THE Zimbabwe Congress of Trade Unions (ZCTU) was this week making frantic efforts to convene an urgent Tripartite Negotiation Forum (TNF) indaba, following weeks of relentless currency battering that has wiped out wages, left trade unions angry and workers desperate.

TNF indabas give government, business and labour a chance to find solutions to Zimbabwe’s myriad crises.

But they are often high tempered, as parties only fight to protect their own interests.

Tempers have flared since last month, when ad hoc policies being rolled out by firefighting authorities ignited waves of price hikes and steep currency depreciation.

The domestic unit has depreciated by 647% on the parallel market since January, its steepest such erosion since bold currency changes came into force in 2019.

The Zimbabwe dollar has seen its value tumble to a peak of US$1:ZW$10 000 on the parallel market this month, from US$1:ZW$750 in January. It has this week stabilised at ZW$7 700.

Much of the crash rocked Zimbabwe from May 31, when President Emmerson Mnangagwa proclaimed election dates for this year.

- Mr President, you missed the opportunity to be the veritable voice of conscience

- ED to commission new-look border post

- Zanu PF ready for congress

- Call for recognition of unpaid care, domestic work

Keep Reading

Following spirited efforts to contain the inflation rate through a blended system, the rate bolted to 175,8% this month, up from 86,5% in May, laying bare the scale of headwinds confronting the country.

Companies have responded by effecting wage hikes to cushion workers. Still, current wage levels fall far below the rate at which the currency has depreciated.

The ZCTU said it was worried about a new trend where wage hikes had pushed everyone into high tax brackets even though what they earn was not enough to see their families through for the month.

Japhet Moyo, the secretary general, told the Zimbabwe Independent that many of Zimbabwe’s workers were surrendering the bulk of their earnings to government and also paying for funeral assurance and medical insurance.

Income tax brackets, which came into effect in January, only exempt individuals earning ZW$91 666 (about US$12) per month from paying taxes.

Many Zimbabweans now earn not less than ZW$320 000 (US$42).

Several have also crossed the ZW$1 million (US$131) threshold, where they are taxed at the highest income tax rate of 40%.

Workers earning ZW$1,2 million pay about ZW$329 000 in taxes to government, while those earning about ZW$1,5 million surrender about ZW$449 000 to tax authorities, according to computations by the Independent.

Those earning US$2 million (about US$263) pay around ZW$649 000 (US$85 income tax.

“We are being ripped off,” one trade unionist said.

“Government is taking more than a third, and we are only left with little, yet prices are rising daily. Something must be done urgently,” he added.

The trade unionists said after deduction of medical insurance and funeral assurance, many workers were taking home nothing and in

some cases, the net can be in the negative.

