Tafara Mtutu IN a striking manifestation of Ecclesiastes 1:9, events in Zimbabwe’s economy have been unfolding in ways that are reminiscent of events leading up to the economy’s official dollarisation in April 2009.

While the circumstances leading to the turn of events in 2009 are different from the current situation, the economy’s response to both scenarios is astonishingly similar.

Our circle begins in 2002 when the expropriation of land without compensation crippled the agrarian economy’s backbone industry and, subsequently, overall economic stability.

The local currency, abbreviated as the ZWD then, began to depreciate on the local market, coming off from a rate of ZW$0,01 to US dollar in 1996 to ZW$5,07 per US dollar in 2004.

Efforts to plug the loss in value inadvertently birthed the parallel market rate, whose percentage premium to the official rate hit highs of 2,898% between December 2003 and January 2004 before simmering to about 100% between 2004 and 2007 after the introduction of the ZWN at a rate of 1: ZW$1 000.

The evolution of the currency rate mimics the movement of the country’s exchange rate woes that played out between 2016 and 2022. After a period of growth and stability between 2009 and 2015, a shortage in the supply of foreign currency began to threaten the prospects of the economy.

To stem the crisis, the government issued bond notes in 2016 as a surrogate currency but confidence in the parity to the US dollar quickly faltered and resurrected the parallel market.

Using the Old Mutual Implied Rate as a proxy, the parallel market rate was quoted, on average, at a premium of 52% in 2017 and 419% in 2018. The premium has since softened to an average of 100% since the introduction of the ZWD out of the ashes of the bond note in February 2019.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In both periods, inflation surged as an extensive import bill amid currency depreciation fanned supply-side inflation. The December year-on-year (y-o-y) inflation rate moved from 55% in 2000 to 66,212% in 2007, and we note that the latest y-o-y inflation rate sits at 192%, up from -1% in 2016.

We opine that the severity of inflation in the past few years compared to the 2000-2007 period has been watered down by relatively better USD in circulation in the economy, both in the formal and informal sectors.

In both periods, we observe price controls on necessities such as bread, oil, and mealie-meal that led to empty shelves in formal retail stores. This was severe between 2006 and 2008 because of sub-replacement cost selling prices imposed by the government and the acute foreign currency shortage.

Fast-forward to the current period where the pervasive informal sector has cushioned the shortages of product in the country. Manufacturers have begun opting for informal distribution channels as they are near cash compared to formal retailers who are facing the brunt of price controls.

Despite this, the poverty datum line has outpaced revisions in disposable incomes in the same way as it did between 2004 and 2007, ushering many into poverty.

Many other events that played out between 2004 and 2007, such as the suspension of trading on the Zimbabwe Stock Exchange (ZSE), publication of inflation-adjusted financial statements by listed companies, introduction of notes of higher denominations, foreign currency retentions in export-oriented sectors, protests over civil servants’ salaries have also been observed between 2019 and 2022.

Looking at the unfolding of events between 2004 and 2009, we observe a compelling case for the economy to drop the local currency out of necessity in the near future.

We observe that the country officially adopted the US dollar in April 2009, roughly a year after the 2008 presidential elections. We assert that this could repeat in the few months after the county’s 2023 presidential elections. Between the 2023 elections and the official adoption of a stable currency, we maintain that the formal economy will be suffocated by a myriad of unconducive policies while the informal sector takes up the vacuum.

We also opine that the economy will continue dollarising despite efforts to support the ZWL, and a look at the banking sector and manufacturing sectors confirms this assertion.

The latest quarterly banking sector report by the RBZ reveals that 44% of the aggregate loan book is now denominated in foreign currency.

Delta, one of the biggest manufacturers in the country, revealed that foreign currency-denominated sales made up roughly 60% of their total FY22 revenue. Equity investors on the ZSE will likely experience movements in share prices in line with parallel market rates over investment periods of at least six months between now and 2024.

