Guest Column: Cliff Chiduku

Last month, the government took all and sundry by surprise when it banned the use of multi-currencies in all local transactions and reintroduced the Zimdollar; abandoned due hyperinflation in 2009.

The move shocked Zimbabweans, who have the 2008 memories still fresh, where they lost their savings when the exchange rate plummeted to Z$35 quadrillion to the United States dollar. The introduction of the multi-currency regime managed to arrest runaway inflation and brought with it investor confidence and stability.

With the lure of the greenback, foreigners stampeded to set up “tuckshops”, especially in downtown Harare where they would horde cash and ship it out to their countries. Companies responded by downsizing operations, retrenchments and salary cuts so that they could remain afloat. Price distortions and uncompetitiveness of local products limited the amount of foreign exchange that came into Zimbabwe through exports.

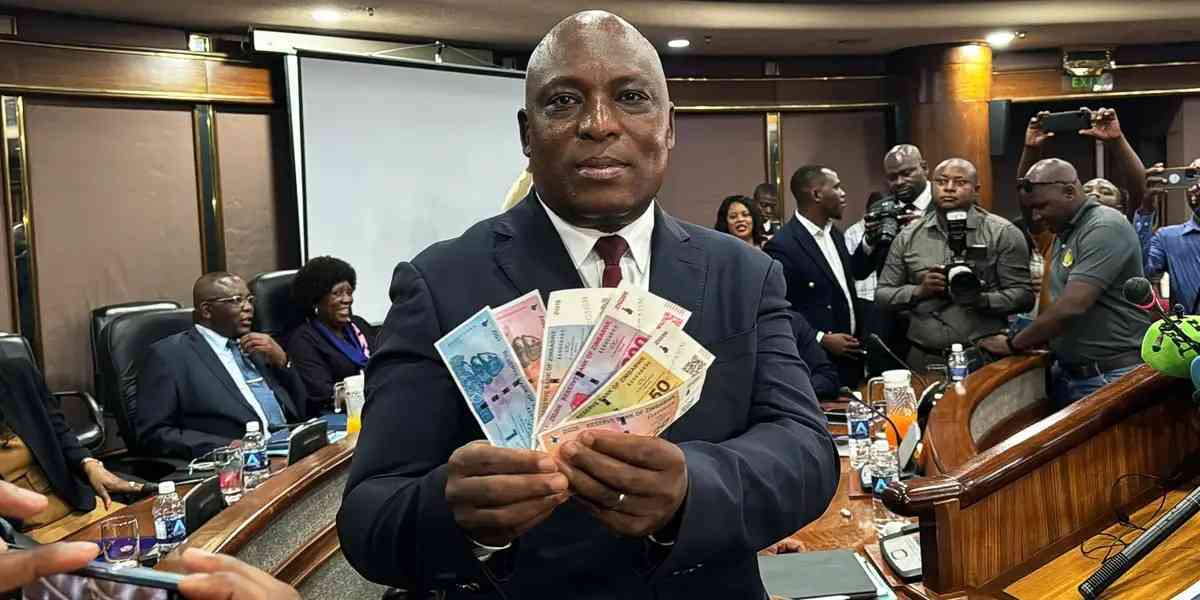

The 2008 mistrust hangover of government by citizens and uncertainty caused many to avoid the formal banking system, resulting in a cash crunch dilemma. As problems mounted, Reserve Bank of Zimbabwe (RBZ) governor John Mangudya responded by introducing a surrogate currency — the bond note, which later gave birth to real time gross settlement (RTGS) dollars. Most Zimbabweans have now come to associate the local currency with food shortages and runaway inflation.

Mangudya assured Zimbabweans that the bond note was only an export incentive. He also vowed that if the surrogate currency failed, he would resign. According to the RBZ, bond notes were to operate alongside other currencies within the multi-currency basket, and would be at par with the US dollar.

According to Mangudya, bond notes were also meant to guard against “externalisation” of the US dollar.