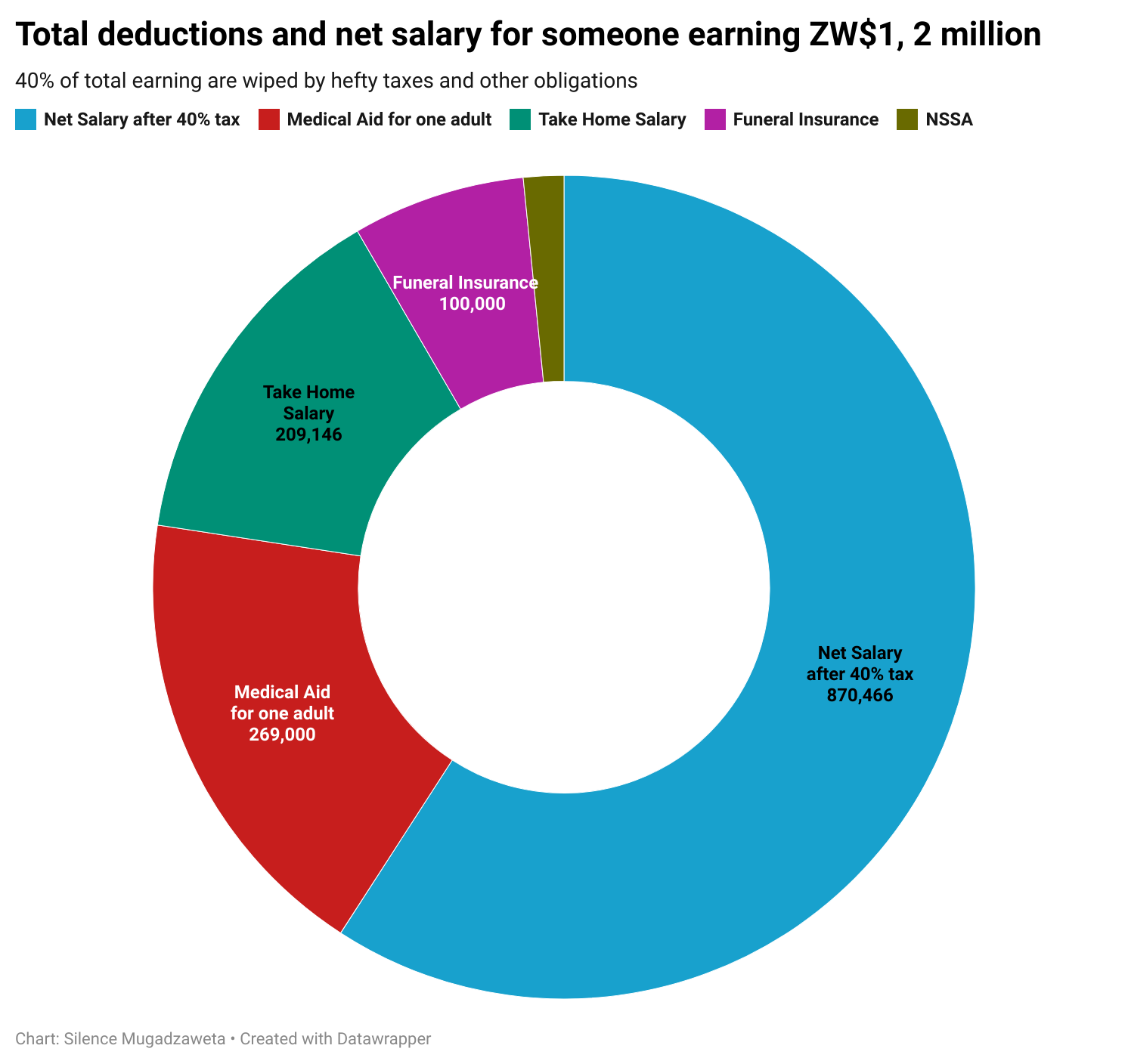

For an example, according the Independent calculations, a worker, who earns ZW$1,2 million, gets a net of ZW$870 466 (US$114).

But after deductions of Nssa, lowest medical insurance scheme at ZW$269 000 per adult and funeral assurance ZW$100 000, the take home salary is reduced to a paltry ZW$209 146 (US$27). If a child is added for the medical insurance cover of ZW$161 000 per child, the salary can go to minus, depending on the number of children.

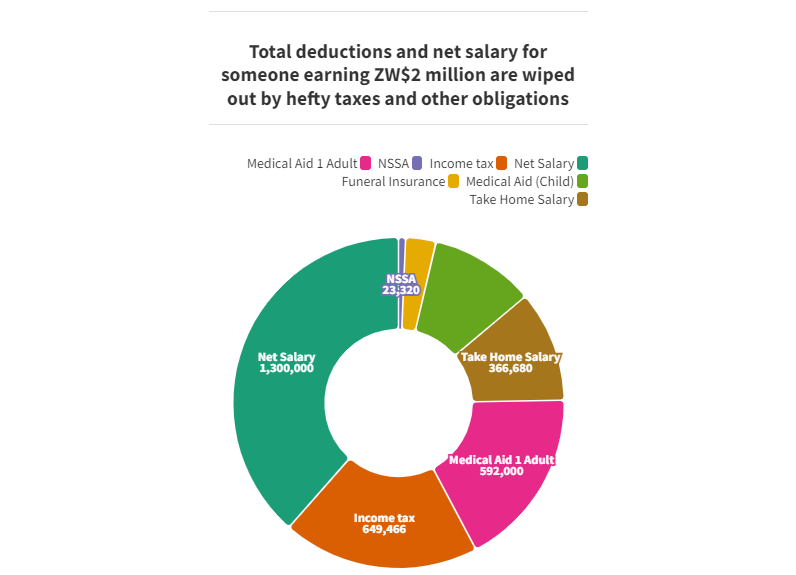

For a person earning ZW$2 million, ZW$649 466 goes to income tax. From the ZW$1,35 million net, after the following deductions of

Nssa, funeral assurance and medical insurance for two adults and two children, they are left with ZW$366 680 (US$48).

The situation is dire if they opt for a private hospital scheme, whose premiums as of this week stood at ZW$592 000 for a single adult and

ZW$345 000 for a child.

Moyo said the crisis had been compounded by the fact that government was reluctant to review tax free thresholds in order to

give workers breathing space.

The Ministry of Finance reviews income taxes brackets during its mid-year fiscal policy statement and in December, when it

announces the national budget.

Moyo `said with harsh economic conditions and a volatile currency this must be changed.

“Looking at what has happened over the past three weeks where the currency has literally crashed, wages are being wiped out by taxes,”

Moyo said.

“All collective bargaining platforms have agreed to increase salaries. It means everyone, poorly paid as they are, are now in that bracket

where they pay taxes. It is unfortunate that these (income tax) reviews have to be done when government announces their fiscal policies, and workers have to wait.

“It is an unfortunate situation where the poor have to pay taxes at the highest rates. We wrote to the Ministry of Public Service, Labour and Social Welfare this week requesting that we convene the TNF to look into the collapse of the currency.

“We want to raise as many questions as possible. The currency has collapsed. We want to find out the measures which authorities are putting in place to protect wages. Life is now difficult for everyone at the moment,” Moyo noted.

Some economists say the solution lay in Zimbabwe returning to dollarisation.

But authorities have ruled out another currency policy shift. In February, Vice-President Constantino Chiwenga said the country would never revert to dollarisation, even as the currency weakened. "Using other currencies brings nothing, but poverty,” Chiwenga said.

“The use of United States dollars is devaluing our local currency. The use of US dollars came after the Global Political Agreement and the likes of (Tendai) Biti (former Finance minister) wanted to use foreign currency.

“We do not want foreign currency we want our Zimbabwe dollar. "The black market has led to price hikes. We can't afford our daily needs. It has also led to our local currency losing value.

“So, the government is in the process of fixing this mess. Those found on the wrong side of the law will be dealt with accordingly," Chiwenga said.

Graphics by Silence Mugadzaweta