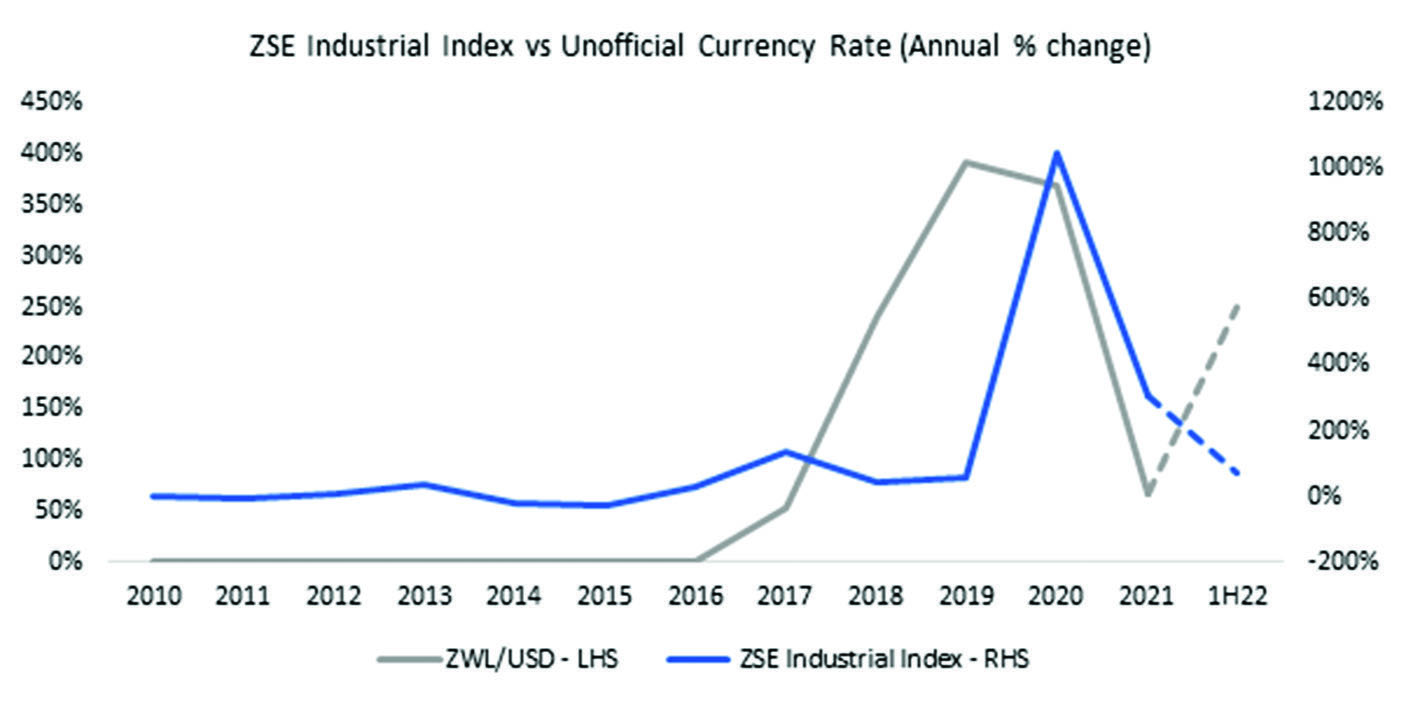

This is underpinned by a regression of annual movements of the ZSE Industrial Index on annual movements of the parallel market rate between 2004 and 2021, which reveals a near-perfect explanatory ability.

We also add that, if the economy dollarises after the general elections, the stock market will self-correct downwards to reflect USD share prices.

In addition, low liquidity of US dollars (or any appropriate stable currency) in the formal market will result in constrained price support for USD share prices, except for blue chips, as was the case in the three years after the economy’s 2009 adoption of the US dollar.

- Mtutu is a research analyst at Morgan & Co. — [email protected] or +263 774 795 854.