IT appears fair to summarise that inflation in Zimbabwe is the result of expansionary fiscal and monetary policies, reduced local productivity in almost all sectors of the economy, imported inflation and droughts.

It is also caused by “greedflation” (overcharging by entrepreneurs), poor international relations and expectations of worsening inflation due to the public’s lack of trust in the Reserve Bank of Zimbabwe (RBZ) and their policies.

If the nation is going to decisively deal with the inflation problem, it will be vital for the Presidency to introduce changes in the country’s approach towards resolving it.

This article provides details on how this can be done through providing new perspectives in the methods used by the RBZ and other government ministries.

RBZ focus on inflation targeting

Historically, the RBZ has used various methods to respond to Inflation.

These include raising interest rates, altering money supply, issuance of gold coins and investigating speculators through the Financial Intelligence Unit (FIU), among others.

These have not yielded the targeted single-digit inflation, in accordance with Treasury’s National Development Strategy (NDS1). The bank has also made inflation targeting one of its goals, although it has greatly struggled to meet the targets.

- RBZ blocks Harare US dollar charges

- Industry cries foul over new export surrender requirements

- One stitch in time saves nine

- Banks keep NPLs in safe territory

Keep Reading

Official inflation targeting occurs when the central bank’s most important objective is that of achieving a predetermined low level of inflation.

For instance, the RBZ can set an annual inflation target of 5%, or a target range of between 2%- 5%. The bank will then thoroughly use all tools available to it, to ensure that inflation reaches the set target or target range. This also means that, the Monetary Policy Committee (MPC) of the RBZ will become the most powerful aspect of the bank, whilst the committee's meetings will have the sole objective of chasing the targeted inflation rate.

For as long as inflation is above the target, the central bank will continue removing money supply from the market through selling bonds, raising interest rates and complicating borrowing conditions (which restrict the growth of loans or credit).

The scarcity of money supply arising from the aforementioned interventions will result in reduced demand for goods and services in the economy.

Eventually, prices will stop their upward trend. It may take between one to two years for central bank interventions to achieve the desired target but according to proven interventions elsewhere, this method can assuredly achieve the desired result (the inflation target).

Currently, the RBZ loosely pursues inflation targeting. However, for it to qualify as an official practitioner of inflation targeting, it will have to become more engrossed and focused on that objective, ahead of all others. Central banks which officially use inflation targeting include those of; South Africa, the United Kingdom, United States of America, Europe, etc.

The principle behind inflation targeting is that, price stability is a primary requirement for an economy to realize growth and better employment levels, in the long-term. Stable prices reduce uncertainty for investors and other market participants in the economy.

This encourages long-term planning and more abundant consumer spending, instead of hoarding forex, as most Zimbabweans apparently do.

On the other hand, rapid inflation typically results in the opposite conditions, which are reduced investment activity, less productivity and more unemployment.

With inflation targeting, the decision to raise or lower interest rates is always determined by whether the prevailing inflation rate is above or below the central bank's desired target.

This means that at every sitting of the MPC interest rates will likely be raised higher for as long as the inflation rate is above the desired level of inflation.

Importantly, before choosing the desired target, the bank consults with the Ministry of Finance. Additionally, in pursuit of the goal, the bank does not yield to political interferences or other non-conventional policies.

Regularly publishing the central bank's target, whilst progress is visibly made towards achieving it, will improve both the credibility of the bank and its transparency.

Consequently, expectations of worsening inflation will be eliminated, thereby, reducing price increases, which are based on the assumption that the future will have much higher inflation rates than the present.

Research indicates that prices become more stable and economies more resilient when inflation targeting is used. In developed countries, ideal inflation targets are between 2% and 3%, whilst for emerging economies, the range of 3%-6% is usually desirable.

For Zimbabwe, this means that the Zimbabwe National Statistics Agency (ZimStat) would stop reporting on blended inflation. Rather, inflation rates will be expressed exclusively using the Zimbabwe dollar.

It will also prove difficult for the RBZ to have an inflation target, which pertains to the United States (US) dollar, since the bank does not print the currency.

The bank also has limited capacity to influence the “greenback” through open market operations, as most of the US dollars in the country are circulating in the informal economy.

Additionally, changing interest rates to affect US dollar inflation will always be subject to rates prevailing in other countries, which also offer earnings for deposits of the American currency.

The RBZ will, therefore, have to use inflation targeting on the Zimbabwe-dollar-denominated inflation rate, an area where it has more influence.

Once the bank makes inflation targeting its main objective, it becomes much easier for ordinary people to assess the competence of its officials.

This also means that it becomes harder for the bank to lose track of its goal, since it is reduced to a single item. In a governance framework characterised by weak institutions, targeting will also ensure that the competence of the central bank will be insulated (assured).

The input of other ministries

It is crucial for all government ministries to also understand their responsibilities when it comes to resolving inflation.

In fact, it is desirable for cabinet ministers to be evaluated based on their competence in using their relevant departments to address inflation.

This is because, if the government surrenders inflation remediation entirely to the central bank, there will be a number of undesirable complications or limitations.

