TAFARA MTUTU THE next couple of years could upend Delta Corporation’s decades-long market dominance in the country after NV Group announced a US$250 million investment into a brewery in Zimbabwe over the next 18 months.

The brewery, once complete, is anticipated to employ over 3000 employees and support local grain farmers situated in Chiredzi. NV Group is an Indian-based distiller that has established itself in just 25 years with popular brands for lovers of gin, whisky, vodka, rum, and brandy.

The business also exports to several Sub-Saharan Africa countries such as Kenya, Zambia, Nigeria, Namibia, and Ghana.

Before we unpack the impact of the new brewery on Delta’s business, it is prudent to take a look at Zimbabwe’s alcoholic beverages sector.

Zimbabwe’s alcohol consumption per capita is estimated to be around 4,8 litres, which pales in comparison to South Africa’s 9,3 litres, and India’s 5,5 litres.

Beer, which accounts for 63% of total alcohol consumption in Zimbabwe, is the country’s most popular alcoholic beverage, followed by spirits which command 12% of the local alcoholic beverages market.

Delta Corporation is the undisputed market leader of alcoholic beverages in the country. The business holds around 95% market share in the clear beer market and about 92% in the opaque beer market.

The company, through African Distillers, is a major supplier of wines, spirits, and ciders in the formal markets of these products.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

However, the company’s market share for spirits, wines and ciders has been facing heavy competition from illicit brewers and illegal imports through the country’s porous borders.

We explore the question of whether this is a threat to Delta by looking at (i) feasibility, (ii) capacity, and(ii) penetration strategy.

Based on Delta Corporation’s engagements with shareholders, we note that the local lager beer market is largely driven by mainstream brands which accounts for 82% of Delta’s sales volumes.

Premium and economy brands drive only 15% and 3%, respectively. Mainstream brands under Delta’s belt include Castle Lager, Carling Black Label and Lion Lager, while Zambezi Lager is among the local brewer’s premium beer offerings and Eagle Lager under its economy brands.

We opine that affordability issues have significantly hampered beer consumption in the country as drinkers opt for alternatives colloquially known asmasoja or tumbwa, and other illicit brews which cost much less than Delta’s established economy and sorghum beer brands but contain more alcohol content.

