BY XOLISANI NCUBE/FIDELIS MHLANGA

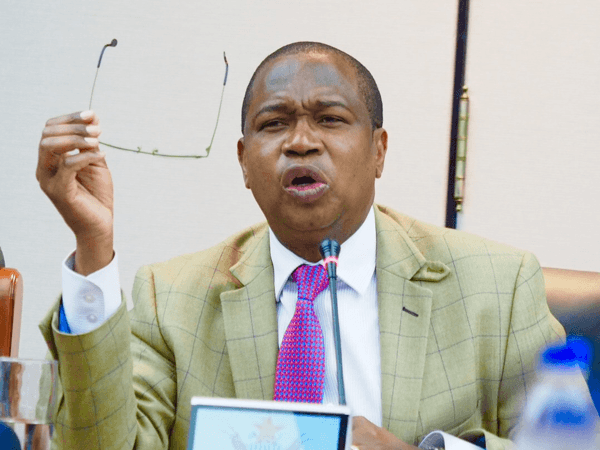

FINANCE minister Mthuli Ncube yesterday announced a three-fold increase in electricity tariffs and raised tax on fuel imports in addition to raising the cost of obtaining government services in a midterm budget likely to send inflation sky high and worsen the economic plight of already suffering Zimbabweans. Zimbabwe’s annual inflation, at 175,66% in June is already the highest in a decade and confirms that the country is in hyperinflation.

Prices of basic goods and services have more than doubled since June amid widespread shortages of bread, fuel and medicines, among others, reviving memories of the chaos of 2008 which led to the country dollarising in February 2009.

Ncube said the economy would contract this year as a result of chronic power cuts that have decimated industry and seen households going for up to 18 hours without electricity. His previous forecast was a growth of 3,1%. Government also suspended publishing inflation figures until February next year.

Electricity charges will go up from 9,86 cents (US1 cent) per kilowatt hour (kWh) to 27 cents/kWh (3 US cents).

Taxation of fuel imports more than doubled from 19% and 16% of the landed cost for petrol and diesel to 45% and 40%, meaning that pump prices will significantly rise from current levels.

Ncube announced an increase in government service fees as well as fresh taxation for electronic transactions.

For tollgates, light motor vehicles would now be required to pay $10 up from $2, mini-buses $15 up from $4 and conventional buses will now pay $20 up from $5. Heavy vehicles and haulage trucks will now pay $25 and $50, respectively.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Route authority application fees have been increased from $25 to $125, operator’s licence application fee have been reviewed to $250 from $50. Original motor vehicle plates now cost $400

from $80, while changing number plates will attract a similar fee.

“Since the establishment of an inter-bank for foreign exchange rate, the local

currency has lost value against major currencies. As at July 16, 2019, the local unit was trading at 8,8 to the United States dollar. Depreciation of the local unit against major currencies has increased the cost of goods and services, hence the current level of fees, levies and charges is no longer reflective of the cost of providing government services,” Ncube told Parliament in a presentation that was boycotted by opposition MPs to protest President Emmerson Mnangagwa’s presence.

“Ideally, fees, levies and charges should be set at breakeven levels in order to guarantee continued provision of efficient services, discourage speculative tendencies by business, and also generate sufficient revenue to support refurbishment and maintenance of existing infrastructure.”

Speaker of the National Assembly, Jacob Mudenda said Parliament would deduct sitting allowance of the MPs.

Ncube also increased tax on imported alcohol and slammed the 2% tax on mobile money transactions between transfer agents and recipients saying they were fuelling the foreign currency black market. He, however, reviewed the tax-free threshold from the current $10 to $20 on electronic transfers.

These measures are effective from August 5, 2019.

On policy framework, Ncube announced that the controversial Indigenisation and Economic Empowerment Act will be repealed and replaced by the Economic Empowerment Act, which will be consistent with the current thrust “Zimbabwe is Open for Business”.

The hope and euphoria that greeted long-time leader Robert Mugabe’s departure after the coup in 2017 has gradually turned to despair as his successor President Mnangagwa has failed to revive the economy or usher in meaningful political reforms. Workers’ incomes have been eroded by the resurgent inflation and many now struggle to buy basic goods like sugar, flour and cooking oil.

In a bid to give some relief to workers, Ncube raised the non-taxable income threshold from $350 (US$76) to $700. He said the government would import grain to feed 5,5 million food insecure people.

Foreign investors could now own majority stakes in platinum and diamond sectors.

Zimbabwe’s economy is in meltdown, fuelling popular anger. There are concerns of a resurgence of the violence that spilled onto the streets in January, when a sharp fuel price hike sparked protests and an army clampdown in which more than a dozen people died. Yet, analysts say increases in the price of fuel and electricity tariffs are needed to remove subsidies and put government’s finances on a strong footing.

Ncube said the government ran a budget surplus up to June, for the first time in years, stopped runaway money-printing and ended offshore borrowing. It has not used a central bank overdraft under an International Monetary Fund Staff Monitoring Programme, actions that are supposed to revive the economy.

But probably the biggest driver of inflation expectations is the lack of confidence many Zimbabweans have in the country’s new currency. Before its reintroduction, it was named the RTGS dollar and had been artificially pegged to the US dollar, leading to a huge discrepancy between its official and black market rate. Many citizens also doubt their leaders can deliver the changes they seek because they are mainly the same people who propped up Mugabe for decades.

Zimbabwe National Chamber of Commerce president Tamuka Macheka said: “The hope that everyone has now is that after the review of the tariffs electricity will be available. So the review must be accompanied by immediate availability of power; this is what we are expecting as business. The magnitude of the review is neither here or there. But what is affecting business right now is availability.”

Economist Persistence Gwanyanya applauded Ncube for reducing both the fiscal and current account deficit in the first half of the year, but cautioned this would be difficult to maintain given the amount of obligations planned in the remaining five months of the year.

Additional reporting by Reuters