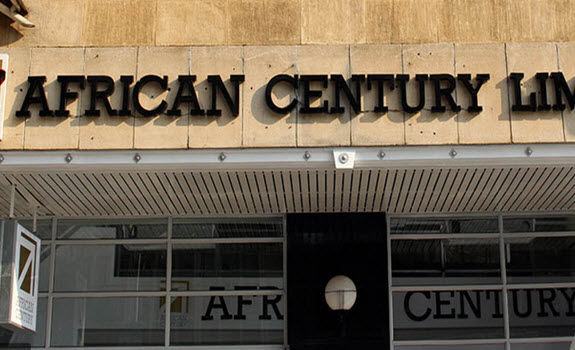

BY DESMOND CHINGARANDE A SWITZERLAND-BASED company that supplies raw materials for fibre cement production, Ramatex SA, has filed a court application to recover US$998 960 held by the African Century Bank (ACB).

Ramatex operated an account with ACB, also known as a Collection Account denominated in United States dollars, into which its customers would deposit money.

Ramatex submitted that during the period leading up to October 2017, it supplied products to Turnall Holdings Limited on credit and was owed US$998 960.

It is alleged that in or about 2018, Ramatex obtained judgment against Turnall at the High Court of Zimbabwe under case No HC 2851/17 in the sum of US$998 960 for goods supplied.

The Swiss firm then instructed its former attorneys to deposit the sum of US$998 960 into the Collection Account for onward transmission to its Swiss bank account.

The funds were then transferred to the Collection Account and the bank assured them that the funds would be transmitted without any difficulties.

It is alleged that in or about February 2019, monetary authorities in Zimbabwe changed the regulatory framework, resulting in the funds held in the ABC Collection Account classified as blocked funds.

Ramatex then instructed the bank to register the sum of US$998 960 as a legacy debt under the framework established by the Reserve Bank of Zimbabwe and ACB undertook to do so.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

It is further alleged that the bank was aware of the deadline for the registration of the blocked funds which had been set as April 30, 2019 and advised the Swiss firm that the blocked funds had been registered as such with the RBZ through NMB Bank Limited.

But in November 2020, after its own investigations, Ramatex established that the application for registration of the blocked funds as a legacy debt had been unsuccessful as it was filed late.

It is Ramatex’s contention that had ACB complied with its obligations, the money would have been released.

The Swiss company is now seeking to recover the money at an interest rate of 5% per annum.

- Follow Desmond on Twitter @DChingarande1