PLATINUM miner Zimplats Holdings Limited spent US$516 million during the quarter to September this year on major capital projects, including the development of Mupani Mine and Bimha Mine upgrade.

In its latest quarterly report, Zimplats stated that most of its projects for the period under review progressed as planned.

The firm spent US$341 million on mine development and upgrade projects at Mupani and Bimha, with an additional US$57m committed, against a total budget of US$468m.

The two projects will replace Rukodzi Mine, which was depleted in the financial year (FY) 2022, and the Ngwarati and Mupfuti mines, which will be depleted in FY2025 and FY2028, respectively.

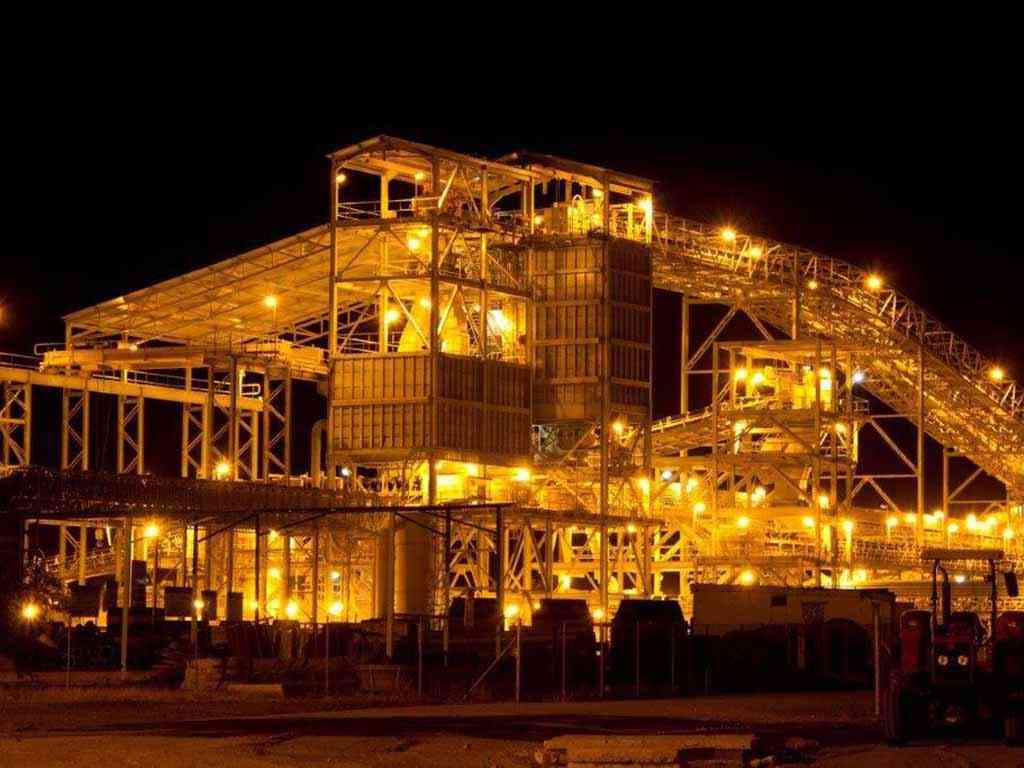

In the period under review, the smelter expansion and the sulphur dioxide (SO2) abatement plant project went as planned, with US$158m spent to date and a further US$256m committed, against a total project budget of US$521m.

Zimplats said it was embarking on a 35-megawatt solar plant project, the first of its four phases to be accomplished at an estimated total cost of US$201m to generate 185 megawatts.

“The project progressed successfully as planned during the quarter,” said the platinum miner.

“Implementation of the Base Metal Refinery refurbishment project progressed well during the quarter, with US$16 million spent to date, and a further US$14 million committed, against a total budget of US$190 million.”

- Zimplats raises expenditure on environment rehab

- Zimplats sinks US$373,6 million into projects

- Mimosa’s 6E volumes decline

- Zimplats revenue down 23%

Keep Reading

Zimplats said exploration activities during the quarter focused on the ongoing surface diamond drilling programme at Ngezi and upgrading the group’s mineral resources.

The report showed that 8 024 metres were drilled as part of the exploration work during the quarter at a cost of US$0,8m, with a further US$0,5m committed as at September 30, 2023.

Ore mined volumes increased by 1% from the prior quarter with production benefiting from an additional operating day. Mined volumes increased by 4% from the prior year comparative period as pillar reclamation operations at Rukodzi Mine were introduced, and production at Mupani Mine continued to ramp up to design capacity, the report indicated.

Platinum, palladium, rhodium, gold, ruthenium and iridium (6E) head grade decreased by 2% compared to the same period last year due to increased contribution of low-grade Mupani Mine development tonnage to total ore milled.

However, it increased by 1% due to improved ore mix.

“The volume of ore milled increased by 1% to 1,96 million tonnes from the prior quarter. Ore milled increased by 13% from the prior year comparative period, benefiting from the increased milling capacity following the commissioning of the Ngezi Third Concentrator plant, in September 2022,” it said.

Zimplats said 6E metal in the final product increased by 1% from the prior quarter in line with milled volumes. However, metal in the final product was 18% higher than the comparative period which was impacted by a scheduled furnace shutdown.

In the period under review, the total operating costs increased by 17% compared to the same period last year due to inflationary pressures and power tariffs which amounted to 48,5%, increasing unit cost by 4%.

Transfers from closing stocks to operating costs amounted to US$0,9m during the period, a decrease of 67% in line with inventory movement in the value chain.

“As a result, cash costs of metal produced increased by 2% compared to the prior quarter, while unit cost per 6E ounce, at US$832, was comparable to the previous quarter,” further read the report.