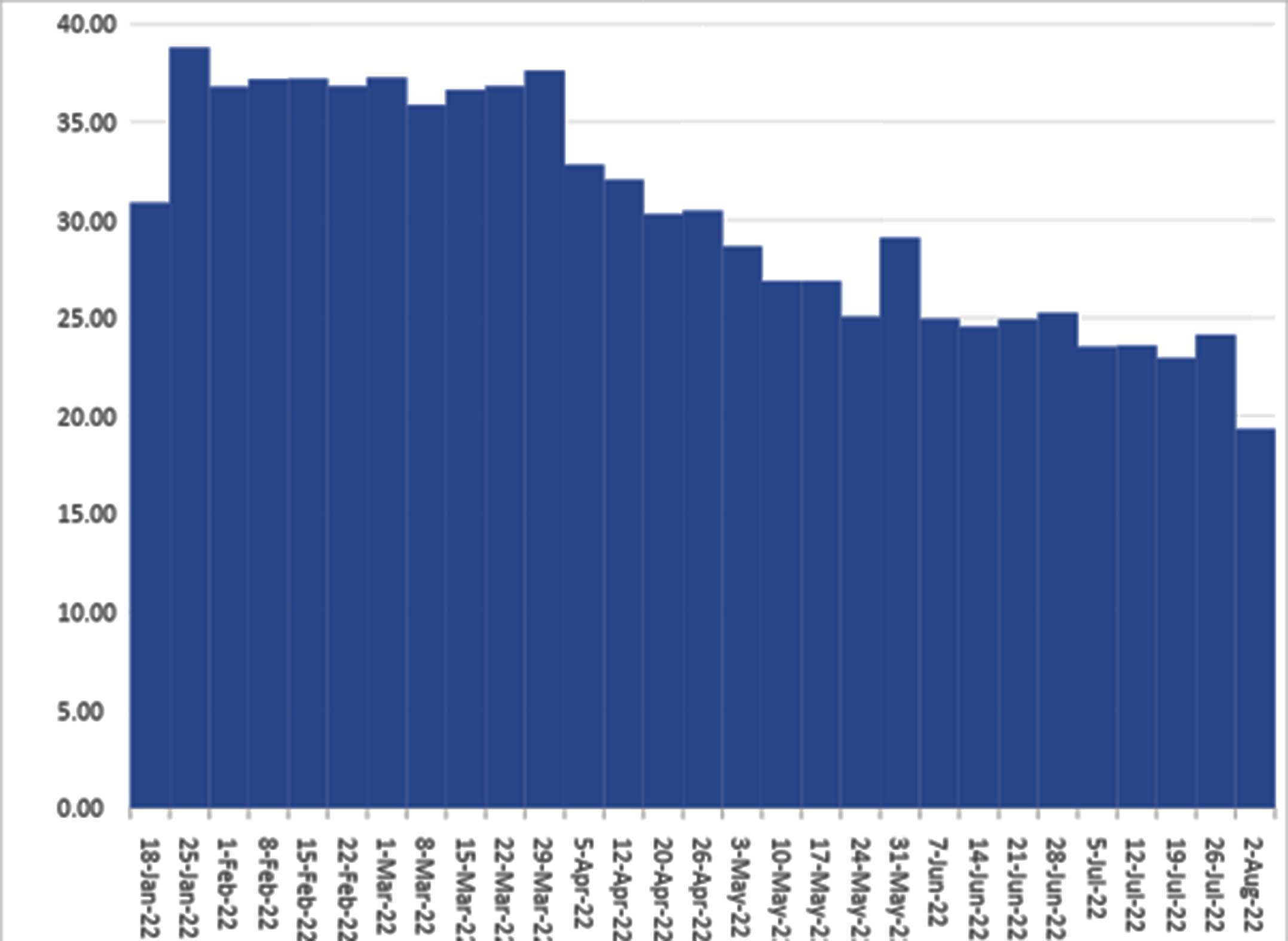

These affordability issues are largely determined by the country’s difficult macro-economic environment over the last two decades, which is characterised by some of the most volatile inflation and currency rates in the Sub-Saharan Africa region and world, and this has limited the scope for expansion of the local beer market.

We also note that, despite existing constraints in the beer market, NV Group’s proposed initial capital outlay of US$250 million and an anticipated staff compliment of 3000 – 4000 employees will likely match Delta’s current output in the clear beer unit of c.1,820,000 hl and the sorghum beer unit’s output of c.3,900,000 hl.

According to its latest annual report, Delta Corporation currently employs some 5000 employees with assets in the local clear and opaque beer units collectively valued at c.US$220 million.

We also note the similar out-grower model with the Agricultural Rural Development Authority’s (Arda) support that will allay any supply-side constraints and reduce the volatility of margins from the onset.

We also note that the significant headwinds that NV Groups has to weather in its penetration strategy. Firstly, we note that the price of local mainstream beer in Zimbabwe is already regionally competitive and coming in at a lower price point could result in NV Group incurring unattractive margins or evenlosses while it builds a market for its beer products.

Alternatively, NV Group could focus on a niche premium beer market, but it would have to contend with strong brands, such as Zambezi and Castle Lite.

However, learning from history, it would be a mammoth task for NV Group to bite off a sizable chunk of market share from Delta’s established portfoliogiven the nationwide outrage that sparked in May 1985 when Coca Cola tried to change its recipe in a lesson that taught them about loyalty to tastes that have carried its customers through the good and bad throughout history.

In addition, the current constraints in packaging material pose another challenge for NV Group’s brewery given Delta’s relationship with Nampak, a major supplier of packaging material in Zimbabwe that has been key in its consistent supply of alcoholic beverages despite bottlenecks in the supply of glass bottles packaging in recent weeks.

We opine that NV Group’s proposed timeline of 18 months is very ambitious and could span over 5+ years, as was the case with Varun Beverages penetration into the Zimbabwean market.

- Mtutu is a research analyst at Morgan & Co. — [email protected] or +263 774 795 854.