BY TANYARADZWA NHARI ZIMBABWE’S efforts to stem inflation surge may hit a dead end if the central bank swings to quantitative easing to fund polls and to pacify a restive civil service, a leading financial institution has warned.

ZB Financial Holdings Limited ZB chairperson, Pamela Chiromo, spoke as aggressive inflation unsettled the Reserve Bank of Zimbabwe (RBZ), which said on Tuesday it was “concerned”.

Quantitative easing is an occasionally used monetary policy, which is adopted by central banks to increase money supply.

However, it can badly backfire, leading to very high levels of inflation.

Quantitative easing was one of the factors blamed for the collapse of Zimbabwe’s dollar in 2008 as annual inflation hit 500 billion percent by December of that year.

Annual inflation shot to 96,4% last month, from 72% in March, placing Zimbabwe among economies with the highest rates in the world.

On Tuesday RBZ maintained the status quo in a string of factors including the policy rate, but vowed to continue fighting recent turbulences.

But ZB said while there may be improvements in the inflation outturn, threats were still linger on.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“The inflation outturn is expected to continue improving in 2022, supported by a tight monetary policy, complemented by fiscal discipline,” Chiromo said in a commentary to financial statements for the year ended December 31, 2021.

“However, the slow-down in inflation remains under threat from possible expansion in the monetary base to fund obligations such as civil service wage increases and the 2023 harmonised national elections, the widening gap between the formal and alternative market exchange rates, among other factors,” Chiromo said.

“Downside risks to the attainment of projected economic growth for 2022 pertain mainly to the possibility of a sub-optimal 2021/2022 agriculture season, following prolonged dry spells during the season, which look set to negatively impact on the food security situation,” Chiromo added.

ZB said increases in international commodity prices remained a factor of concern.

“Risk also arises from uncertainty in international commodity prices, and higher than anticipated international oil prices especially following the Russian invasion of Ukraine and resultant disruption of supply chains,” she added.

In a statement issued after a monetary policy committee meeting on April 29, the RBZ on Tuesday shifted the blame for Zimbabwe’s deteriorating crisis to confrontations between Russia and Ukraine.

A worrying trend has been Harare’s knack to find scapegoats, to counter accusation of corruption and mismanagement.

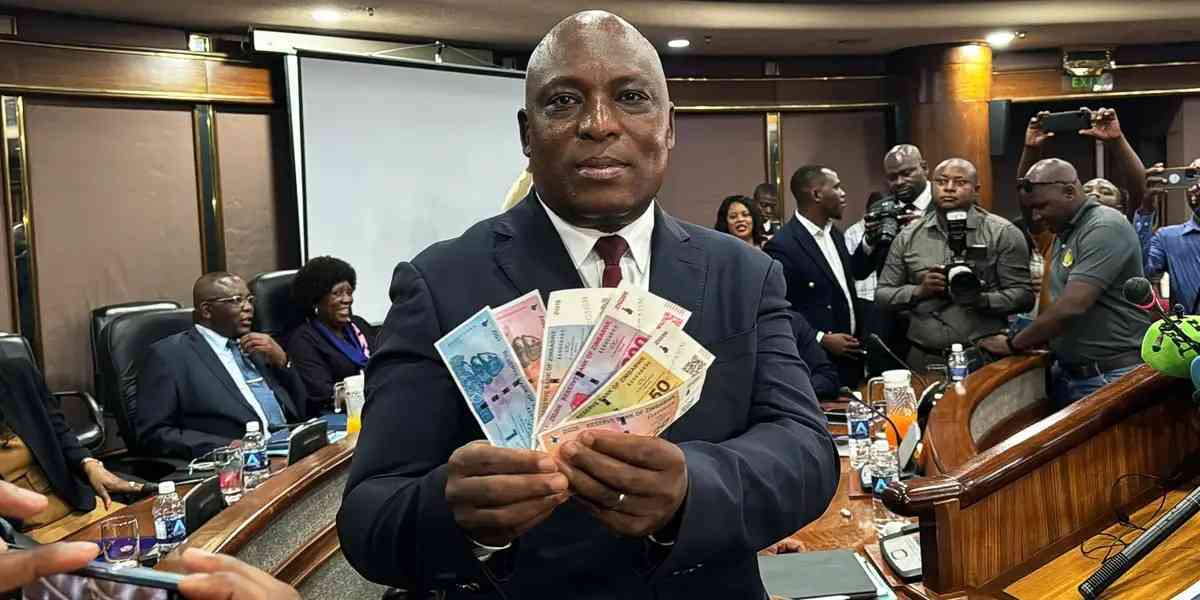

“The committee noted with concern the recent uptick in month-on-month inflation, from 7,7% in March to 15,5% in April 2022, and the increase in annual inflation from 72,7% in March to 96,4% in April 2022,” the RBZ chief said.

The RBZ governor said despite the troubles, fundamentals remained strong, with a “stable” exchange rate and healthy foreign currency inflows.

- Follow Tanyaradzwa on Twitter @thombi_e