A LEADING economist this week cast doubts over the International Monetary Fund (IMF)’s 2,5% gross domestic product (GDP) growth projection for Zimbabwe, saying the global lender relied on outdated data in coming up with its conclusion.

Tony Hawkins, the respected former Graduate School of Management lecturer at the University of Zimbabwe, wants the IMF to rely on blended inflation in coming up with a view on Zimbabwe.

He said he doubted the Fund used such data when it came up with new growth projections in its 2023 World Economic Outlook report, which was released during the IMF/World Bank Spring Meetings in the United States last week. The projection said Zimbabwe’s GDP would come in slightly below previous estimates at 2,5% this year, before rising to 2,6% in 2024. The 2,5% represented a 0,3-percentage point downgrade from the 2,8% predicted by the IMF last year, and is much lower than Zimbabwe’s 3,8%.

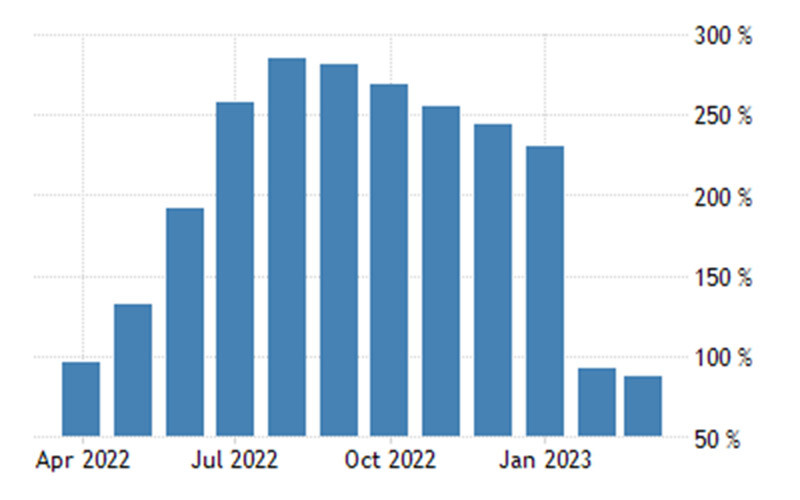

The IMF also revised Zimbabwe’s annual inflation outlook, predicting the figure to remain in triple digit ranges.

Its projections are based on protracted shocks on Zimbabwe’s economy stemming from high inflation, foreign currency shortages, exchange rate problems and a deepening power crisis, projected by the Zimbabwe National Chamber of Commerce to likely cost the economy US$4 billion this year.

In an interview with the Zimbabwe Independent, Hawkins said in its projections, the IMF’s relied on long-term trends, rather than on short-term fluctuations.

“I don’t think they will be taking into account the good year, which I think would make for a higher growth rate, more likely to be 4% rather than 2,5%,” Hawkins said.

“I also think there is a biased outlook locally, which is the case in authoritarian countries. I think the (IMF’s) inflation numbers were based on projections on Zimbabwean dollar inflation before we switched to the blended rate. Of course, the blended rate will be much lower as we have seen.

- Village Rhapsody: How Zimbabwe can improve governance

- Village Rhapsody: Engage men to end gender-based violence

- Village Rhapsody: How Zimbabwe can improve governance

- Zim maize output to drops by 43%

Keep Reading

“There will remain a distortion because that (IMF) inflation (projection) is higher than what the blend rate tells us,” Hawkins said.

Early this year, Zimbabwe switched to a blended indexed inflation rate after battling with triple digit rates for over a year.

After the re-configuration, with rate slowed to double digit figures, which is in line with government’s annual targets.

But industries said in March the government’s move to drop domestic currency indexed inflation rates were only meant to manage a blazing crisis and give an impression that everything was under control.

The Confederation of Zimbabwe Industries warned that Finance Minister Mthuli Ncube’s decision — the third such move to massage statistics in about 15 years — would have grave consequences on the frail economy.

In coming up with a blended rate, government will use a weighted average of goods and services priced in Zimbabwean and United State dollars.

But industrialists argued that financial statements were being prepared in Zimbabwean dollars, which is the base currency.

Hawkins this week said Zimbabwe was playing politics with inflation.

“I think it’s part of electioneering and politics that any statistic in this country now is made on political grounds,” the leading economist noted.

Government says GDP growth will be at 3,8%, driven by good rains and better commodity prices.

Hawkins said Reserve Bank of Zimbabwe governor John Mangudya had failed to achieve inflation or exchange rate stability.

“Both of those statements (IMF and government) are blatantly untrue,” he said.

“We need to get control of money supply, which has grown by over 500%, which is very inflationary. Reserve money, which they said was going to grow at 0% a quarter just doubled and is much higher,” Hawkins added.

Economist Prosper Chitambara said the energy crisis needed to be urgently addressed.

“I know something is happening but more needs to happen to address the energy crisis because in the short term, not much can be done,” he said.

“The energy crisis is a major downside risk in the outlook and of course the currency crisis.

“We are in a currency crisis where we have seen the loss of value and that presents a significant downside risk in the outlook,” Chitambara said.

In its latest inflation and currency report, CZI noted that the exchange rate premium decreased from 45% in January 2023 to 42% in February 2023 with the rates moving toward convergence.

However, CZI noted, in March 2023 that the parallel market rate started to depreciate faster, resulting in the exchange rate premium increasing to about 61%.

“Given that formal sector players are allowed a margin of 10% over the official exchange rate, the parallel market premium at the end of March was about 47%,” CZI said.

“This is quite significant with the potential to prevent the flow of USD to the formal sector, as the USD prices based on the formal exchange rate become inflated.

“The depreciation of the exchange rate in Zimbabwe is always linked to liquidity injection, hence there is a need to mop up the liquidity before it continues to cause further depreciation,” CZI said in its March 2023 Inflation and Currency report.