Economic analysts have lauded the move by the Reserve Bank of Zimbabwe to increase export and domestic foreign currency sales retention thresholds for business and a reduction in interest rates, but insisted the measures were not adequate.

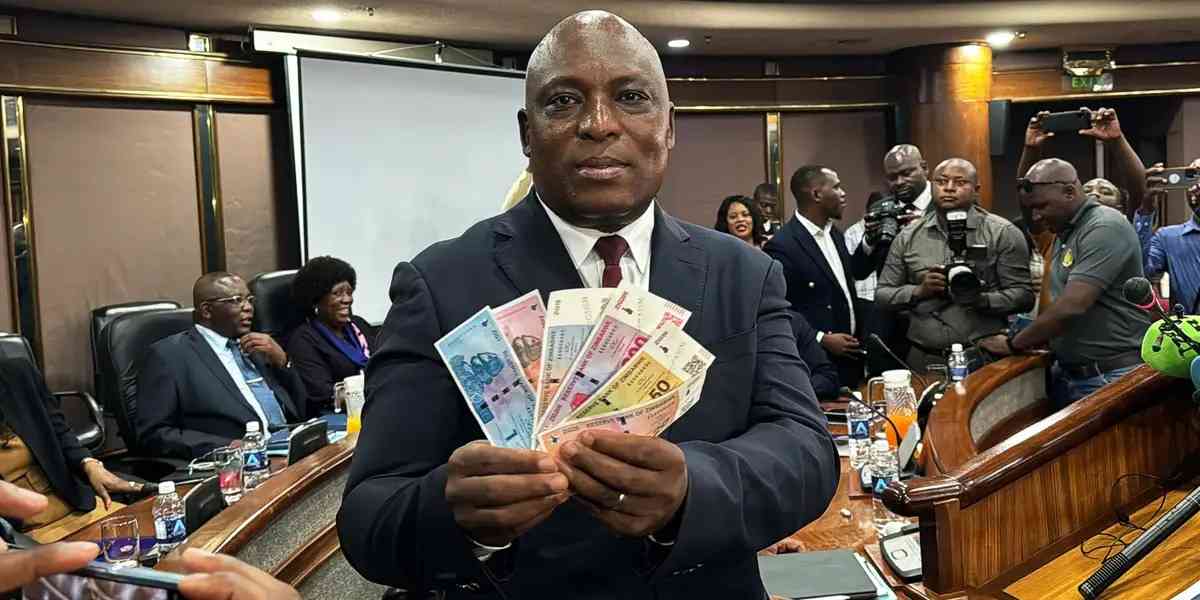

In the 2023 Monetary Policy Statement (MPS) released last week, RBZ governor John Mangudya announced that forex retention thresholds for business had been raised to 75% from 60% on export earnings while for local foreign currency sales it had been raised to 85% from 80%.

The central bank boss also cut interest rates by 50 percentage points to 150% from 200%.

RBZ’s intervention came at a time when foreign currency sourcing by businesses was becoming more difficult while capital has all but dried up in the market .

Beverage manufacturer, Delta Corporation Limited chief executive Matlhogonolo Valela told a Confederation of Zimbabwe Industries conference last year that the country’s capital markets in 2022 had been “destroyed” as result of the punitive interest rates.

“On the question of the retention ratio, that is a welcome move towards liberalising the system,” economist Tony Hawkins told Standardbusiness.

“It’s a good move, it’s very late, and there shouldn’t even be a retention threshold.

“Anyway, the (RBZ) should just let the market operate properly.

- Dual economy Zim’s Achilles heel

- Village Rhapsody: How Zimbabwe can improve governance

- Dual economy Zim’s Achilles heel

- Scrap IMTT to save industry, govt urged

Keep Reading

“So, this was the best way, but it is still not perfect by a long, long way.

“Secondly, on interest rates, this is nonsense.

“The Reserve Bank’s own figures show that the average interest rates for corporates is about 111% which is what they are paying from the 200% minimum.

