guest column Stephen Chan

Zimbabwe now faces a second major descent into inflation and economic despair in a space of 12 years.

The first, in 2008, involved almost metaphysical rates of inflation – 231m% at one point that year according to some reports, with other estimates even higher.

The crisis resulted in hugely controversial elections, which the opposition surely won — but which saw Robert Mugabe re-installed as President in a power-sharing deal with the opposition. To stabilise the economy, the worthless Zimbabwean dollar was jettisoned and people were given the option of using a basket of foreign currencies, the US dollar chief among them. The problem was then how to source US dollars — and this was done largely by borrowing.

Fast forward to 2019, nearly two years after Mugabe was ousted and Emmerson Mnangagwa installed as President – Zimbabwe’s annual inflation is officially 176%, the highest in the world after Venezuela.

But this official figure is almost certainly false. My own calculations, based on prices I observed during the 2018 Zimbabwean elections and reports from Zimbabwean friends now, estimate inflation at about 600%. And this is within what remains of the formal economy. Recourse to the black market to secure goods such as fuel and bread unavailable elsewhere means a parallel inflation rate that is higher – by my calculations, at about 800%. And now the publication of inflation data has been suspended for six months.

The government’s inability to pay for electricity imports has meant power outages of up to 18 hours each day. This is in part a result of poor rains and low water levels in Lake Kariba, the source of a huge percentage of the nation’s hydro-electricity – amid reports that it might be altogether decommissioned. Even if this is not the case, the turbines at Kariba are far from being in good shape and, even in seasons of abundant rain, Zimbabwe had to depend on electricity supplies from South Africa and Mozambique. These countries now want to be paid.

Mnangagwa’s almost desperate slogan for Zimbabwe is that it is now “open for business”. But the elections of 2018 that were meant to legitimise his presidency were marred by violence and deaths and no election observer group validated the polls as fully free and fair. Under those conditions, initial promises of foreign investors faded away.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

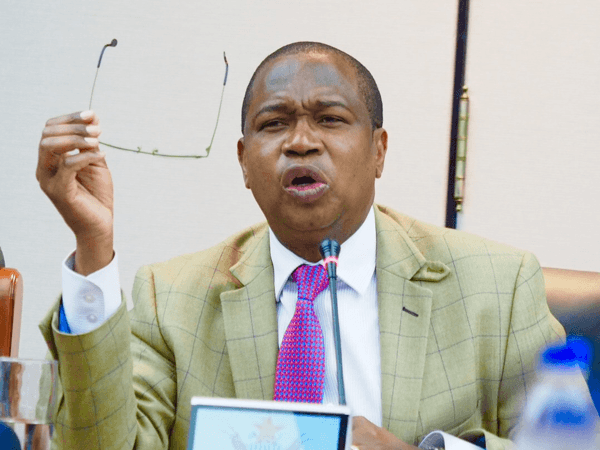

Dollars began to dry up, sourcing new dollars became impossible, and the new technocratic Minister of finance, Mthuli Ncube, began desperate but hugely orthodox measures to instil some discipline in a runaway economy. Those who were rich and powerful declined to make sacrifices of their own, while those who were poor simply got poorer.

Tight control

Almost a year into the job, Ncube has reined in some of the profligacy in State spending and managed to bring in an increase in tax revenue. But his tax measures have been hugely unpopular, with poorer business people seeing them as disincentives to invest in future productivity. One of his hugely unpopular early measures was to tax cellphone financial transactions. At a stroke, this jeopardised what was beginning to become a thriving cyber economy. It seems Ncube feels a need to deal only with concrete transactions in a hard currency, however valueless, that he and the government can try to control. In June, he introduced a new Zimbabwean dollar, outlawing the use of the US dollar. This has already led to a rapid erosion of spending power, with the new currency trading at almost ten to one US dollar. He has defended his decision, although his critics remain many.

With the lack of incentives to small businesses that bridge the formal and informal economies, a huge number of families depend on salaries earned by public servants. There are about 400 000 civil servants in Zimbabwe. Given the lack of real value in the Zimbabwean dollar, they probably live on less than US$2,00 a day. They and their families, not to mention the network of relatives in the extended family, cannot survive on that. Ncube’s fixation with control shows the dead hand of a government that has run out of ideas and, above all, trust in entrepreneurial initiative and self-creation. Nevertheless, it wishes to have control of all it surveys, even as this diminishes before its own eyes

Ncube’s astounding plan

According to an interview with Bloomberg in mid-August, Ncube said he hoped to establish a nine-member monetary policy committee that will reduce interest rates from 50%. Within 12 to 18 months, Zimbabwe plans to sell domestic bonds with a duration of as long as 30 years to fund infrastructure investment. In time, it will approach international markets, he said. How exactly any of this is to be done is yet to be explained.

Hanging over all this is the size of the debt that Zimbabwe needs to repay before investors will consider the country a viable risk for new loan liquidity. Estimates for this figure range from US$9 billion to as much as $US30 billion.

Under a debt-settlement plan, which Ncube maintains he is discussing with creditors, Zimbabwe would complete an International Monetary Fund (IMF) staff-monitored programme in January 2020. He told Bloomberg that Zimbabwe would then borrow the $1,9 billion it owes the World Bank and the African Development Bank (AfDB) from the G7 group of industrialised nations. This would allow it to win $1 billion in debt relief from the World Bank and AfDB, which it would pay back to the G7. But this is an astonishing strategy. It is based on the ability, and credibility, to borrow money to repay money. And there is absolutely no indication that the G7 would loan significant sums to Zimbabwe until both economic and, above all, political reforms are instituted.

Whether Zimbabwe could complete the IMF staff-monitored programme by January is a huge question in itself.

The IMF conditions are not easy ones.

Having got this far, Ncube has no choice but to hope that his policies will work. He inherited a mess of gigantic proportions. It was as if the ruling Zanu PF party, the government, and the oligarchic ruling class thought the free lunch could go on forever. Someone would always loan it more money.

Ncube realised that this could not any longer be the case. But his solution seems to be simply a new way to borrow more money. The first terrible truth is that it is not Zimbabwean money that will save Zimbabwe. The second terrible truth is that Zimbabwe’s economy may not, for some time, be saved.