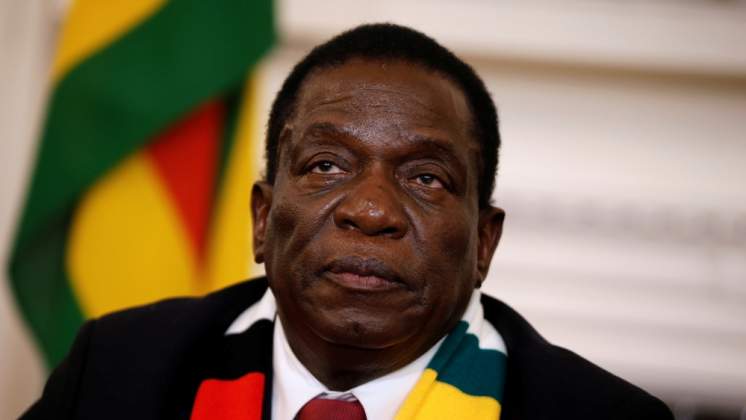

BY SHAME MAKOSHORI RADICAL policy shifts a year into President Emmerson Mnangagwa’s administration have wiped a staggering US$500 million in potential investments out of Zimbabwe, new data predicting an escalation of headwinds this year showed yesterday.

In an analysis of foreign direct investment (FDI) trends during the four years since Mnangagwa assumed power in November 2017, researchers at Inter Horizon Securities (IH) said the regime garnered tremendous goodwill as it undertook to reverse a sea of growth-inhibiting policies that were in force under the late former President Robert Mugabe’s 37-year grip on power.

But all hell broke loose after a decade-long crisis spiralled out of control when the Reserve Bank of Zimbabwe and the Finance ministry, under pressure to end worsening hardships and de-industrialisation, pushed through currency reforms, giving the Zimbabwe dollar a bigger presence over foreign currencies in transacting.

The domestic currency has seen no respite since then, triggering a relapse to a damaging inflationary charge.

Fragilities since February 2019 have unsettled investors, who have withheld big amounts previously earmarked for Zimbabwe.

IH’s paper showed FDI hit a peak of US$745 million in 2018, before coming off 62,4% in 2019 to US$280 million, as the economy battled to come to grips with the hasty changes.

IH said investment plummeted further by 30,7% in 2020, as the economy came under pressure from the 2019 currency changes, along with hyperinflation and foreign currency shortages.

“Inflows were projected to have slid further by 22,68% to US$150 million at the end of last year, according to IH.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“FDI is estimated to come in at circa US$150 million in 2021 compared to US$194 million in 2020,” IH said in the report, which is titled “IH Zimbabwe 2022 Equity Strategy”.

“Unfortunately, this decline in FDI inflows started in 2019, before the COVID-19 pandemic.

“The rapid policy changes implemented in 2019 resulted in Zimbabwe losing investor confidence, which it had gained in 2018, after the election of a new government.

“Exacerbating the low FDI inflows trend in Zimbabwe was the COVID-19 pandemic, which also affected investment flows globally. We expect aggregate FDI inflows to Zimbabwe to remain low in 2022.

“However, based on 2021 observations, we expect foreign investment towards the mining industry to increase.

“Despite a down drift in foreign direct investment, capital injection from local investors has gained momentum in the past few years.

“We have witnessed an uptick in corporate transactions and equity financing as companies expand via mergers and acquisitions as well as organically.

“Of note, was the announcement of the potential acquisition of a 31,22% stake in First Mutual Life by CBZ Holdings in 2021,” IH noted.

Turning to regional FDI trends, IH said despite world trade suffering severe headwinds in 2021 due to the COVID-19 pandemic, inflows into the continent surged by a staggering 147% to US$97 billion, compared to US$39 billion in 2020.

“The surge in the continent’s FDI was supported by sub-Saharan Africa FDI which increased from US$29 billion in 2020 to US$88 billion in 2021, registering an uptick of 200%,” IH said.

“The share swap transaction between South Africa’s multi-national Naspers and its Dutch-listed investment unit Prosus, valued at US$46 billion, accounted for about 52% of total FDI received in Africa in 2021. Green field investment activity in SSA fell 10% to an estimated $394 billion,” IH noted.

- Follow us on Twitter @NewsDayZimbabwe