Since last year, the government has been hinting on the imminent reintroduction of the Zimdollar, with currency reforms taking centre stage as enunciated in the Transitional Stabilisation Programme. To avoid redollarisation, the government earlier this year laid the foundation for the return of the Zimdollar by introducing what they called an interim currency, the RTGS$.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

And on June 24, 2019, the die was cast. In a bid to defend the fledgling bond note against black market speculation, Finance minister Mthuli Ncube outlawed the use of the US$ and other foreign currencies in all local transactions.

This monetary policy intervention, we were told, was meant to bring on board the competitiveness of local products and spur exports. However, there was the possibility of such interventions suffering the cobra effect.

The cobra effect occurs when an intervention or solution to a problem results in something much worse or generates unintended consequences.

The term is usually used to illustrate the effects of incorrect stimuli to economics or politics. The cobra effect philosophy is said to have its roots in when India was British colony. The Government of India was worried about the increasing number of deaths from venomous cobra snake bites in areas around the capital city, Delhi. After thousands had died of snake bites, the government offered a bounty to villagers who would bring cobra-heads to the authorities. At first, the strategy worked because a large number of the reptiles were killed as people chased the dollar.

Eventually, cobra-prenuers began to breed the reptile for the bounty. When the government realised this, the programme was scrapped, causing cobra breeders to set the worthless snakes free. Resultantly, the cobra population increased and so did snakebites. The solution to the cobra menace worsened the situation.

A similar incident occurred in ancient Vietnam. The government there also introduced a similar bounty programme, paying hefty rewards for every rat killed. Since the rodents were devouring farm produce and spreading diseases, something had to be done to end the nuisance.

To get the said reward, villagers were supposed to produce rattails to authorities as evidence of rodents killed. However, authorities began to see tailless rats, especially in Hanoi, the capital city.

It was believed that rat-catchers would set traps, sever the tails and then release the rats so that they could procreate, thereby increasing their revenue. When the government got wind that rat-catchers were making a killing, the programme was also terminated.

The return of the Zimdollar will definitely affect businesses whose survival has been anchored mainly on imports. The reintroduction of the “zollars”, which was supposed to cure the foreign currency conundrum, is likely to make it more difficult for companies to restock. Government will fail to provide the critical foreign currency through formal channels. Consequently, businesses are likely to resort to alternative sources in order to get the greenback for survival, thereby fuelling the rise in parallel market rates.

The obvious effects of such a policy will be the disappearance of basic commodities from shops, as people rush to grab the last product on supermarket shelves, obtainable in RTGS$.

This latest move will, no doubt, rewind Zimbabwe to 2008, which was characterised by hyperinflation, spiralling prices, shortages of basic commodities, fuel crises, erosion of earnings and an increase in social vices such as prostitution as people try to make ends meet. The latest official inflation rate is testimony that Statutory Instrument 142 of 2019 has failed to tame the socio-economic problems bedevilling Zimbabwe.

Economists have been urging Ncube to either redollarise or join the Rand Monetary Union, saying economic fundamentals requiring the reintroduction of Zimdollar are not yet in place.

Zimbabwe’s inflation last week hit an all-time high in over a decade, leaping from 97% to 175%. Just like in 2008, Zimbabwe is in recession, with zero aggregate demand and no productivity. Prices of basic commodities continue to soar, chewing into worker’s salaries and wages, thereby eroding buying power.

Spaghetti queues for goods and services are the order of the day, with solutions no where in sight.

The mining and manufacturing sectors, which used to be the mainstay of the economy, are in the intensive care unit, thanks to incessant power outages.

Reports are that telecommunication companies (telcos) are considering switching off their base stations during load-shedding periods as they no longer find it viable to use fuel powered alternatives to do business.

The telcos are introducing downtime for their base stations as operating them without electricity is a drain on their purses. At this rate, Zimbabwe is sliding to the Stone Age era of letter writing when communicating, thanks to wrong political and economic prescriptions.

The country is back at square one. An attempted intervention or solution to Zimbabwe’s economic problem by Ncube and company has made the situation even worse. It is a fact that Zimbabweans are poorer than they were before the November 2017 coup that ousted President Robert Mugabe. The not-so new dispensations should be warned of the cobra effect syndrome whenever making political and economic policies.

Cliff Chiduku is a journalist. He writes in heis personal capacity