THE Zimbabwean banking sector continues to demonstrate a semblance of resilience on the back of a broad range of complementary fiscal and monetary stabilisation measures anchored on a contractionary stance to cool off inflationary pressures and exchange rate volatility.

Banking institutions continue to be proactive in light of the dynamic operating environment by reconfiguring business models and operating strategies.

Barring this concerted effort, the asset base of the Zimbabwean banking sector has been depreciating.

Banking sector performance remained satisfactory, as reflected by adequate capitalisation, strong asset quality, adequate liquidity and sustained profitability, among other key financial soundness metrics as at June 30 2023.

The banking sector was adequately capitalised and all banking institutions were in compliance with the prescribed tier 1 and minimum capital adequacy ratios of 8% and 12%, respectively.

The average capital adequacy and tier 1 ratios were 40,48% and 35,35%, respectively.

Aggregate core capital increased from ZW$611,11 billion as at December 31 2022 to ZW$5,05 trillion as at June 30 2023, a growth which was mainly attributable to capitalisation of retained earnings.

However, the quality of retained earnings remains compromised for the majority of the financial institutions as they are composed of revaluation gains from investment properties and translation gains from foreign exchange-denominated assets.

- Banks reconfigure operating strategies

Keep Reading

Banking institutions are employing a number of capital preservation strategies, which include investing in gold coins and investment properties, lending in US/ZW$$, as well as maintaining a portion of their capital in foreign currency.

Aggregate banking sector loans and advances increased by 7,9 times from ZW$1,29 trillion as at December 31 2022 to ZW$10,19 trillion as at June 30 2023.

The increase was largely attributed to an increase in foreign currency-denominated loans, which constituted 94% of the sector’s loan book.

Total loans to total deposit ratio for the banking sector remained relatively stable at 55% as at June 30 2023 from 53,67% at the end of 2022. The foreign currency loans to foreign currency deposits ratio was 60% during the same period.

