaction. Whether our industrial leaders are unaware of the technology or simply ignorant and resistant to change — we will never know.

Zimbabwe should instil a culture of change in its people and its organisations.

For instance, if your organisation implemented a particular system, monitoring and evaluation should always be carried out to see if the system continues to meet the organisations requirements.

It is easier and more economic to make small changes to a system, add components and modules as they are needed, than to wait until the whole system is obsolete. In which case a new system has to be devised resulting in high costs.

IT personnel in organisations should be utilised to their full potential instead of merely providing technical support functions such as changing printer cartridges and managing the photocopier. The personnel should look at applicable information communication technologies to best serve their organisations.

This should include process automation, system integration and training other employees on how best they can take advantage of changes in technology.

I would like to end by saying, change does not imply diversity. It is not always a matter of shifting your business model and product line, but a principle of adding efficiency to your processes, adding reliability, minimising human error and adding value to customers.

Old dinosaurs like banks can partner with telecommunication companies in a deal similar to that between CBZ and Telecel in coming up with the Telecash gold debit card.

It will be good if that partnership resulted in VISA or Mastercard being included with the debit card. That will be real value addition and all leading companies should be racing to achieve this particular goal.