For instance, by strictly focusing on the inflation target, the RBZ can cause sharp swings in the country's yearly productivity (GDP). The output shocks (gross domestic product, GDP volatility) can result in a contraction of the economy in the long-term, since market participants spend and invest more generously, in an environment of stability and predictability.

Therefore, as the central bank uses inflation targeting, the Ministry of Finance should ensure that its fiscal policies (borrowing and expenditures) are also helpful in achieving the desired target. For example, when the bank wishes to reduce inflation, Treasury must not rapidly increase its expenditure in the economy as it would have the opposite effect of raising prices.

The Minister of Finance should also introduce policies, which ensure that the economy can perform at full potential, thereby, increasing its output.

The higher productivity means that goods and services in the economy will be produced at a much lower cost. Resultantly, cost-push inflation would have been dealt with. This means that Treasury’s regulations should encourage entrepreneurship, foreign investment, export-sector growth, etc.

In the same manner, the Ministry of Public Service, Labour and Social Welfare should aim to cut-off unnecessary jobs from the civil-service wage bill, remove ghost workers from the payroll and reduce excessive spending, which may be a result of wasteful seminars and conferences held by government employees.

This would result in reduced government expenditure, which is ideal for fighting inflation.

The Ministry of Agriculture can also be assigned the task to expand the domestic sugarcane, hemp and maize sectors, with the aim of producing bio-fuels, which will act as a substitute to imported petroleum products (petrol, diesel).

Reduced imports imply that the country will have less exposure from imported-inflation and the Zimbabwe dollar will have a stronger exchange rate.

It is essential to outline that a strong Zimbabwe dollar implies reduced domestic inflation since imports will cost much less and the RBZ will have abundant foreign exchange reserves.

The Ministry of Foreign Affairs and International Trade, alongside the office of the President, may also target to develop neutrality in external geopolitical tensions.

This means avoiding taking a side when countries unrelated to Zimbabwe are having major disputes or even wars. To add to that, diplomatic spats with powerful investor countries of the Organisation for Economic Cooperation and Development should be eliminated, unless they threaten Zimbabwe’s existence.

This will be helpful in making Zimbabwe a favourable destination of investment funds and the resultant stability can even make the Zimbabwe dollar a safe-haven (extremely stable) currency.

In an effort to increase the flow of remittances to the country (and strengthen the Zimbabwe dollar), the Education Ministry can establish a branch, which focuses on finding jobs for non-essential Zimbabwean personnel, in other countries.

This may initiate with the establishment of MoUs with nations, which are in need of Zimbabwe's human resources. Clearly, the country has an excess of sufficiently-educated manpower, which also has a super work-ethic.

Miners should focus on value-addition and establish more local industrial capacity, in the process. This will limit inflation-shocks, which arise from a weakening currency due to poor export-commodity prices.

The Ministry of Energy and Power Development will also need to understand its role in providing affordable and more importantly, reliable electricity, as a means of achieving domestic price-stability.

The importance of an effective railway and logistics system in reducing the cost of goods and improving the revenues of local manufacturers and exporters cannot be undermined, as well.

Conclusion

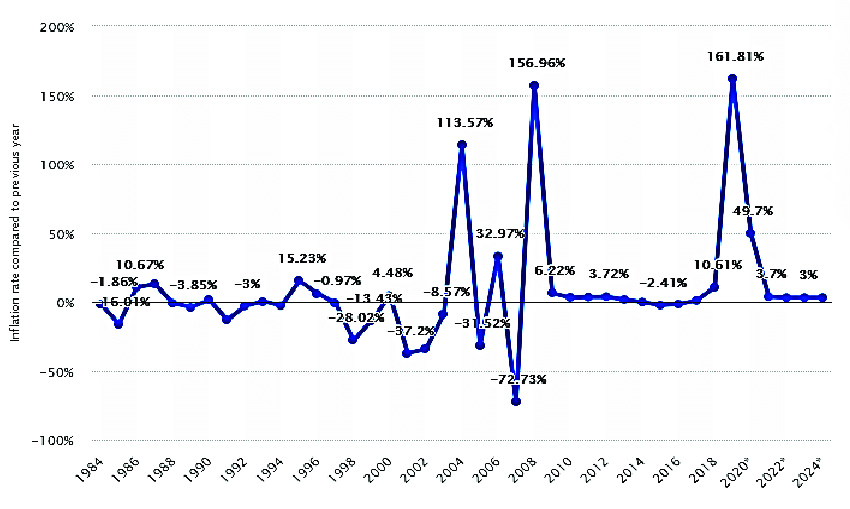

Zimbabwe has an inflation problem, particularly since the early 2000s. The fact that it tends to be recurrent after periods of elimination can be quite concerning.

Going forward, it is strongly suggested that the RBZ focuses more on inflation targeting, since this can simplify its tasks and increases the chances of success. Additionally, the President should ensure that all Ministries are fully aware of the roles that they have to play, as the country holistically responds to inflation. This should put finality to the problem, whilst addressing other economic imbalances.

Surrendering the problem of inflation to the central bank alone, would be futile at worst.

At best, it would result in a distorted economy, where, for example, there are both low inflation and extreme levels of unemployment (economic contraction).

- Tutani is a political economy analyst. — [email protected].