BY BLESSED MHLANGA

PRESSURE is mounting from business, labour and informal traders for government to abandon the Zimbabwe dollar, which is being rejected as a medium of exchange because of lack of confidence and its instability.

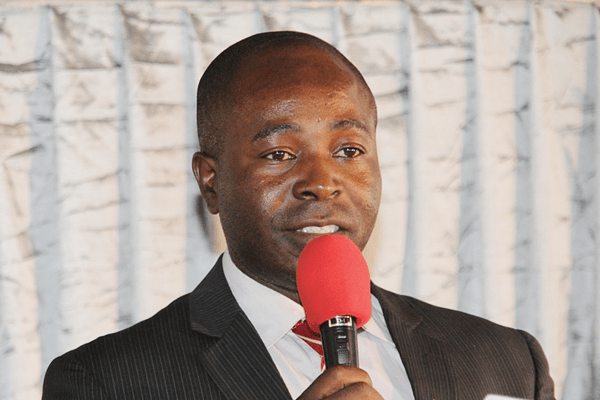

Confederation of Zimbabwe Retailers president Denford Mutashu told NewsDay that the market had already self-dollarised and that the appetite for the United States dollar was very high because the local currency was too unstable for sustainable planning.

“If you check internationally, currency is (about) confidence. Currency must have certain traits, characteristics that are not questionable. It should be used as a medium of exchange without either party feeling prejudiced. So in our case, the challenge we will always have is we are coming out of a multi-currency regime,” he said.

“You can never police a currency or its acceptance in an economy where the market is 70% informal. All those people that you see going to the bank withdrawing cash, you will never see them going back to the bank (to bank it).”

Mutashu said without stimulating production and addressing economic fundamentals, the market was not going to be comfortable with the local currency which is failing to hold its own. Most businesses, including local authorities, have resorted to quoting their services and products in the US dollar and asking their clients, who pay in the local currency, to use the prevailing interbank rate on the day of making payment.

A local businessman, who refused to be named, said selling in local currency would result in his business collapsing because most of his costs were in foreign currency.

The Zimbabwe Congress of Trade Unions (ZCTU) said its members were facing challenges accessing healthcare, accommodation and basic services because most of these were being pegged in United States dollars when they are earning the fast-depreciating local currency.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“This regime has reduced workers to slaves, paying them money that is valueless and unacceptable as a mode of trade,” ZCTU president Peter Mutasa said.

“The money is not performing its function of storing value or working as a medium of exchange. We have to resist this and we have been given the mandate by our members to mobilise for a return to the multi-currency regime.

“Many workers have been thrust into slavery and abject poverty. As a result, after a careful economic analysis, we are calling for government to immediately introduce the rand as the official legal tender. We are disturbed by the position of government and business, who are insisting on using the local currency as legal tender. We know these two institutions are benefiting at the expense of labour and the poor.”

This comes as even vendors at the largest vegetable market in the counrty, Mbare Musika, have almost abandoned the local currency, charging ridiculously high prices in Zimdollar while offering discounts and low rates for those who buy using foreign currency.

Tonderai Mafeso, a trader in Mbare, said after selling his wares in Zimdollars, he dumps it (local currency) on the black market, where he buys the US dollar to hedge value.

“We have no confidence in the local currency because it loses value on a day-to-day basis. We, therefore, prefer to buy and sell and save in foreign currency instead of the bond,” he said.

A bucket of maize is selling for US$3 or $120 cash, with swipe and EcoCash not accepted in most instances for certain products like maize, potatoes and mealie-meal.

Street vendors, especially those selling counterfeit books, clothing and beverages, have also refused to deal in plastic money or the local currency.

Former Finance minister and MDC vice-president Tendai Biti said the market had already re-dollarised and what was left was for government to recognise this, instead of resisting the obvious.

“Why would anyone accept a currency that is valueless and a currency that last time around in 2007-2008 shut down their businesses?” Biti said.

“The market has already dollarised. In 2009, what the government simply did was recognise the de facto, that dollarisation that had taken place. So here, (President) Emmerson Mnangagwa, in his wisdom or more appropriately lack of wisdom, or (Finance minister) Mthuli Ncube, will resist, but the fact of the matter is the market has dollarised.”

Government has warned that it will penalise businesses that are charging in US dollars, although it is charging for services, including passports, taxes and has even allowed other sections of the economy to charge in foreign currency.

“You can’t criminalise rational behaviour. Just like right now, 90% of Zimbabweans are buying the US dollar on the streets. There is no amount of teargas, no amount of gun, there is no amount of tank that is going to stop that because a human being behaves rationally, he will protect himself,” Biti said.