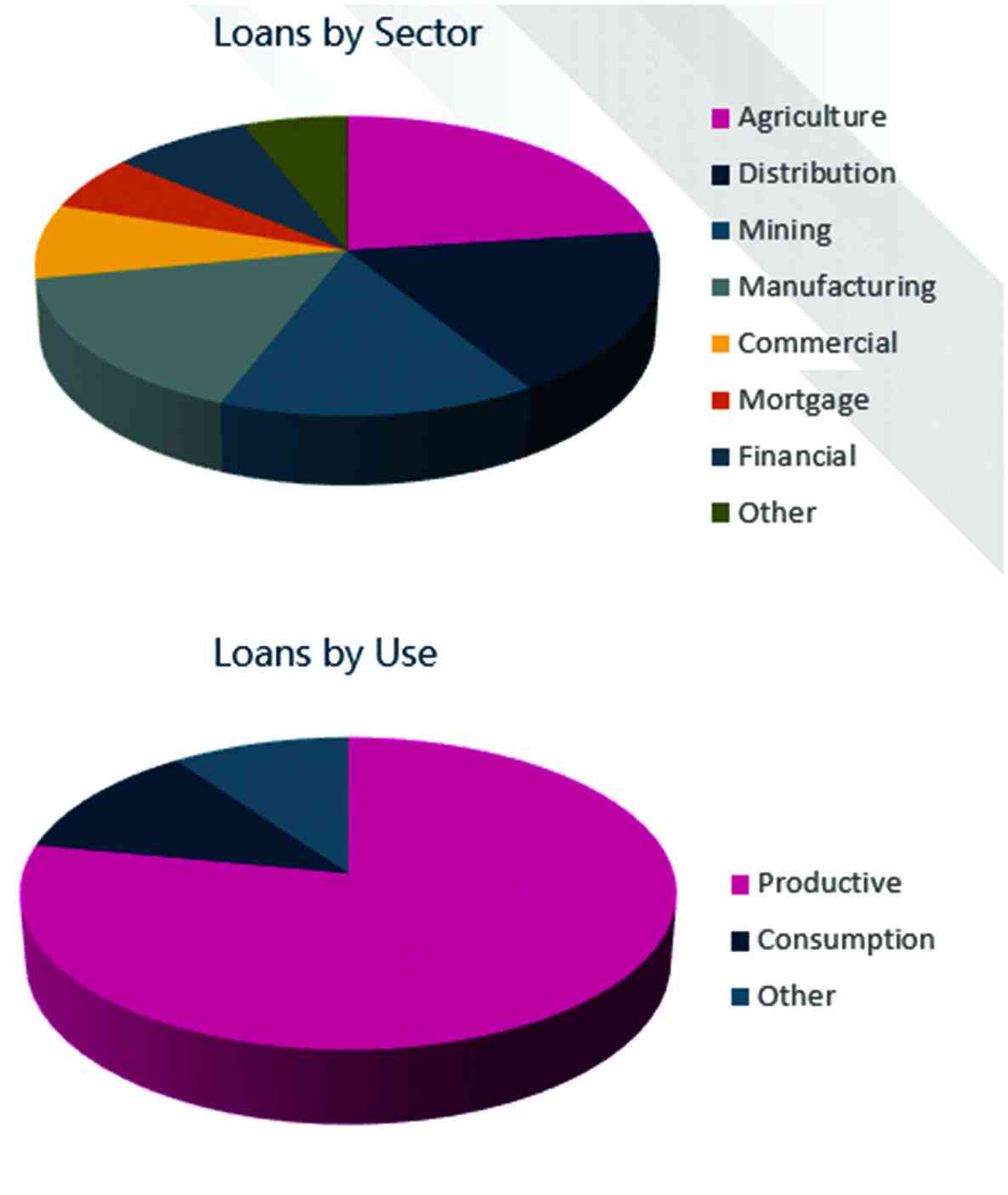

The banking institutions continued to contribute to economic recovery and growth by channelling resources to the productive sectors of the economy. In the period under review, loans to the productive sectors constituted 77,67% of total loans.

Asset quality remains satisfactory. The aggregate non-performing ratio (NPL) of 3,62% as at June 30 2023 is still within the prescribed 5% by the regulator. The ratio increased from 1,58% as at December 31, 2022 owing largely to a narrowing balance sheet and increasing default on USD-denominated loans.

All banking institutions were profitable with reported aggregate profits of ZW$4,55 trillion for the period under review compared to ZW$181,25 billion reported in the corresponding period in 2022.

The growth in the banking sector income largely emanated from non-interest income, which constituted 92,51% of total income (ZW$6,01 trillion).

Having regard to the need to strike a balance between business viability and the provision of affordable and accessible products and services in the spirit of promoting financial inclusion, the regulator continues to monitor bank charges, in collaboration with the Bankers Association of Zimbabwe.

Sustainability is transitioning to the fore of the global financial landscape by becoming a strategic priority, against the realisation that strong, resilient and sustainable institutions contribute meaningfully to inclusive sustainable economic development and attainment of Sustainable Development Goals (SDGs).

In this regard, the Reserve Bank of Zimbabwe remains resolutely focused on the implementation of sustainable banking practices in the financial sector and is working closely with the sector in the implementation of the sustainability standards under the Sustainability Standards and Certification Initiative (SSCI) being driven by the European Organisation for Sustainable Development (EOSD).

Microfinance is increasingly considered a key instrument in the implementation of effective and sustainable strategies aimed at poverty alleviation and inclusive economic development.

The microfinance sector in Zimbabwe continues to contribute towards the attainment of Zimbabwe’s 2030 Vision of ‘an Upper Middle-Income Society by 2030’ through the provision of essential financial services to low-income and marginalised communities and their micro- and small enterprises.

On aggregate basis, the sector registered growth in all the main performance indicators over the review period, including loan portfolio, capitalisation level, profitability and deposits mobilisation by the deposit-taking microfinance subsector.

As at June 302023 there were 216 registered microfinance institutions, comprising 208 credit-only and eight deposit-taking microfinance institutions.

The article was first published in the Banks & Banking Survey Magazine.

Foregn currency exchange was at US$1:ZW$5 739 as at June 30 2023.

Rukarwa is the lead analyst at Erccro ConsultancyInc. — enock.rukarwa@erccroconsulting.co.zw