“The typical Zanu PF economics is whereby you have a law where you have more exceptions to the law than there are people observing the law.

“It’s like them banning the export of raw materials, but give the guys who are exporting to the Chinese a licence and so on.

“He brought the rate down to 150% that is a theoretical rate, the actual rate is actually 111% according to their own figures too.

“It’s either they don’t read their own figures or don’t understand their own figures. Maybe they just like to mislead the public?”

Hawkins said the International Monetary Fund called for a tightening of the monetary policy, not loosening it.

“The governor has difficulty with the truth,” he said.

“The fact of the matter is the money supply is growing, in November it was like 370% and that is clearly, highly inflationary.”

According to the policy statement, broad money grew by 391,88% on an annual basis, an increase from 131,86% realised in December 2021.

Mangudya said this largely reflected the impact of exchange rate movements, foreign currency deposits increased by 530,07%, thereby contributing 234,96 percentage points to the 391,88% annual increase in money supply.

Meanwhile, inflation remained in triple digits for most of 2022, which proved a clear relationship between the annual inflation rate and money supply.

The annual inflation rate last month was 229,8% down from December 2022 comparative of 243,8%.

“They shouldn’t be cutting interest rates in that situation and we all know that inflation is about to take off again because the exchange rate has devalued by 16% in the last five weeks,” Hawkins said.

“That is very high by any standards.”

Economist Clements Machadu said reduction in the interest rates would help stimulate economic growth at a time when the country's economy is expected to record its lowest growth rate since 2021.

“This year the economy is expected to record its lowest growth since 2021 and this is partially due to the tightening measures that have been deployed by authorities to contain inflation, which include high interest rates,” Machudu said.

“There is, therefore, need to free up demand by easing some of the tightening measures, of course without reigniting inflation,” he said.

“I, therefore, see the reduction in the interest rates as a move that will help in stimulating the economy in light of the slow growth expected this year.

“It will enable businesses to access less expensive finance to sustain their operations, implement new projects and produce competition which will also reflect on prices.”

He said consumers would also be able to access better credit to buy goods and services, which helps in firming demand and improving production, hence driving more economic activity.

He, however, added that the rates were still too high.

Regarding the increases in forex retentions, Machadu said the authorities enabled business to be competitive and for the economy to be viable.

“This occurs in the sense that business can now retain more forex to meet its working capital as well as other expansionary and operational requirements,” he said.

“It also fosters business efficiency by reducing the need to go to the auction system to look for forex and having to wait for days to access it."

Machadu added that the move would also reduce black market activities as it reduced the need to resort to the parallel market for emergency forex requirements.

“Also, by standardising the retention levels across all sectors of the economy, it helps in levelling the playing field while also removing arbitrage,” he said.

Economist Prosper Chitambara called on the authorities to take heed of inflation rates.

“Taking into account annual inflation rates of 229,8%, as of January, means we are effectively in negative real interest rates territory because it has its own fair share of challenges,” Chitambara said.

“Ideally, real interest rates must actually be positive but I think it is good news as it actually reduces the cost of borrowing and it’s also in line with the expectation of the Reserve Bank that inflation is actually going to continue to decelerate.

“Whether or not that is going to happen, is something else. I think that there are a lot of pressures on inflation.

“We have seen fuel pricing going up and we are expecting fuel prices to continue to go up at a global level so that could obviously exert inflationary pressures in the economy.”

He said the adjustment in thresholds is positive development, but pointed out the need of a more significant adjustment in line with the need to fully liberalise the foreign exchange system and the economy.

Chitambara said there was room for improvement as the market was expecting something more significant than what was announced.

The adjustments in the 2023 MPS, in part, were due to a series of meetings between Mangudya and the Confederation of Zimbabwe Industries (CZI) last week, according to people familiar with the matter.

CZI had originally proposed that the export retention threshold be increased to 80%, from 60%, and 90% instead of 80% on local foreign currency sales.