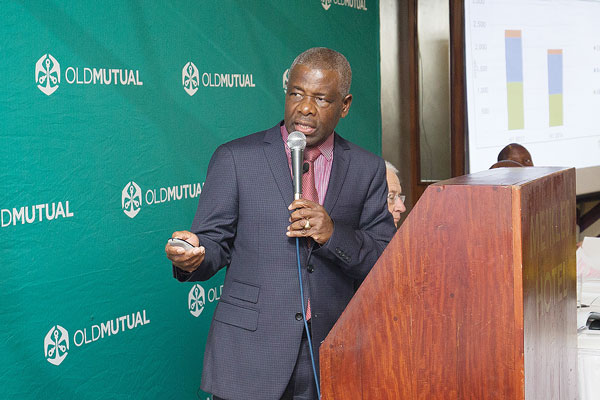

OLD Mutual Zimbabwe group chief executive, Jonas Mushosho has retired from the conglomerate after reaching the retirement age. Mushosho served as CEO for over seven years.

NewsDay Business reporter Tatira Zwinoira (ND) talked to Mushosho (JM) at his farewell reception last week on his reflections as well as what comes next for him.

ND: You have now retired from Old Mutual, I guess the question would then be what’s next for you?

JM: Before I answer what is next for me, I first of all want to express my gratitude to Old Mutual for 30 years of an unbelievably good career, an enjoyable career. Old Mutual has been very good to me. Old Mutual is an important institution in the fabric of Zimbabwe as one of those icons and one of those torch bearers that will build and shape the future of the nation. And therefore, being associated with Old Mutual I will continue to carry the Old Mutual values and its ambitions that it carries in the country.

But I am leaving Old Mutual on retirement a happy and satisfied member of the family.

Obviously, when reaching retirement, one has to take some time to rest a bit and spend time doing some of things that I have not been able to do, particularly, in the past three years because of extensive travel. As you are aware, I was the Group CEO for Old Mutual Zimbabwe which is in itself a very large financial services group, a very complex business. And I was also MD for the rest of Africa, that is, all Old Mutual businesses in Africa, outside South Africa, 12 countries, so there was a lot of travel.

In fact, I travelled every single week, but that job has been very enjoyable; my most enjoyable job in my working career. Waking every morning having to think of 12 different challenges coming from 12 different countries, five different lines of businesses.

So, I need now time to rest and have time to do some of the things I have not been able to do, but within a short time.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

This is not retirement, but it is retirement from Old Mutual…so one just merely changes career. I think the knowledge, experience and work I have done in Zimbabwe and outside will count a lot in the next phase of my career and I will let friends, colleagues, and those who have an interest know exactly the next stages not far from now.

ND: Very diplomatic JM: Yes. I also need to spend time on things that are very dear to me. I am very much involved in church work which sadly I have not done a lot of in the past three years. So, I think I have a lot more to contribute to the church particularly in my work, preaching and teaching at the bible school.

ND: You mentioned the networks you built, not just in Zimbabwe, but outside as well. Do you feel your next path might take you outside the country or will you remain in Zimbabwe?

JM: I would like to remain based in Zimbabwe, but working across the continent. I believe that Zimbabwe is my home base and I have what I must contribute to this country, but certainly I just think that the next stage of my career is pan-African

ND: Now, when one retires they think of the ups and downs of your career. Do you think you left any areas that you could have done more during your tenure at Old Mutual?

JM: Ah, there are lots. There are lots of things we have not been able to achieve. I spoke in my farewell speech about unfinished works… every leader will have unfinished works. Some things that they did not get to finish and some things they were not able to accomplish so I do have lots of things.

ND: Which one immediately comes to mind? Or should I say which one would you say gets you to think ‘I wish I had finished that one?’

JM: I think the one that bothers me most is the agenda around young people.

We started the youth fund with the hope of making a significant contribution to create employment and business opportunities for young people. And I have often said many times, 70% of our people are young under the age of 35. We are producing these by the droves out of universities and colleges, but they are not finding employment, and this cannot be right.

Some of us when we left university, we were walking straight into jobs, but we have bright kids who have a right to play a part in the economic activity of their country and there are no opportunities. And we can’t fool ourselves to think that the young people are going to be content to stand on the side lines and be excluded from the economic activity of this country. So, we have not been able to make progress, but we have started doing work to support young people.

We have an innovation hub that Lillian (Lillian Mbayiwa, Head of Group Marketing and Innovation) is leading that will support young people.

I would have been happier if we had done a lot more than we did.

ND: You are retiring at a time the economy is at a crossroads. As a company that has so much vested interests all over the economy, what is your take?

JM: Every economic crisis, no matter how long or deep, will eventually come to an end. At Old Mutual and in my own life we believe that this economic crisis will come to an end.

What is more important are the kind of things we are doing now to prepare for the future and I think this is where Old Mutual plays a significant role because of Old Mutual’s strong base and proud history of being resilient.

Our company has been here since 1896, officially opening an office in 1902. And this company has survived two world wars, several droughts, famines, Unilateral Declaration of Independence by Ian Smith followed by United Nations sanctions, a protracted liberation struggle, then we had hyperinflation and many other difficulties. But Old Mutual has remained committed to contributing to economic activity.

More than ever before, you need strong institutions to remain strong all the times and to be ploughing and sowing into the future, so this is the role Old Mutual should be playing during these difficult times. To be a leading institution that shows strength and commitment to this country.

ND: What advice would you give your successor?

JM: These is not much that I would give to him… The bulk of his agenda is not going to be a thing that he inherits. We bring in new people so that they can bring fresh ideas and run their own race. Sam (Matsekete, the new Old Mutual Zimbabwe group chief executive officer) has been appointed because he is a capable leader and we expect him to run his race the best way he knows how and it can’t be for me to start telling him what he should start doing.

We just want him to be himself and to have the space to run Old Mutual during his time and tenure in a way that at the end of his tenure he leaves it in a better space than he found it. ND: How would you describe your tenure as CEO?

JM: An enjoyable journey. I think what I have enjoyed most is working with people both inside and outside Old Mutual to try to do very good things that have supported economic activity and the communities. I think I inherited a lot of projects from my predecessor and I am happy we were able to execute and finish those projects.

We started other things, with the exco (executive) team, that we were able to finish and complete.

There is also some unfinished business that goes into the future. Old Mutual is not a one man place; it is an institution that builds and thrives on teamwork, so I don’t want to focus on what I have accomplished, but on what Old Mutual has accomplished.

ND: Old Mutual worked closely with government over the years in some of the projects you did. Do you think government could have done more, would you like to see that in the future?

JM: Old Mutual, as the largest financial services group, believes that its role in the economy is to support economic revival. And the second point is in doing activities that support economic activity we need several partners, with government being one of them, but there are others.

We go out of our way to work with government and other like-minded people who support the communities. We focus less on “government should have us”. What we expect from government is government must focus on providing an enabling environment so that the private sector can do what we do.

In an environment like this, there are things we would wish government to do, but others that we feel government could have done faster.