BINDURA Nickel Corporation’s (BNC) total capital expenditure stood at US$8,34 million in the year ended March 31, 2023, driven by its plan to replace old and antiquated mining machinery.

The increase was from a 2022 comparative of US$6,47 million.

The current old machinery led to lower production volumes resulting in a loss of US$18,48 million for the 2023 period, from a profit after tax of US$8,06 million in the 2022 comparative period.

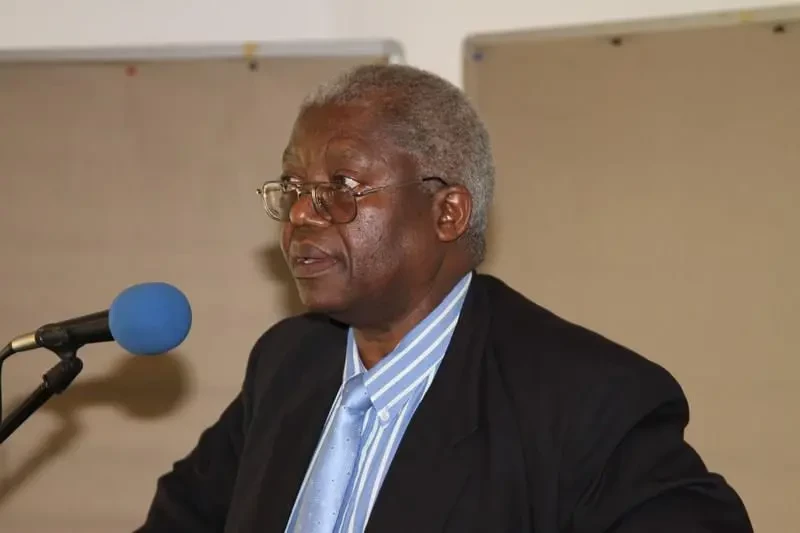

In its annual report for the year ended March 31, 2023, BNC board chairman Muchadeyi Masunda said the increased expenditure was as a result of the replacement of old and unreliable underground mobile equipment.

“Total capital expenditure for the year amounted to US$8,3 million. This was driven by the programme to replace the old and unreliable underground mining mobile equipment and was being funded from bank loans and internal cash flows,” he said.

Masunda said the company experienced numerous operational challenges that affected production.

“The mine was adversely affected by low underground mining mobile equipment availability due to obsolescence. The business was able to acquire four new load, haul and dump, in addition to face rigs, support rigs, and production long-hole rigs during the year. However, the delivery of the equipment was delayed due to disruptions to global supply chains,” he said.

“Production was also negatively impacted by an unexpected change in the ore body, leading to a severe decline in the high-grade massive resource footprint. This change requires a rapid transition in the mining model from a low-volume, high-grade strategy to a low-grade, high-volume strategy.”

Masunda said the transition was behind schedule owing to delays in the delivery of the new underground mining mobile equipment.

During the second half of the period under review, BNC experienced additional operational challenges of a sub-vertical rock winder breakdown, limited hoisting capacity due to the damaged SVR bull gear, and power cuts.

“Against the backdrop of the above factors, ore hoisted for the year was 418 587 tonnes, which was 11% lower than the previous year’s 463 338 tonnes. Tonnes of ore milled of 418 020 were 9% lower than last year’s tonnage of 461 130, in tandem with the lower tonnage hoisted,” Masunda said.

“Head grade declined to 0,96% from 1,30% for the prior year while recovery efficiency was 77,9% versus 85% for last year. Nickel in concentrate production declined by 37% to 3 180 tonnes from the previous year’s 5 082 tonnes.”

He said unit cash costs of production increased by 70% to US$18 269 per tonne while the all-in-sustaining costs of production increased by 76% from US$12 410 per tonne for the prior year, to US$21 841 per tonne.

“The increase in unit production cost was mainly due to the decrease in nickel production, the high cost of maintaining the old and obsolete underground mining mobile equipment and the increase in power tariffs during the year,” Masunda added.

Resultantly, revenue decreased to US$49,5 million during the 2023 financial year, compared to US$74,2 million in the prior year.

Total assets were recorded at US$110,87 million during the period under review, down nearly 8% from the 2022 comparative owing to reduced inventories, trade and other receivables.

Masunda said BNC was implementing several strategies to change its fortunes including transitioning to a high-volume, low-grade strategy and replacing its SVR bull gear by the end of next month.

The firm is also working on investing in acquiring new and rented equipment while also implementing several cost cutting and cash-saving measures.